Dollar decline

Post on: 13 Июль, 2015 No Comment

The euro could replace the dollar as an international currency. Between Q1 2008 and Q2 2013 (most recent report), the value of euros held in foreign government reserves nearly tripled, from $393 billion to $1.45 trillion. At the same time, dollar holdings rose 36%, from $2.77 trillion to $3.76 trillion. Dollar holdings are 63% of the $6 trillion of total measurable reserves, down from 67% in Q3 2008. This decline means that foreign governments are slowly moving their currency reserves out of dollars.(Source: IMF. COFER Table )

China is the largest investor in dollars. As of December 2012, it held $1.2 trillion in U.S. Treasury Securities. It periodically hints it will reduce its holdings if the U.S. doesn’t reduce its debt. Here’s an example — China May Reduce U.S. Debt. Instead, its holdings continue to increase. For updates, see What Is the U.S. Debt to China?

Japan is the second largest investor, with $1.2 trillion in holdings. It buys Treasuries to keep the value of the yen low, so it can export more cheaply. However, its debt is now more than 200% of its GDP .

Oil-exporting countries (and the Caribbean banking centers that often serve as their front) hold $512 billion. If they decide to trade oil in euros instead of dollars, they would have less of a need to hold dollars to keep its value relatively higher. For example, Iran and Venezuela have both proposed oil-trading markets denominated in euros instead of dollars.

Why the Dollar Won’t Collapse

Many say the dollar won’t collapse because

- It’s backed by the U.S. Government, making it the world’s safe harbor currency .

- It’s the universal medium of exchange, thanks to our (still relatively) sophisticated financial markets .

- The major oil contracts are still priced in dollars.

Many in Congress want the dollar to decline because they believe it will help the U.S. economy. A weak dollar lowers the price of U.S. exports relative to foreign goods. making our products more competitive. In fact, the decline in the dollar helped to improve the U.S. Trade Deficit in 2012.

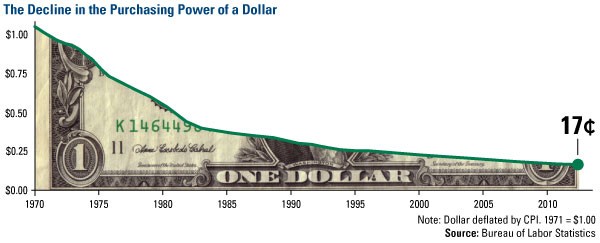

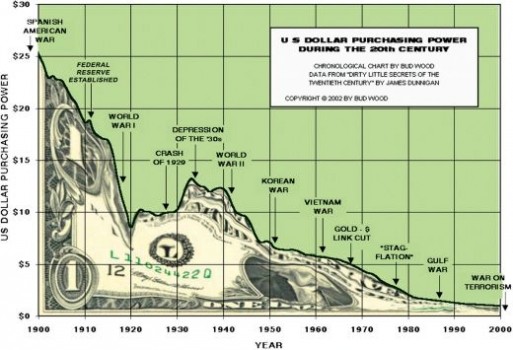

Although the dollar has declined dramatically over the last ten years, it has not yet created a collapse. It’s not in the best interest of most countries to allow this to happen, since it would decrease the value of their dollar holdings.

Regardless of the outcome, be prepared. Most experts agree that the best hedge against risk is with a well-diversified investment portfolio.

Ask your financial planner about including overseas funds. These are denominated in foreign currencies rise when the dollar falls. Focus on economies with strong domestic markets. Also ask about commodities funds, such as gold. silver and oil. which increase when the dollar declines. Article updated December 3, 2013