Do You Own Oil Stocks Hedge Your Bet With These 3 Companies

Post on: 16 Июль, 2015 No Comment

Do You Own Oil Stocks? Hedge Your Bet With These 3 Companies

As a Canadian investor, it’s easy to get caught up in the negative consequences of low oil prices. After all, our economy is under serious threat, which should have a wide-ranging impact on companies in all sectors. So, what is an investor to do?

Fortunately, there are some companies that benefit from low oil prices, and are hoping for the rout to continue. These companies are obviously great to own in this environment, especially if you already own energy producers, and are looking to hedge your bets. Below we identify three.

1. Magna International

Perhaps no Canadian company benefits from low oil prices more than auto parts manufacturer Magna International Inc. (TSX:MG) (NYSE:MGA). This makes perfect sense—low oil prices lead to price breaks at the pump, which benefits auto companies. And when auto companies win, Magna wins.

If that isn’t enough, Magna’s sales are geared towards larger vehicles, the kind that often have less fuel efficiency. With oil prices so low, these vehicles become more appealing, and their sales numbers have been ticking up. To illustrate, the Canadian light truck segment grew by nearly 19.5% year-over-year in December.

2. First Quantum Minerals Ltd.

Let’s start with the obvious: low oil prices provide a nice boost to all miners, thanks to lower diesel costs.

Different miners are affected in different ways. For example, the news isn’t all good for gold miners. Low oil prices have offered a nice boost to the American economy and dollar, which does no favours for the gold price. Or look at Teck Resources Inc.. which is benefiting from lower diesel costs, but is also trying to justify the Fort Hills oil sands mega-project, of which it owns a piece.

That said, the low oil price is very good news for copper miner First Quantum Minerals Ltd. (TSX:FM). This good news is also welcome relief, as the miner has been struggling with some big problems recently, most notably, with declining copper prices and a skyrocketing royalty rate in Zambia.

With that in mind, First Quantum is still very risky. If you’re going to own it, make sure it’s a small amount. If you’re looking for something you can put more money into, then number three on this list is worth considering.

3. Brookfield Asset Management

You might be wondering, “how does an alternative asset manager benefit from low oil prices?” The answer may not be obvious at first, but let me explain.

Brookfield Asset Management Inc. (TSX:BAM.A) (NYSE:BAM) tends to thrive when others are weak. For example, when an unstable company needs financing, Brookfield is able to provide funds with advantageous terms. Or when an asset is up for sale (perhaps because the owner needs extra cash), Brookfield is often able to buy these assets for a bargain. You can hate the company all you want, but Brookfield is very good at what it does.

So, with energy companies reeling so much, Brookfield is perfectly positioned to take advantage. Don’t be surprised if you hear some big deals over the next year.

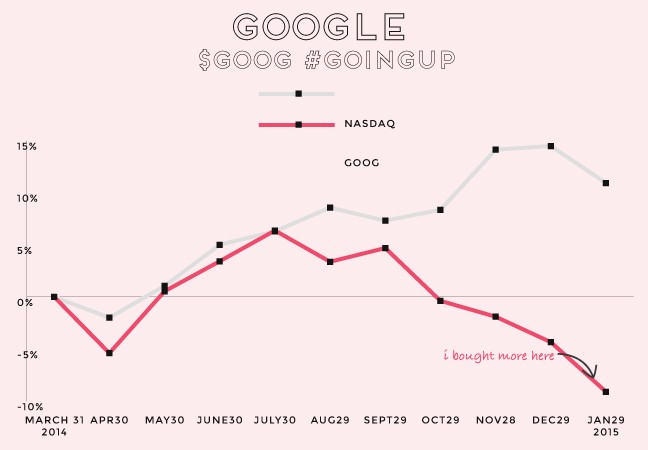

Another stock to own besides oil companies

When tech companies fall from grace like this Canadian icon did, it’s typically impossible to regain relevance. Here at Motley Fool Canada, we think this company and its CEO are prepared to prove all of the doubters wrong. We have even named it one TOP turnaround stock for 2015. Will you be left on the outside looking in should our intuition come to fruition?

If you’re a curious soul (like me), then you can download the name, ticker symbol, and price guidance absolutely FREE.

Simply click here to receive your Special FREE Report, A Top Turnaround Stock Idea for 2015.