Do Gold and Silver Protect you from Inflation

Post on: 15 Июль, 2015 No Comment

June 19, 2013

In a recent interesting article in the Fool’s blog network the author tries to settle which precious metal, gold or silver, is a better investment and serves as a better hedge against inflation. But do these metals serve as a good inflation hedge to begin with? I would like to tackle this issue and examine how well precious metals have protected your portfolio against inflation in recent years; let’s also compare them to other inflation hedges.

It is not new that both gold and silver haven’t done well in the past couple of years. Moreover, gold and silver prices might further fall in the coming months especially if in the near future the Fed will decide to taper its current asset purchase program, which is likely to pressure down future inflation pressures.

Gold and silver ETFs such as SPDR Gold (NYSEMKT: GLD) and Shares Silver Trust (NYSEMKT: SLV) also showed a sharp drop in prices: Since the beginning of the year GLD’s price plummeted by more than 18.5% (year-to-date); shares of SLV dropped by 28.9%. The sharp drop in gold price also led to a decline in GLD’s gold holdings by more than 25%, since the beginning of 2013. Conversely, SLV’s silver holdings only slightly fell since the beginning of the year by less than one percent.

In any case, both precious metals ETFs and prices haven’t performed well in 2013. On the other hand, U.S inflation rose by 1.1% in the past twelve months. Thus, in the past twelve months, investors haven’t protected their portfolio from inflation by holding gold, silver or a precious metal ETFs. But perhaps gold and silver are more of “doomsday hedge” in case of a sudden spike in inflation.

Why Gold and silver?

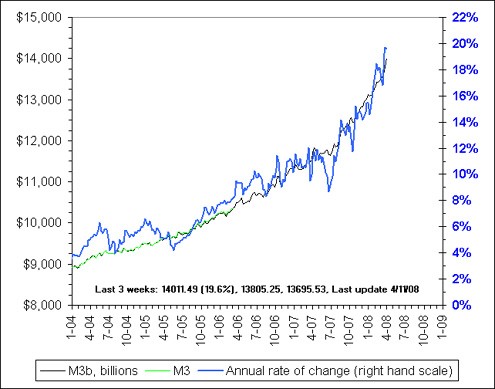

The sharp rise in demand for gold and silver started soon after the financial collapse in 2008, which was followed by the Federal Reserve augmenting its balance sheet by buying long term securities. This led to a sharp rise in the U.S money base. The price of gold soon followed and rallied alongside the U.S money base as seen in the chart below.

Many investors fell back on precious metals as a safe haven against a potential sharp rise in inflation. The Fed kept its asset purchase program and people kept waiting for this asset purchase program to translate into a rise in inflation. Alas, the inflation remained stable at below 2% in most years since 2008.

Gold price is beating inflation

Many gold and silver enthusiasts look at the sharp rally precious metals had in the past decade as a selling point for the benefits of holding gold or silver especially as a hedge against inflation. But do gold and silver hedge against inflation? The chart below shows the developments of gold and U.S CPI in which both series are normalized to 100 as of January 2004.

During this time, gold prices spiked by 360%, while inflation rose by only 25.5%. This means, gold didn’t serve a hedge as it outperformed the U.S CPI by a high margin. So gold didn’t hedge against inflation because it didn’t match the rise in inflation. It served as a good, highly risky and speculative investment, which is more than fine for those who wish to bet on this metal.

The two charts above also show that the rise in U.S money base didn’t translate into a spike in inflation.

Hedging against inflation

If not gold or silver then how does one go about hedging against inflation? The financial markets offer many ways to do so without needless exposure to high risk and volatile assets. This includes investing in U.S treasury Inflation-Protected Securities or even investing in iShares Barclays TIPS Bond Fund (NYSEMKT: TIP) that follows the price and yield of inflation-protected sector of the U.S treasury market. This ETF also has a much lower fee rate of 0.2% than SLV or GLD – their fee rates are 0.4% and 0.5%, respectively. TIPS Bond Fund ETF holds a variety of treasury Inflation-Protected Securities.

Other alternatives include hedge stocks such as Wal-Mart Stores (NYSE:WMT). The company’s lion share revenues come from the U.S (nearly 70%) and its steady growth in sales in consistent with the rise in U.S economy in nominal terms (i.e. real GDP growth rate + inflation). The table herein summarizes these data.

As seen above, the growth in sales of Wal-Mart during the past three years is very close to the growth in U.S economy and inflation. If inflation will rise sharper, it will reflect in the rise in Wal-Mart’s revenues. On the other hand, gold and silver prices moved in 2011 and 2013 very differently than the U.S economy did.

Take away

I think gold and silver are high risk and high potential return investments. They don’t serve well as hedge against inflation. This realization is becoming more apparent in recent years as both precious metals haven’t performed well. Finally, if you still fear of a sharp rise in inflation, you might be better off investing in securities that are more related to the U.S inflation as indicated above.

For further reading:

Disclaimer: The author holds no positions in stocks mentioned and does not plan to initiate positions within 120 hours of the posting of this article. This article is to be used for educational, research and informational purposes only and does not constitute investment advice. There are no guarantees, expressed or implied, of future positive returns in regards to the subject matter contained herein. Understand the risks inherent in investing before making the decision to invest or consult an investment professional for more information. Reasonable due diligence has been performed in regards to the information in this article. However, the author expressly disclaims any liability for accidental omissions of information or errors in fact.