Dividend Reinvestment Yes Or No

Post on: 17 Июнь, 2015 No Comment

Dividend Reinvestment — Yes Or No? 87 comments

Mar 7, 2013 6:19 PM

There have been many articles and comments written on SA about whether it is better to collect your dividends in cash or to reinvest them back into the underlying company. This instablog is going to take this subject head on.

Dividend reinvestment (DRIP) was created as a tool for long-term investors. The concept was developed to allow for the compounding of dividends and to allow investors to purchase additional shares in a company at no cost. The concept was to allow a passive approach to building a position, and just as importantly, to force you to continue investing, regardless of market conditions, which in essence takes emotion out of the equation once you have ownership in a company.

Let me begin by saying some people are not in a position to fully take advantage of a DRIP program. Some rely on their dividends to support their lifestyle and whatever is left over is selectively invested.

Some people who consider themselves dividend growth investors have accounts they no longer contribute cash to, and the only way they can add positions and diversify their portfolio is to collect all dividends in cash, and then open a new position.

There may be other scenario’s I haven’t mentioned.

This instablog is not designed for that group of investors. This instablog is designed for those of you who are dividend growth investors, have an increasing dividend income stream as a priority, and are still contributing cash into your portfolio on a regular basis.

Like anything else in life, and in your investing career, it all starts with your goals. What are you trying to accomplish? You can have a series of specific goals, but you must prioritize them. Which of them are most important to you?

The objectives that a lot of dividend growth investors have are, the safety of the dividend, growth of the dividend, and the value of their position. Is the position rising in value? In other words, what is the total return?

I think most dividend growth investors would say they want growth and income.

Most investors I think, equate growth to mean the total value of their portfolio. Growth and Income is a code word for total return. I think that’s the goal for most dividend growth investors over the long run. The problem is that there are times when these two criteria are in conflict with each other. There are going to be times when share price is dropping 10%, 20% or more, yet the dividend income continues to rise. So, which has priority? Growth or Income?

You need to know the answer to that question whether you use a selective dividend reinvestment strategy or an automatic dividend reinvestment strategy. There is no wrong answer. It’s based on what you are trying to accomplish. The only wrong answer is, I don’t know, in other words, uncertainty. So, what’s your number one priority?

In my case, I’m looking for total return over the long run. In fact, the formula I use in my stock selection process is:

High Quality + High Current Yield + High Growth of Yield = High Total Return.

Once I’m in the position, I switch my recruiter hat to my manager hat. I now must manage the position. What is the priority? Growth or Income?

This is where you must establish your Mission Statement. Your company motto, if you will. Once you have a Mission Statement, every decision you make must be support your motto.

Ford said, Quality is job #1.. The Marine Corps says, Looking For A Few Good Men.. Realty Income (NYSE:O ) says, The Monthly Dividend Company.. My Mission Statement declares, To build an income stream that is reliable, predictable and increasing.

There you have it! I chose income over growth as a priority, but I believe I will get both over the long run. I simply have to insure that all of my short to intermediate term decisions support my Mission Statement. As long as I stick to this, I believe I will get high total return.

Let’s talk strategy.

A lot of people prefer the selective dividend reinvestment approach. This is where you collect your dividends in cash and then you selectively purchase undervalued companies. Again, some of you are in a position where this is really your best option, so don’t take offense to my following comments. They are not directed at you.

To those of you who are contributing cash to your portfolio on a regular basis, and an increasing income stream is important to you, for you to choose selective dividend reinvestment is Crazy Thinking. I’ll present my case as I go.

One of my concerns with selective reinvestment is that we are purchasing undervalued companies with the dividends and new cash. We are talking about investing 100% of all available cash options and devoting it to undervalued companies. Are all of your choices successful? If you are going all in with cash and dividends, you need to be sure, I would think. If you are that sure, why not sell off some of your other positions and devote even more cash into your new undervalued position?

I own 40 plus companies, some overvalued, some undervalued. I can’t tell you which ones will perform the best over the next 12 months, or the next 2-3 years for that matter. So, I diversify my cash flow. Dividends get reinvested into the underlying companies and the new cash goes to the best undervalued opportunities. Balance is what Im looking for!

Let’s talk about overvaluation.

People have this incredible fear of reinvesting dividends into overvalued companies. People! Let’s stop and think for a moment.

I agree that when you purchase a company, valuation is very important because of the amount of cash going into the position and this will impact your long term total return. You may be looking at buying 200, 500, 1000 shares or more so your initial price carries weight.

Let’s move to the next step! When you receive your dividends, how many shares are they buying if you reinvest the dividends? Is it 3 shares? 5 shares? 8 shares? How much impact are those shares going to have on your cost basis if they are reinvested into an overvalued position? Is that going to decimate your total return. Really?

Your reinvested shares, as you go forward, will be in various price ranges. It all works out in the end and you don’t have to guess at it.

With the way the market flows up and down, reinvested dividends into an overvalued company isn’t going to negatively affect your cost basis over the long term, but it will provide a steady and increasing flow of income.

Let’s talk about Core positions.

In looking at the formula for stock selection that I listed above, I want to own High Quality companies, especially since we are talking about Core positions. These are the companies that are the backbone, or the foundation of my portfolio. These are companies like KO, CL, ADP, MCD, PNY and others. These companies almost always sell at a premium. It takes a major recession just to bring them down to fair value, never mind under value. How do I build my core positions if all I do is purchase undervalued companies?

If I’m ever in a position where the dividends aren’t enough to meet expenses, and I must liquidate some of my companies, my Core positions are the last thing I wish to sell. I’d prefer to keep the Core and continue to draw those reliable dividends for income.

If I’m not adding to my Core positions because they are always selling at a premium, it means I have less reliable income to count on. I’m of the opinion that Core positions should always be dripped.

Let’s talk about weightings.

One of the responsibilities of managing a portfolio successfully, I would think, is to minimize the damage any one position can do to your portfolio value. For a more detailed analysis on proper weighting, you can find my analysis here:

If all you do is reinvest in undervalued companies, how do you keep your positions relatively weighted? Your best performers are going to be your smaller sized positions and you are going to sit there and say, I wish I owned more. Go ahead, admit it. You’ve been there, done that. That doesn’t compute with me. The strong often get stronger!

Your overvalued positions are usually your more successful positions. It’s the reason they are usually overvalued. Ha!

If I discontinue reinvesting in the companies that outperform, then 100% of available cash, dividends plus contributions, are going into underperformer’s. From my point of view, that’s Crazy Thinking. I think reinvesting back into your winners and using your new cash to buy undervalued companies is a more balanced approach.

Let’s talk income flows.

Let us keep in mind that the purpose of DRIP investing is to get the power of compounding income flow in your favor. If you have selected a high quality company that tends to raise their dividend every year, you are in essence turbo charging your income flow. Case in point:

Two and a half years ago, I purchased a position in MMP for Project $3 Million. This is an online portfolio that I manage for a 28 year old, so the history is short, but the lessons apply.

Project $3 Million:

Since I made the purchase, MMP has had eight 52 week highs over that time frame. You heard me right. Eight 52 week highs in less than 3 years.

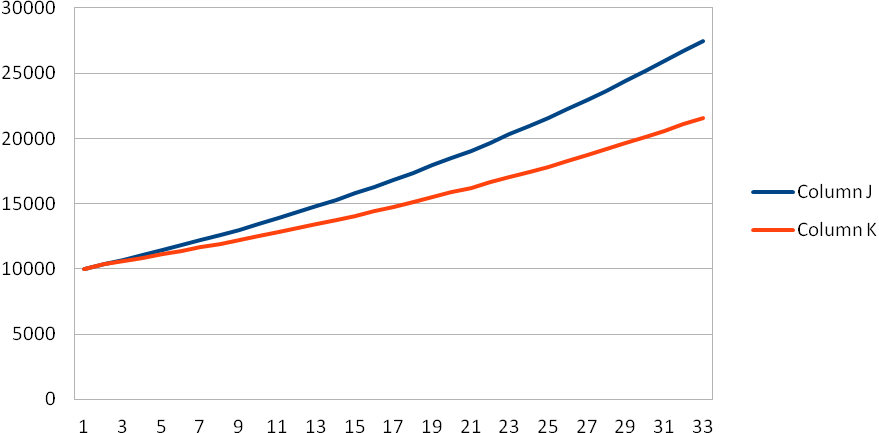

Chart:

During that time frame, there have been 10 distributions, which have been reinvested. If I were using the selective dividend reinvestment strategy, there would not have been any additional buys in MMP. Yet, I know the strong often get stronger and I ignored the overvaluations and kept reinvesting. Here are the results, and keep in mind, this is real, not theory or an academic study.

The distribution growth, including reinvestment, shows that the distribution income grew 50.1% in just 2 1/2 years. That’s a compounded annual growth rate (OTCPK:CAGR ) of 17.64%. Think about it!

If the distributions were simply collected and selectively reinvested elsewhere, the CAGR for MMP would have been 9.9%. Not bad, but look what you gave up? What are the odds of your undervalued selection making up the difference?

Want to talk total return? MMP is the best performing company in the portfolio. It’s up 82%, at the time I wrote this instablog, in just 2 1/2 years and the reinvested distributions had an impact on that. Those distributions were reinvested back into MMP and the whole time they were overvalued. The strong often get stronger.

If a company is so overvalued that you are afraid to reinvest the dividends, then perhaps you should sell your position and lock your gains in. That’s what I did with VFC and MKC as described here:

As I stated earlier in this instablog, the income has priority with me when growth and income are in conflict with each other. My Mission Statement declares that I, build an income stream that is reliable, predictable and increasing. Automatic dividend reinvestment insures that, regardless of market conditions!

Let’s talk downgrading yields.

If I’m selectively reinvesting, based on valuations, I may be taking a 5% yield dividend and end up purchasing a 3% dividend yield. I’m deliberately slowing down my dividend growth rate. If I choose to hold the cash until a 5% yield company becomes available, I’m not earning anything on that cash, it’s not compounding!

Taking a 5% yield dividend from a high quality company and buying a 3% yield company, in my opinion, is Crazy Thinking. Why not use your cash contributions for that. Let your dividends reinvest and compound, especially since you don’t know in advance who your best performing companies are going to be over the next 12 months or more.

Let’s talk ownership rights.

If you want ownership rights in a high quality company, you are going to have to pay a premium for them because reliability and predictability doesn’t come cheap. When a company is almost always selling at a premium, the market is telling you it’s a Blue Chip and it’s worth it’s weight in gold for those of you who will end up relying on the dividends for income.

Let’s talk reality.

I will use results from Project $3 Million because it’s easy to confirm since the portfolio is public. There isn’t any reversionary history here. The portfolio was established at the end of 2008. The first dividend didn’t show up until 2009.

I know this is short term (3 years), but it still shows the power of automatic dividend reinvestment. The cash dividends received vs the reinvested dividends are real and are a fair comparison. So, keep in mind, if you are selectively reinvesting, your selection must make up the difference to compete with automatic reinvesting.

There are 5 positions in the portfolio which have not had funds added to the position over the last 3 years. The only action has been to reinvest the dividends. Some are overvalued, some not. The results are what they are.

I will show the total dividend growth followed by the 3 year CAGR with dividends reinvested and then the 3 year CAGR dividends taken as cash.

Company. $$ growth. 3 yr CAGR/ reinv. 3 yr CAGR/cash

These are Core positions and I think the difference between automatic dividend reinvestment and selective reinvestment is considerable, and we’re still talking short term. I can’t begin to imagine what the long term results are going to look like as the dividends continue to grow.

Keep in mind, when selectively reinvesting, you must find equal high quality, equal dividend yield, equal dividend growth and make up the difference for the compounded annual growth rate, and you’re going to have to do it with a company currently underperforming. If you don’t, your taking a step back.

I say reinvest the dividends and use new cash for purchasing undervalued positions.

Instablogs are blogs which are instantly set up and networked within the Seeking Alpha community. Instablog posts are not selected, edited or screened by Seeking Alpha editors, in contrast to contributors’ articles.