Diversification Across All Asset Classes

Post on: 24 Апрель, 2015 No Comment

Sometimes, an advice will make perfect sense but end up misguiding (and hurting) you. When it comes to diversification, this happens often.

We hear about the advice all the time. Some even call it the only free lunch in investing and I couldnt agree more. Diversifying your investments is one of the best ways to ensure capital preservation. which Im sure you will agree is crucial.

I can just see some of you at this point wanting to click to the next website. You are thinking oh Ive heard this before, I am diversified already. Are you really?

Diversification Across All Investments

It worries me every time I find someone having all their money in stocks (or stocks and bonds for that matter). They usually tell me how diversified they are and how safe their investments are but fail to recognize that at times, all stocks and bonds go down.

As reader Ian Hickman pointed out:

I’d be careful investing all of your money in (index funds) as your won’t be diversifying. Yes, there is a great diversification of stocks in the fund, but perhaps you should look to invest in something that has a negative correlation to the stock market too?

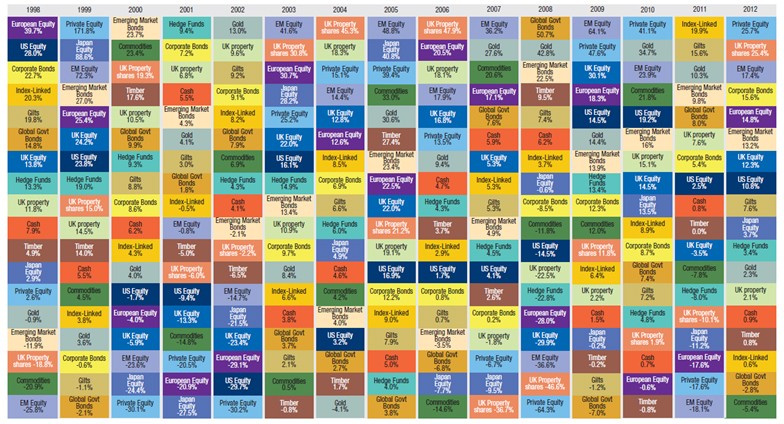

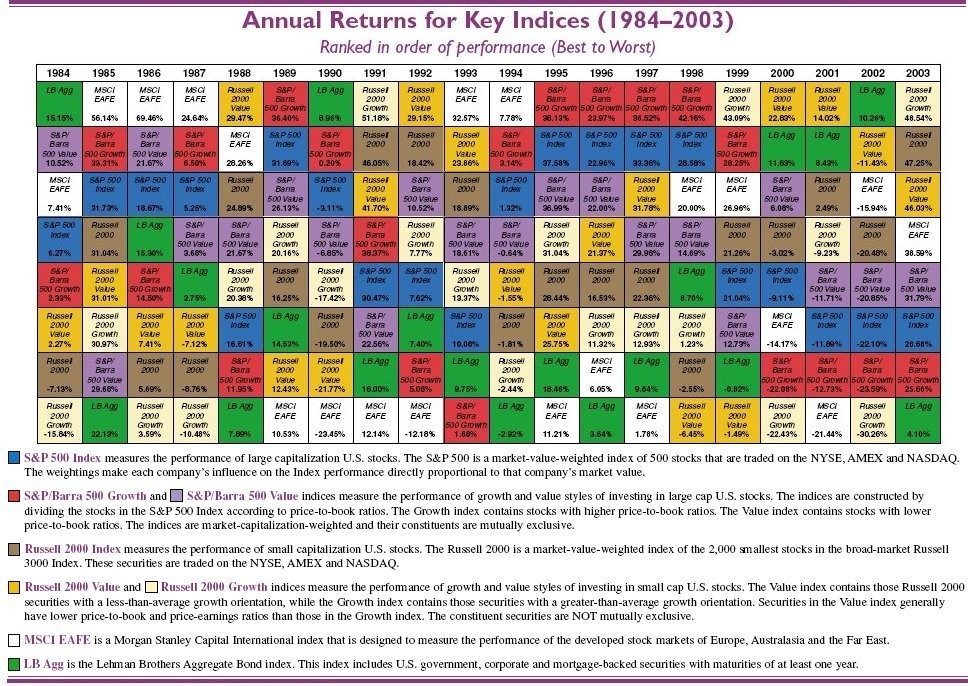

Diversify across asset classes, not just within stocks !

Examples of Asset Classes to Invest In

All this sounds good, but where should we be investing in? Here, Ive put together some different asset classes. Note that Im not suggesting any particular as a good investment, but just listing a bunch so you can do your research and figure out whats right for you.

- Stocks the most familiar so this requires no explanation

- Bonds you can construct your own sets of bonds, or buy bond funds

- Foreign Currency dont buy currency in your country, a huge majority of your net worth is already invested in it!

- Treasury Inflation Protected Securities Safe investments that have interest payouts tied to the consumer price index

- Real Estate Most people have this in their houses, but depending on your investments, you may want to look into rental properties and real estate income trusts (REITs )

- Hard Assets Gold, oil, and diamonds (yes, women are right sometimes) and others. Anything you can actually touch and feel are potential investments. In the old days, owning most of these are impossible but with ETFs and future contracts. its getting easier and easier without worry of theft, transportation and storage.

- Savings Accounts We probably all have at least one but most of us dont think about these as part of our investment portfolio. I recommend online savings accounts for their high yield and convenience but any will do for the purposes of diversification.

Im sure there are others so please fell free to comment and I will add them to the list.

A Final Note about Diversification

Look. Diversifying has nothing to do with making you a ton of money. In fact, you will probably be kicking yourself when a particular asset class is skyrocketing because you didnt put all your money into it. However, diversification is one of the few ways to help ensure a comfortable retirement, and I would never jeopardize that for a small chance to get rich quickly.