Direct Access Trading Systems (DATs) Financial Web

Post on: 16 Март, 2015 No Comment

Direct access trading systems are preferred by many traders because they do not have to go through a middleman. This system provides faster execution and allows a trader to increase potential profits. With this type of system, orders that are placed go directly into the market and are matched up with the aid of a computer system. Here are the basics of direct access trading systems and how they are used.

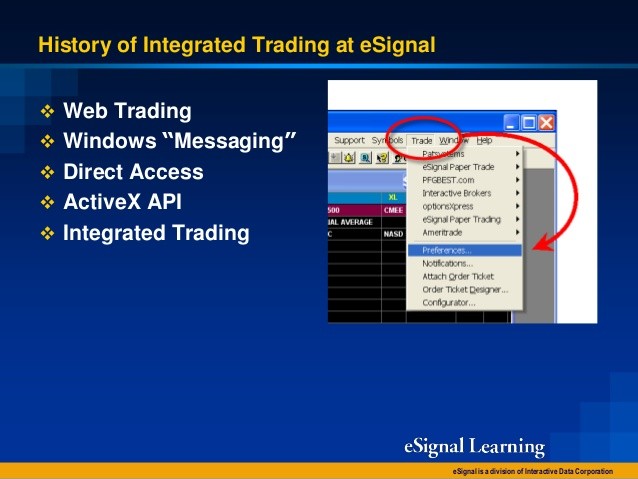

Online Brokers

Trading with an online broker is one of the most common ways that most traders access the market. An online broker can help you open an account very quickly and have access to the market. However, you will be required to go through a broker before your order will actually be placed into the market. In most cases, this will only take a few seconds. In other cases, it can take several minutes. While many traders do not see a problem with this, it could potentially cost you valuable profit if you are going to be a frequent trader.

Professional Traders

When you trade, you will be going up against professional traders, which requires you to get into and out of the market quickly. Professional traders work for brokerages and institutional investors. They have access to trading systems and you will need access to them as well if you hope to profit going up against them. If you are using a traditional online broker, you will not be able to get into and out of trades as quickly as you need to.

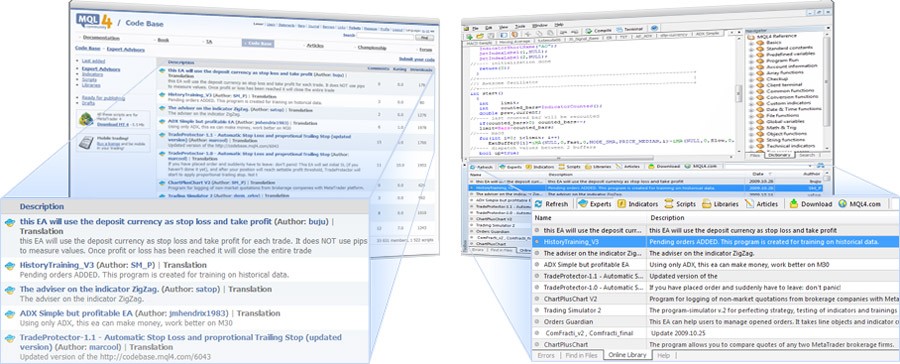

ECN

When you utilize a direct access trading system, you are going to be able to trade on an ECN network. The term ECN stands for electronic communications network. This is a computerized network of brokers which allows you to get direct access to the market. When you place a trade in the market, your order is going to be matched up to another party immediately with the aid of a computer network. This means that you are not going to have to go through a human to get your trade into the market. This is a much more efficient method of trading and it can significantly improve your order execution.

Increased Fees

When you choose to get involved with a direct access trading system, you will find that the fees will be increased. In most cases, you are going to have to pay a higher commission than you would if you work with a traditional online broker. If you are not going to utilize a trading strategy that can be improved with fast order execution, then you may not find it necessary to pay these extra commission fees. However, if you are going to become a serious trader in the future, you may want to put some thought into whether paying the extra fees could significantly improve your trading performance.

$7 Online Trading. Fast executions. Only at Scottrade