Different Types Of ETFs

Post on: 17 Июль, 2015 No Comment

There are many different types of ETFs. some of the common ones we will cover here. The first exchange traded fund, known now as an ETF, hit the markets in 1989 with Index Participation Shares which was the first proxy for the S&P 500 and traded on the AMEX. Though it took a few iterations to get full approval by the SEC eventually the Standard & Poor’s Depository Receipts or SPDR ETF was allowed to trade without hassle in January 1993. The ‘Spider’ ETF is the biggest of all ETFs in the world today.

After that rocky start, though, the ground was paved and today there are many ETF trading for just about anything you can think of. There are ones tracking the price of commodities like the SDPR Gold ETF. There are also ETFs that act as proxies for the gold mining industry, ticker symbols GDX and GDXJ.

There are many Oil ETF trading currently as well. The United States Oil Fund LP, USO, is the most actively traded Oil ETF. Proshares has a very liquid short Oil ETF, SCO, which is leveraged 2x giving traders the opportunity to bet against the price of oil with leverage without having to trades futures on the NYMEX.

Similar to SCO, Direxion has a pair of highly leveraged (3x) Gold ETF’s that play both sides of the gold miners market. The ticker symbols are DUST (short) and NUGT (long). Not to be left out, there are, as well, a number of silver ETF’s currently trading. The best known and most liquid of these is the SDPR SLV ETF. Proshares also has a leveraged short silver ETF, ticker symbol ZSL.

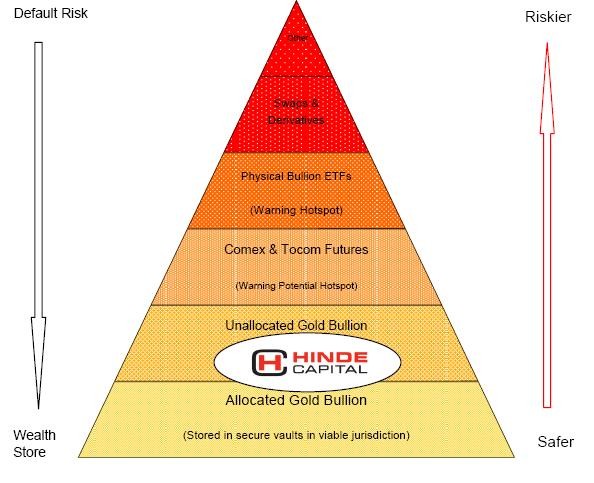

These types of ETFs are designed to give investors direct access to the physical commodities and are meant to be fully backed by them. There are a number of people in the precious metals community who question the validity of this given the stunning growth of the size of the GLD and SLV ETF’s relative to the known supplies of physical metals.

Another complaint has been that it has diverted investment away from the mining companies suppressing their share prices. Regardless of these claims, all of the precious metals ETFs have become favorites of investors wanting exposure to the metals during their decade-long bull market.

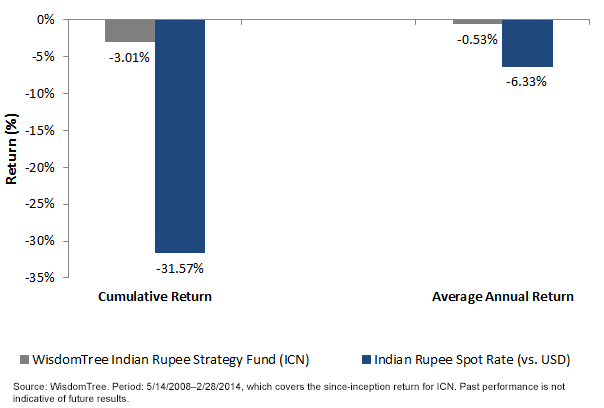

In addition to commodity ETF’s, Rydex has a number of currency ETFs which are quite successful, where a share is worth $100 and which pay a monthly dividend that acts as a proxy for the bond yield curve of the currency. These types of ETFs give investors cheap and easy access to currency fluctuations as well as act as a form of savings account during times of U.S. dollar stress. One can invest in Canadian or Australian Dollars, Swiss Francs, Euros, Mexican Pesos, Swedish Krona, and many others.

Related Stock Market News:

Previous Post Comparing Stock ETF Trading And Investing