Deflation What Is It and The Implications For Investors

Post on: 17 Июнь, 2015 No Comment

Theres lots of talk about global deflation lately.

Shane Oliver, chief economist for AMP Capital, explains that with falling inflation on the back of falling commodity prices and global spare capacity, deflation is more of a threat globally than a surge in inflation in his market commentary this week

Heres what he said:

Introduction

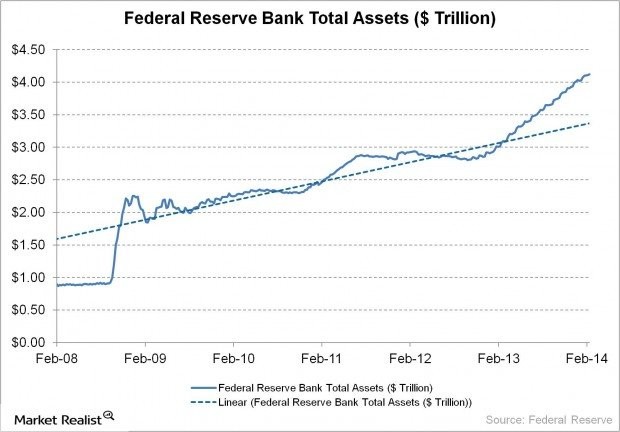

While a constant concern since the Global Financial Crisis (GFC) has been that easy monetary policies would cause surging inflation it simply hasn’t occurred. heig

The absence of inflationary pressures is a good thing, as it means the global sweet spot of okay economic growth, with low interest rates and bond yields can continue. But what if we end up with sustained deflation?

A renewed plunge in bond yields over the last year to record or near record lows is warning of just that.

December has seen falling consumer price levels in many countries and annual inflation rates are now just 0.8% in the US, -0.2% in Europe, 0.5% in the UK, 0.4% in Japan (after removing the impact of higher sales taxes) and 1.5% in China.

In Australia, inflation looks likely to fall below the 2-3% target. In fact, as can be seen in the next chart the collapse in the proportion of countries with hyperinflation is now being matched by a steady advance in the proportion seeing deflation.

Source: Thomson Reuters, AMP Capital

The rise in deflationary pressures is now starting to generate more social interest with Google showing a rising trend in searches for the word “deflation” relative to “inflation” to levels last seen at the time of the GFC.

See the next chart.

But what is deflation? How likely is a sustained period of deflation? And what does it all mean for investors?

Source: Google Trends, AMP Capital

What is deflation?

Deflation refers to persistent and generalised price falls.

It occurred in the 1800s, 1930s and the last 20 years in Japan.

Source: Global Financial Data, AMP Capital

Whether deflation is good or not depends on the circumstances in which it occurs.

In the period 1870-1895 in the US, deflation occurred against the background of strong economic growth, reflecting rapid productivity growth and technological innovation.

This can be called “good deflation”.

Falling prices for electronic goods are an example of good deflation.

However, falling prices are not good if they are associated with falling wages, rising unemployment, falling asset prices and rising real debt burdens.

For example, in the 1930s and more recently in Japan, deflation reflected economic collapse and rising unemployment made worse by the combination of high debt levels and falling asset prices.

This was “bad deflation”.

In the current environment sustained deflation could cause problems.

Falling wages and prices would make it harder to service debts.

Lower nominal growth will mean less growth in public sector tax revenues making still high public debt levels harder to pay off.

And when prices fall people put off decisions to spend and invest, which could threaten economic growth.

Deflation drivers

The decline in inflation globally has raised concerns we may see sustained deflation.

Several factors are behind this:

- First, commodity prices have been in a downtrend since 2011 as emerging countries have slowed and the supply of commodities has improved. This decline has been across most industrial commodities but has been noticeable lately in relation to oil prices. This lowers inflation via lower energy prices but also via lower raw material and transport costs.

- More fundamentally the sup-par recovery globally since 2009 means the world has plenty of spare capacity. Normally after a recession we see a period of above trend growth but so far this hasn’t really happened and so excess capacity remains. A rough estimate shown below is that global economic activity is nearly 3% below potential. When there is excess capacity it means companies lack pricing power and workers lack bargaining power.

Source: IMF, AMP Capital

- While the US is less at risk as its more pro-active monetary policies have put its economy in a stronger position, it is not immune from deflationary pressures globally.

It is now importing deflationary pressures from the rest of the world as the rising $US is pushing import prices down.

Unless you are an energy producer, deflation flowing from lower oil prices is not a problem because it provides a boost to real spending power.

However, the danger is that the plunge in inflation driven by the fall in oil prices will drive inflationary expectations down at a time when inflation is already weak leading to a greater risk of entrenched deflation.

Deflationary forces will also be felt in Australia as global prices fall.

This may be partly offset by the lower $A pushing up import prices.

However, as we have seen over the last year inflation has remained low despite the lower $A.

How likely is a sustained period of “bad deflation”?

The risks of deflation have clearly increased.

However, notwithstanding a short term period of deflation in some countries, a sustained 1930s or Japanese style bout of bad deflation is still likely to be avoided:

- While goods prices are at risk of deflation, services price inflation is relatively resilient.

This is partly because services prices have a higher wage element and wages are often sticky downwards, and there is less excess capacity in services industries.

More global monetary easing should help ensure global growth continues and in turn prevent a slide into sustained deflation. So our base case remains that global inflation remains low rather than collapsing into sustained deflation.

Key to watch will be the success of the ECB and Bank of Japan in boosting their countries’ growth rates.

Implications for investors?

Were sustained deflation to take hold it would favour government bonds and cash over equities, property and corporate bonds for investors.

As can be seen in the next chart low inflation is generally good for shares as it allows shares to trade on higher price to earnings multiples.

But when inflation slips into deflation, it can be bad as it tends to go with poor growth and profits and as a result shares trade on lower PEs.

* Shows price to a 10 year trailing average of earnings (ie Shiller PE). Source: Global Financial Data, Bloomberg, AMP Capital

Some see gold doing well in a period of deflation, but I doubt this and more likely would see it falling further as demand for gold as an inflation hedge will evaporate in a deflationary world.

However, as discussed the most likely outcome is that inflation will remain low over the year ahead with improving growth helping it bottom but still significant spare capacity preventing much of a rise.

This has several implications for investors

First, the environment of low interest rates will remain in place for some time to come.

The Fed may well delay its first rate hike till later this year and when it does move it will be gradual.

Elsewhere, rate cuts are more likely including in Australia.

This means continued low returns from cash and bank deposits.

Second, given the absence of significant monetary tightening a bond crash like we saw in 1994 remains as distant as ever.

The most likely outcome is just low returns from government bonds reflecting record or near record low yields in many countries.

Source: Global Financial Data, AMP Capital

Third, the low interest rate and bond yield environment means that the chase for yield is likely to continue supporting commercial property, infrastructure and high yield shares.

Finally, as the generally easy global and Australian monetary environment continues it will help underpin further gains in growth assets like shares, albeit with more volatility.