Daily Pfennig Pfennig and Pfriends(SM) Edition To DollarCost Average Or Not—That Is The Question

Post on: 26 Июнь, 2015 No Comment

Happy Cinco de Mayo! This is one of my favorite holidays, so sit back, grab a margarita, and let’s talk some metals.

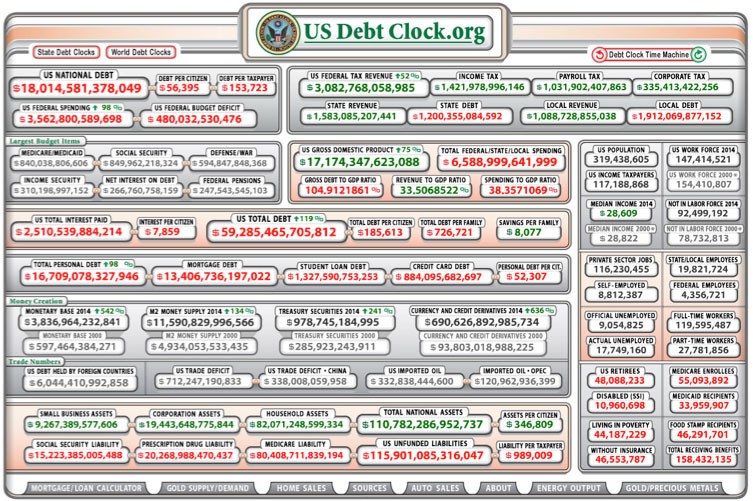

Recent declines in prices since the beginning of the year have really shaken investor confidence in the precious metals complex. Gold saw its biggest two-day drop since 1980, although in percentage terms, it was not quite as bad as it was back then. There are many theories floating around as to why there was such a big sell-off that began April 12. Theories include: speculation that the Fed will back off of their Quantitative Easing measures later this year, ETF and hedge fund selling/shorting, the Cyprus central bank possibly selling some of their gold reserves, a China slowdown, recommendations to sell or short gold from large bullion banks and, of course, manipulation. Nobody knows for sure if it was one, all, or none of these things that triggered the collapse in prices. What we do think is that metals prices will continue to be quite volatile, with downside pressure in the near term, and lots of potential upside over the longer term.

If you are like me, I believe that metals are currently oversold, and look at these cheaper levels as possibly a good buying opportunity. The fundamental reasons I own precious metals have not changed, regardless of the price they attach to them. First and foremost, it is a hedge against all of my paper dollar assets in my portfolio and the potential of a decline in the value of the U.S. dollar. Also, the printing presses have not been turned off, and I believe inflation is here and will continue to get worse; gold has traditionally been a good hedge against inflation. Central banks seem like they are in a race to devalue their currencies, which will eventually lead to a loss of confidence in fiat currencies, and central banks are still buying tremendous amounts of physical gold. They can print all the money they want, but they can’t print more gold. Not to mention that it seems like the world is on the brink of more wars than are already taking place.

Source: Bloomberg

Participating In Today’s Dynamic Environment Using DCA

With all that being said, I am pleased to let you know that we have created a way to invest in precious metals and take advantage of dollar-cost averaging while doing so. EverBank’s new Non-FDIC insured 1 Metals Select ® Automatic Purchase Plan gives clients the ability to participate in an unallocated metals account (gold, silver or platinum) for as little as $100 a month, allowing the client to dollar-cost average their metals purchases. The $5,000 minimum will be waived for clients participating in the purchase plan. Clients or prospects wishing to participate will need to have a World Markets Access ® Account or Yield Pledge ® Checking or Money Market Account, which will be used to fund the monthly draws. You will have a choice of making your purchases at the beginning or middle of the month, and you can close your unallocated metal account at any time. Also, if your goals change over time and you want to have the physical metal sent to you, we can convert your unallocated metal account to an allocated account 2 and have them shipped to your door (conversion and shipping fees will apply). There are no storage, maintenance, or set-up fees on this account, and all you pay is a small premium 3 when you buy or sell. For example, on the $100 minimum investment amount, the premium 3 amounts to 75 cents.

The low minimum on this account makes it an attractive option for people who don’t have a large lump sum to put in up front, or have steady incomes they want to invest over time. Also, this is a great tool for beginning investors, or those of you who want to open a custodial account to start accumulating metals for your children. The best part is you don’t have to pull your hair out watching the market and trying to time your purchases, or having to remember to place your trades. Like late night infomercial king Ron Popeil says, “Just set it, and forget it.”

For more information on our Metals Select ® Automatic Purchasing Plan, please call our trade desk at 800.926.4922 or click here

EverBank World Markets, a division of EverBank