Cycle of Market Emotions

Post on: 29 Май, 2016 No Comment

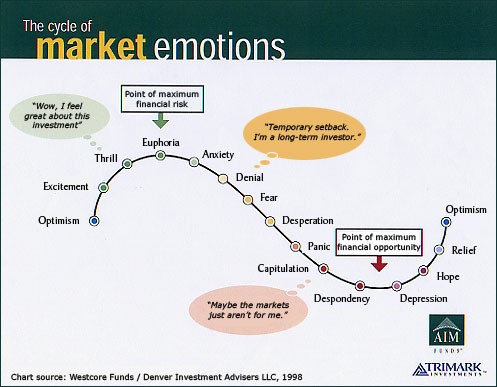

Over the last 20 years, the market has returned an average of 11% annually. The average investor however, only enjoys 4.5% per year.* At this rate, individual investors are barely outpacing inflation (which is around 3% over the same time period). Why are so many investors failing to take full advantage of the opportunities the market affords them? The root of this problem is investment behavior (also known as the psychology of investing). In fact, studies have shown that emotionally driven investor behavior has a bigger impact on investment success than the actual performance of the market. To understand why, lets take a look at the Cycle of Market Emotions.

*Source: 2008 Dalbar Quantitive Analysis of Investor Behavior Report

Perception vs. Reality

The Upturn

• Optimism —The average investor enters the market feeling optimistic (Point 1). They may also have high expectations for the returns they will experience.

• Excitement —When the market goes up, the expectations start to become a reality and the investor experiences excitement (Point 2).

• Thrill —The market continues up and the investor is thrilled (Point 3).

• Euphoria —As the market reaches its peak, the investor is euphoric and quite confident that the market will continue up (Point 4).

By the time the investor reaches the point of Maximum Financial Risk, they should be extremely cautious. Instead the investor ignores the reality of the inevitable downturn and feels very over-confident, thinking Prices keep going up. I cant lose! Often, they will throw more money into the market or switch to more aggressive strategies, in an effort to chase higher returns. These are emotional decisions driven by greed. But as history has shown time and time again, no bull run lasts forever. And so begins the negative emotions that accompany a downturn in the market cycle.

The Downturn

• Anxiety —The market begins to dip, generating feelings of anxiety (Point 5).

• Denial —The market continues to fall, and the investor goes through denial with such thoughts as Its ok, Im in it for the long run, and This is just a temporary setback, (Point 6).

• Desperation and Panic —As the market cycles lower still, feelings of desperation and panic ensue (Points 7 and 8, respectively).

• Surrender —Panic eventually gives way to surrender, when the investor thinks How could I have been so wrong? I just cant handle being in the market any longer. I cant take any more losses, (Point 9).

Ironically, at this juncture the market is just one step away from the point of Maximum Financial Opportunity. This is the best time to invest, while buying power is at its highest. Unfortunately it is also the point where the emotional investor succumbs to fear and throws in the towel, abandoning the market entirely.

There are three major negatives that occur hot on the heels of this emotion-based decision: One, it makes paper losses real (and usually quite significant). Two, the investor is now on the sidelines when they should be investing. And three, because the investor is out of the market (waiting to regain the confidence to reinvest), they generally miss out on the first 1/3 of the next bull market. Historically, the first third of the bull market accounts for 60% of the total performance of that bull trend.

The Bottom and the Recovery

• Depression —While the investor wallows in depression (point 10), the market hits bottom and gives way to a new bull.

• Hope —As the market continues to strengthen, the investor is hopeful that the market will continue up (Point 11).

• Relief —Once the market confirms it is in an uptrend, the investor feels relief, but they are still not confident enough to invest (Point 12).

• Optimism —The investor waits until they feel optimistic again (Point 1 or often much later) before re-entering the market. As we described above, this usually doesnt happen until they have already missed a large portion of the up move, and their chance to recoup losses with it.

The market cycle has now come full-circle, ending right back where it began. And the cycle will repeat itself over and over. It is no surprise that average investors underperform the market when emotions weigh so heavily on their investment decisions. And the investor will keep making the same mistakes again and again (which by the way, is a variation on the definition of insanity, i.e. doing the same thing over and over again and expecting different results). But one cant be a successful investor without remaining invested. The key is to learn how to keep emotions in check.

Escaping the Vicious Cycle

At Niemann, we believe the best way to achieve investment success is to take the emotion out of investing. As weve just seen, there will be times during a downturn when your emotions shout, Get out of the market! At these times it is tantalizingly easy to make significant investment mistakes, but thats exactly when—with your advisors help and support—you need to resist the temptation to abandon the market. Our history shows the best way to be a successful investor is to stay disciplined, stay invested, and stick to the plan that you and your advisor have crafted. Our process is designed to help you do just that. All we ask is that you give us the time to prove our process.

Past performance does not guarantee future results.