Contracts for Difference_1

Post on: 19 Апрель, 2015 No Comment

Contracts for Difference, also known as CFDs, are a financial agreement between two trading partners to swap the difference between the opening and closing value of a contract. Contracts for Difference are a financial derivative and are traded without actual ownership of the underlying financial instrument on which you are speculating.

For many investors, two of the key features and attractions of a CFD are:

- The ability to use a CFD to go short of a market

- Leverage

Going short is speculating on a market to fall. This means that you can, potentially, profit whether prices are going up or going down.

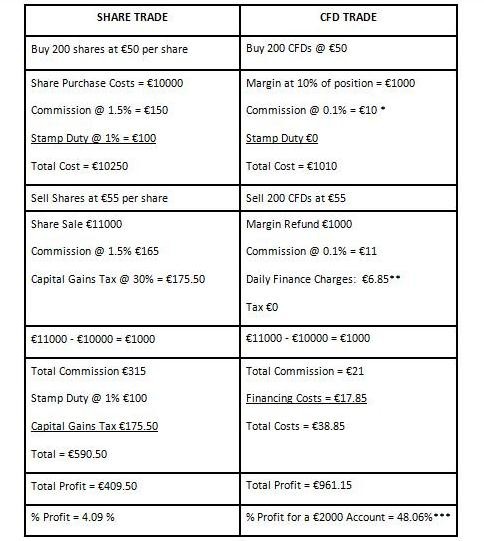

A CFD is traded using leverage, in other words, traders typically put down a deposit or percentage of the total trade value. As your position in the market is greater than your invested sum, you can potentially stand to profit more than you would without using leverage. Leverage helps to magnify your profits. However, it is important to be aware that leverage can also work against you, because losses are also magnified.

Contracts for Difference Tax Benefits

Contracts for Difference relate to, but do not entail, ownership of the underlying financial instruments in the market you are trading in. As a result, investors do not pay stamp duty* on CFD trades.

Contracts for Difference — Risks and Risk Management

As outlined above, the use of leverage can be risky, because both profits and losses are magnified and losses can potentially exceed the value of your initial deposit. If not monitored and/or stemmed at a manageable level, the falling value of your trades can result in serious losses.

Contracts for Difference, however, can be traded using risk management tools. Whether you think the market will rise or fall, you can add a Guaranteed Stop Loss order to your trades.

A Guaranteed Stop Loss order acts as a safety net; it will stop your potential losses at a level that you can set. Put another way, a Guaranteed Stop Loss will close your trade if it hits a certain levels. This means that you can calculate, in advance, the level of your potential losses should the market move against you.

It’s also worth noting that a Guaranteed Stop Loss limits your downside but not your upside.

Contracts for Difference — Markets

You can trade a broad range of markets through Contracts for Difference. Some of the most popular markets are the FTSE 100, the Dow Jones, EUR/USD, GBP/USD, gold and crude oil.

Contracts for Difference Brokers

There are a range of Contracts for Difference brokers like ETX Capital and IG Markets however note that opening in account isn’t guaranteed. All applications are subject to terms and conditions. For more details see Contracts for Difference brokers.

Contracts for Difference (CFDs), margined forex and financial spread trading are leveraged products and may not be suitable for everyone. Losses can exceed your initial deposit. Please ensure that you fully understand the risks involved and seek independent financial advice where necessary.

Contracts for Difference. last edited by F. Lawson. 15-Sep-11.

For related articles please see:

CFDs Blog — last update: 04-February-2015

The CFDs Online blog covers a wide range of news and opinions on the CFD markets from some of the leading CFD market analysts, traders and investors. As well as a CFD price comparison, the CFDs Online blog shows how — read more — CFDs Blog .

CFDs Brokers — last update: 10-October-2012

CFDs Brokers — in the UK there are many companies offering CFD trading and they tend to charge different commissions and fees. Some brokers offer commission free trading, provide different trading tools, indicators and — read more — CFDs Brokers .

CFDs Prices — last update: 10-October-2012

CFDs Prices: A guide to current CFD prices for the major CFD markets with stock market, forex and commodities CFDs prices. Plus a review of CFDs tools, data and — read more — CFDs Prices .

CFDs Online — last update: 22-December-2011

CFDs Online — How to Trade CFDs Online, Why trade CFDs Online, Where to trade CFDs Online and — read more — CFDs Online .

Hedging with CFDs — last update: 10-October-2012

CFD trading is the ideal hedging tool to help investors protect their investment portfolios. The principle behind using CFD trading to hedge is one of — read more — Hedging with CFDs .

CFD Trading vs Spread Trading — A guide to the similarities and differences between CFDs and Spread Trading. If you are interested in pursuing CFD trading or Spread Trading, but have not yet decided which one — read more — CFD Trading vs Spread Trading .

CFDs Guide — last update: 10-October-2012

CFDs Guide — a CFD trading guide looking at how CFDs work, how to trade CFDs, where to trade CFDs, fully worked examples for buying and selling as well as a guide to — read more — CFDs Guide .

CFDs Margin, Fees and Dividends: an in-depth look at the costs associated with trading CFDs along with margin requirements and stop loss levels. Certain CFD brokers do not charge fees they only — read more — CFDs Margin, Fees and Dividends .

Why Trade CFDs? — last update: 10-October-2012

Why Trade CFDs — CFD trading lets you trade against market movements without actually buying or selling the physical shares or assets, this means that they are quick and accessible, removing the need to trade through a stock broker. Also CFDs let you — read more — Why Trade CFDs? .

Interactive Brokers — last update: 08-September-2011

Interactive Brokers — CFD trading with Interactive Brokers offers low cost trading, DMA pricing transparency, up to 10-to-1 leverage and sophisticated trading tools along with — read more — Interactive Brokers .

Contracts for Difference — a quick guide to Contracts for Difference (CFDs) looking at leverage, risk management, Contracts for Difference brokers and — read more — Contracts for Difference .

CFDs Explained — last update: 14-September-2011

CFDs Explained: a guide to CFDs (Contracts for Difference). CFDs Explained looks at leverage, trading risks, buying and sell as well as CFD brokers and — read more — CFDs Explained .

CFD Companies — last update: 14-December-2011

CFD Companies: The CFD companies guide includes a selection of CFD company reviews, important factors for choosing a CFD company and the differences between CFD companies that — read more — CFD Companies .

CFD Trading Strategies: Since the price of a CFD is based on the market price, your CFD trading strategies should be much the same as when you trade physical the underlying market. Of course CFD trading, like spread trading, is leveraged so you need to — read more — CFD Trading Strategies .

Share Trading Strategies — Approaching your share trading according to a strategy has a range of advantages, perhaps the most obvious one is that when you make a profit, it is easier to see what you did right, and if you make a loss, it is easier to — read more — Share Trading Strategies .

A Quick Guide To Stock Market Trading — Stock markets, also known as equity markets, are financial centres for trading company shares. Some of the most well known stock markets are the London Stock Exchange, the — read more — A Quick Guide To Stock Market Trading .