Considering a NonDollar Option Forex Australia Currency Analysis

Post on: 28 Апрель, 2015 No Comment

The majority of new traders are advised to look at currency pairs using the US dollar when they start trading. Although this is often a favourable behaviour, it may be a good idea to explore other non-dollar options as well. There are various reasons why you should look at non-dollar options including the effect of the currency on a trading strategy. This article examines the currencies and their role in the forex Australia market.

What are the major currencies?

When you trade on the forex Australia market you will notice that there are 8 major currencies. This means that if you do not want to trade the US dollar then there are 7 other major currencies to choose from. Of course, you have to consider the implications of trading these other currencies and how easy relevant information is to obtain. It is recommended that new traders who do not want to trade the US dollar should look at the Euro and the British pound as these two currencies are the strongest after the US dollar.

If you are looking for a major currency that does not have great price volatility then you should consider the Japanese Yen. The Yen is a stable currency that tends to range more than it trends. However, if you are looking for major currencies that do have high volatility you should look at either the Australian dollar or the New Zealand dollar.

How do I trade a currency on the forex Australia market?

All forex brokers will offer quotes on currency pairs with the US dollar. When you move away from the US dollar you may find that the broker does not offer this. There are certain commonly traded currency pairs like the EUR/GBP which will be available. However, you could find the major currency pair you were thinking of trading is not available because it is not one of the commonly traded pairs.

What are the drivers behind a currency?

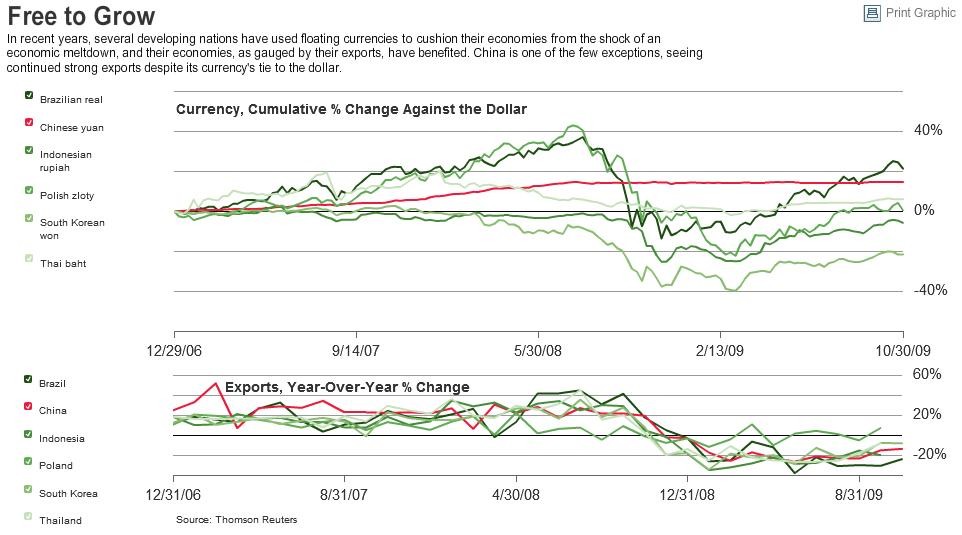

When you look at non-dollar currencies you have to consider what the drivers are. The New Zealand and Australian dollar are considered commodity currencies and this means that demands in certain commodities impact them. With the Australian dollar you have to look at gold and grain prices and see how the exports of the country are doing.

The other major currencies are not commodity currencies and some are driven primarily by fundamental drivers. One of these currencies is the British pound which is affected mainly by the fundamental releases of the country. With the Euro you have to consider the state of the entire Euro Zone and how the fundamentals of each country affect the currency.

How do I get information about a currency?

One of the reasons why the US dollar is recommended to new traders is the ease of which information can be obtained. If you want to find out anything related to the currency you can easily do this. Charts mapping the currency are also very easy to find. When you trade currency that is not the US dollar you may have a problem getting all the information.

However, if you stick to the major currencies then you should not have a problem. It is when you are looking at the exotic pairs and currencies that you find a problem with information.