Commodity Trading A Brief Overview

Post on: 9 Апрель, 2015 No Comment

Commodity Trading A Brief Overview

Written by Trader Maker

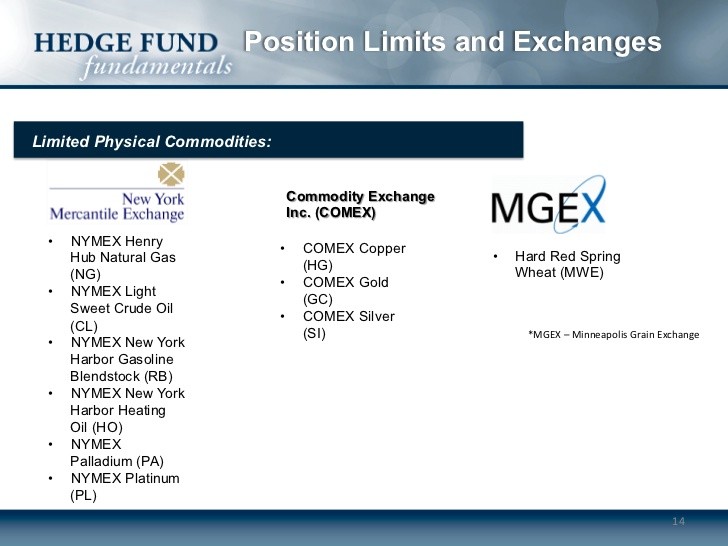

Commodity Trading is best described as commodities and futures. These can be the general term that connotes the markets. This is an investment strategy that deals with the buying and selling of commodities. Something that is considered to be of value, has quality that is standardized and is manufactured in large amount is known as commodity. Clients, who invest on commodities do so in view of “commodities” which are resources that are bought for a wide spectrum of uses. For instance, precious and non-precious metals are still tagged as commodity and they are traded based on the wide spectrum of goods they can make out of it using them as a vital ingredient.

When investors discuss the stock market they hardly differentiate between stock and equities utilization. What this means in essence is that commodities are actual physical products like gold, wheat, corn, oil, crude and many more.

Participants in Commodity Trading

Private Investors: These are a group of individuals that can amass a pool of cash to reduce risk and increase gains

Retail Investors: These are individual commodity traders who trade using their own accounts or via a commodity broker in a view to make money via price fluctuations.

Commercial firms: There are entities that are involved in the production, processing and merchandising of a commodity.

Why Commodities Trading?

Commodities are the main asset class that is negatively associated to bonds, making them an important force for diversification. Ideally, bonds are minimally correlated with stocks, but commodities have been actually been negatively correlated to both stocks and bond. What this does mean is that as commodities tend to decrease stocks and bonds increases.

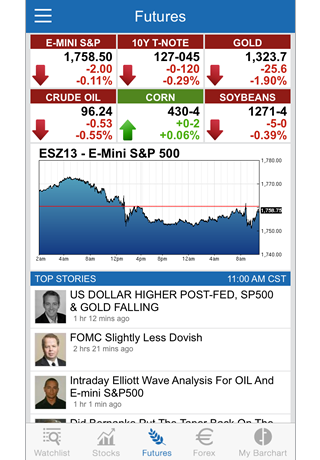

Commodity Trading can be extremely volatile and unpredictable; this is inherently because the financial market is known for its erratic behavior and price surges. If you look at a chart for a commodity product such as Soyabeans or oil and compare that to any stock index, you’ll certainly spot the difference. This means that when trading commodity you must be extremely disciplined in your approach and employ reliable money management technique. Placing a preplanned stop loss just as you enter the market is very important.

Trading commodities on the internet provides an investor with everything he needs right from the moment you log into your trade account. On most brokerage firms, you should find live market data, which could include futures news, price quotes, charts, technical and fundamental analysis tools that are available to clients.

Conclusion

There’s also the concern the huge cost concerns when it comes to managing a commodity trading account. It offers investors the opportunity to make some extra bucks in the long run. Although, online commodities may seem a very prudent investment idea in an uncertain time, discipline is need, mental alertness and a good trading plan if success must be achieved. Newbies can start this experience via the use of an online broker. That said, trading opportunities that are present in commodity trading are quite huge.