Commodities Today Domestic Oil Names To Offset Middle East Risk

Post on: 8 Июнь, 2015 No Comment

Summary

- Analyze the latest from Iraq and what could happen in the region should Iraq require help.

- Look at the gasoline market and discuss why that could see prices rise sharply.

- Discuss domestic oil names which investors could buy in a basket to play the rise in oil prices and Middle East turmoil.

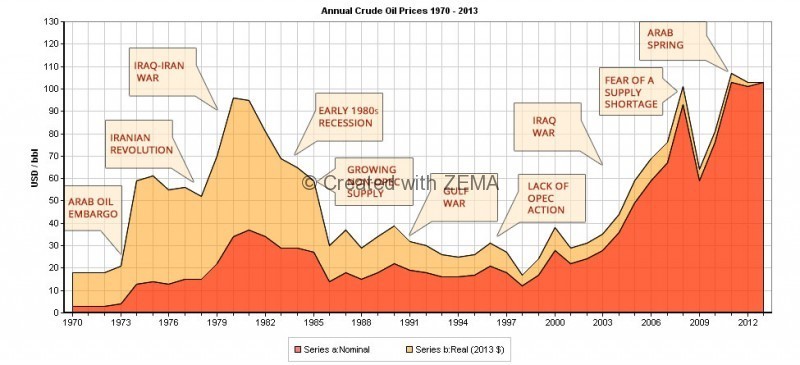

With the world now realizing how serious the issue in Iraq is, we think that over the next few weeks there could be an oil trade developing. It seems apparent that a fight is brewing in Iraq and with the latest revelation yesterday that Iran was willing to help the government in Iraq by sending some of their elite forces it seems likely that various neighbors could be dragged into this battle with the alliances tied to religion.

With the rebels having taken weapons, vehicles and millions in cash they appear set to fight a prolonged war if a superior force does not first come in and stabilize the situation.

Chart of the Day:

Below is a chart of RBOB Gas that shows the recent rally on the news in Iraq. We have been discussing the fact that RBOB could see a rally into the summer, even with oil prices already trading higher and this event could compound the situation as refined oil products, which includes gasoline, are exportable under US law and with rising energy prices around the world could incentivize refiners to begin exporting. Keep an eye on RBOB prices as they could impact the transportation stocks and the general market as well should we have a prolonged move higher.

Source: CNBC

Commodity prices are as follows (at time of submission):

- Gold: $1,274.80/ounce, up by $0.80/ounce

- Silver: $19.635/ounce, up by $0.102/ounce

- Oil: $106.96/barrel, up by $0.43/barrel

- RBOB Gas: $3.0635/gallon, down by $0.0202/gallon

- Natural Gas: $4.736/MMbtu, down by $0.026/MMbtu

- Copper: $3.031/pound, up by $0.0155/pound

- Platinum: $1,437.90/ounce, down by $3.40/ounce

Oil Markets Rallying

With WTI and Brent Crude rallying on the news we think that investors will find a trade in the domestic US names. We covered this somewhat yesterday but after looking at the situation over the past 24 hours, we think that investors should target the oily names with onshore US production who are growing their production figures.

We would focus on a basket of stocks centered around the key US shale oil areas such as the Bakken, Eagle Ford, Permian and Wattenberg. Also, due to the situation we think that it would be best to not focus solely on the momentum names, nor only on the larger more steady names.

Our thinking is that one would want to own the big names in the Bakken such as EOG Resources (NYSE:EOG ) and Continental Resources (NYSE:CLR ) which does also get one into other plays but the two names offer a lot of exposure to the oil rich Bakken; which is our key point here. Even though we are discussing a short-term idea, the management teams at these two companies are both quite capable and among the best in the industry.

Outside of the Bakken we would focus the rest of the trade on smaller names. Part of the reason is that some of these emerging plays are heavily populated by the smaller companies which were first movers in the area and there is less of a choice among the larger names. One also has to remember that some of the larger names involved in these other plays have significant natural gas exposure from other shale plays, and that is not at all attractive when discussing names to play an oil spike here in the US.

In the Permian, which is what we would call a re-emerging oil play due to advancements in drilling technology, we really like the smaller players. This is a strategy which has worked out well in the past and which we think will work again. The two names we like here are Laredo Petroleum (NYSE:LPI ), a $4 billion market cap explorer with more than 200,000 net acres in the Permian, and Diamondback Energy (NASDAQ:FANG ) which is another $4 billion market cap company developing acreage in the area. Out of these two names we think that Laredo is the value trade but that Diamondback is the momentum trade, especially factoring in that the company is in the works to create a new MLP vehicle to hold their Permian mineral rights. This will unlock value for the company and allow them to continue to develop their acreage without taking on new debt or diluting shareholders with equity raises in the near-term.

It certainly appears to us that PDC Energy is breaking out and we could see the shares test $70/share as fighting escalates in the Middle East.

Source: Yahoo Finance

The last name we will throw out there is a personal holding in our retirement portfolios that is active in the Wattenberg and Utica shales. PDC Energy (NASDAQ:PDCE ) is a less oily name than the others but has most of its new production focused around liquids in the Wattenberg with significant natural gas production from the Utica not coming online until at least 2015. With the stock having perked back up in recent sessions we think that this name could become a big winner after having traded sideways for a while.

Disclosure: The author is long PDCE. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.