CHF Is No SafeHaven but a Safe Proxy for Global Economic Growth

Post on: 2 Июнь, 2015 No Comment

April 24, 2013 7:01 am

In our view the Swiss franc is Not a Safe-Haven, but a Safe Proxy for Global Economic Growth. Global investors want to participate via the purchase of safe Swiss equities and multi-nationals in global growth.

The Swiss Global Economy

In our view the Swiss franc is Not a Safe-Haven, but a Safe Proxy for Global Economic Growth.

From the official Balance of Payments release: “In 2013, the receipts surplus from investment income surged by CHF 23 billion to CHF 53 billion.”This steep increase was due to the higher receipts from Swiss investment abroad”.

Global investors want to participate via the purchase of safe Swiss equities in global growth and the yield these companies are able to obtain.

According to an article in the Finanz und Wirtschaft. Swiss blue-chips contained in the SMI make less than 20% of their sales in Switzerland, but 25% are in the United States as opposed to 16% for other European companies.

However, Swiss investors hold 80% of their equity portfolio in Swiss stocks. Swiss blue-chips are very much engaged in the so-called defensive sectors like health care and non-cyclical/food. Nestle makes up 20% of the index, the pharma companies Novartis a 19% share, Roche another 17% (source )

From Bloomberg. April 2014

With just 2 percent of sales made in its home market of Switzerland, Nestle has a heightened sensitivity to currency-market shifts compared with most other companies. It cites the strength of the Swiss franc for reducing reported revenue by 8.6 percent. What we need is probably both a weakening of the Swiss franc and a weakening of the euro against the dollar, Swiss central bank President Thomas Jordan said a few days ago.

Visibly the aim of the Swiss establishment is to reduce the value of both euro and Swiss franc, to inflate revenues of Swiss companies; this despite Swiss unemployment at very low levels and a continued inflow of qualified personnel into Switzerland. Companies like Novartis and Roche have the choice among qualified people from all over the world that would love to work in Switzerland. As reported by Swiss radio, these specialists have issues in finding a new jobs, once their contracts with the big Swiss pharma giants finishes.

SNB Findings about the Swiss safe-haven

The SNB itself, has found finally found out that CHF is no pure safe haven, like for example the yen.

Based on Verdelhans The Share of Systemic Risk in Bilateral Exchange Rates , the SNB researchers Christian Grisse and Thomas Nitschka elaborated a risk-factor model of exchange rate changes. mostly based on VIX volatility. As control variables they employ the spread between German and Italian bonds and the TED spread (difference between US treasury bills and Eurodollar deposit rates) to confirm their results:

Our results highlight that the Swiss franc is a safe haven relative to many, but not all currencies: in response to increases in global risk the franc appreciates against the euro as well as against typical carry trade investment currencies such as the Australian dollar, but depreciates against the US dollar, the Yen and the British pound.

Around the period of the Lehman bankruptcy, the change in the VIX index was associated with a more than 0.2% appreciation against the Australian dollar, and a more than 0.2% depreciation against the US dollar. source

This research and that SNB leading officials keep on claiming that the Swiss economy needs the floor shows that the central bank does not really understand the CHF price movements. Once again in May 2013, markets are speculating on a higher floor.

Swiss Friends: Proxies for Switzerland

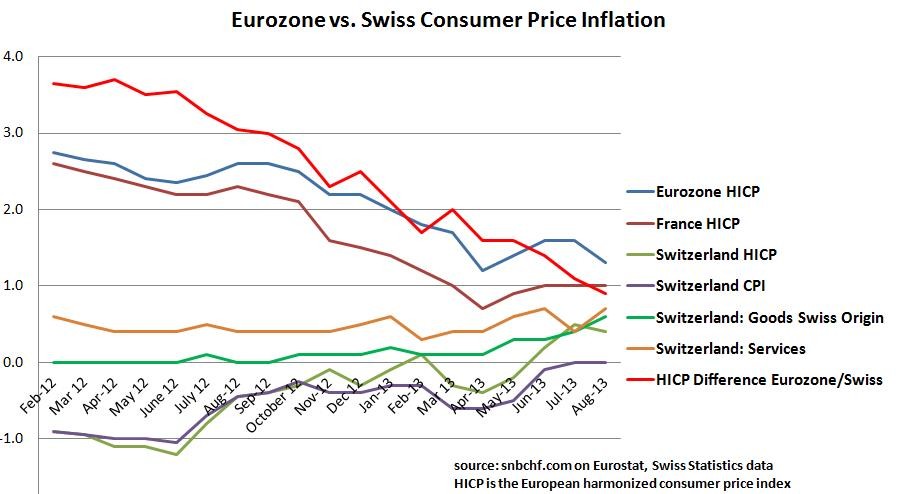

They do not grasp that for the first time fundamentals and not speculation like last year September help to push the EUR/CHF rate upwards, namely weak data for Germany, Japan, China and a weak Brent oil price.

In our April 2013 we foresaw the improvement of the EUR/CHF exchange rate based on weak data for the Swiss friends. other assets and economies with which the franc is positively correlated, which are all proxies for global growth.

The Chinese economy is weaker, the Brent oil price under 100$. the German DAX broke down to 7500, the yen near USD/JPY 100, the Australian dollar has depreciated and last but not least the gold price has broken down.

On the other side, Spanish and Italian banks are recovering thanks to current account surpluses, weaker inflation and lower bond yields. US housing and risk appetite is improving thanks to investment flows to the US and cheaper gas prices.

An Alternative Model for Valuing FX Rates

For us, the SNB model above is far too simplistic to explain currency exchange rates. We sketched a model based on the following five factors:

1) Credit cycles: Currencies in a boom phase of the credit cycle tend to appreciate.

4) Risk aversion the only factor contained in above SNB research is often driven by economic improvements or weakness in the United States. As they stated by SNB researchers the typical risk-off currencies are now USD, JPY and GBP. With the backstop at 1.20 by the central bank in their back, FX and carry traders might use the currently high risk-appetite to push EUR/CHF further upwards.

5) The alignment of rich and poor countries: Commodity prices are mostly related to economic data in China and other emerging markets.