CFA vs FRM

Post on: 8 Апрель, 2015 No Comment

The Chartered Financial Analyst (CFA) is the most respected investment credential in the world and it is offered by the CFA Institute. The curriculum, format of examination, evaluation, awarding of charter is performed by CFA Institute.

Candidates who fulfill all the terms and successfully complete the program will be awarded with the CFA charter and becomes CFA charterholder. The charter is known as a Gold Standard of the investment world.

The Financial Risk Manger (FRM) is a professional designation awarded by the Global Association of Risk Professionals (GARP) to the candidates who successfully completes this certification program. It is a globally recognized standard for those who manage risk.

With the rapid changes in the finance industry worldwide there is a need in professionals who manage risk, money and investment to obtain globally standardized up-to-date knowledge and FRM aims to fill that gap.

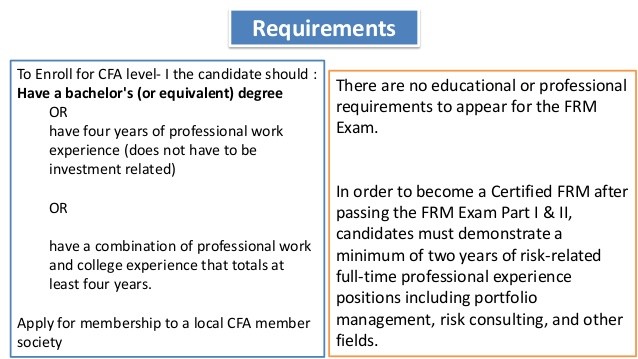

Requirements

To Enroll for CFA level 1 the candidate should

- Have a bachelors (or equivalent) degree

- or be in the final year of bachelors degree program at the time of registration

- or have four years of professional work experience (does not have to be investment related)

- or have a combination of professional work and college experience that totals at least four years. Part time, summer or internship work experience is not allowed.

- Be a member of the CFA Institute.

- Adhere to the CFA Institute Code of Ethics and Standards of Professional Conduct

- Apply for membership to a local CFA member society, and

- Complete the CFA Program.

There are no educational or professional requirements to appear for the FRM Exam. It is practice-oriented examination offered in two parts; questions are designed to relate theory to practical, real-world, problems.

In order to become a Certified FRM after passing the FRM Exam Part 1 & 2, candidates must demonstrate a minimum of two years of risk-related full-time professional experience positions including portfolio management, risk consulting, and other fields.

CFA vs FRM

Definitely Courses vary from each other in the content and focus aspect,

- CFA looks in and out into, the finance world whereas; FRM looks into, Risk Management aspects of finance.

- CFA program covers more on Portfolio management, Ethics, Valuation etc. and FRM covers more about risk related functions.

- Some topics may be similar in some aspects like hedge funds, fixed income, statistics etc.