CFA or CPA Which Qualification is Better Finance Resume and Career Guide

Post on: 4 Апрель, 2015 No Comment

Finance professionals often pursue professional qualifications in order to advance their careers.

Certified Public Accountant (CPA) and Chartered Financial Analyst (CFA) designations are arguably the two most prestigious titles in their respective fields. What are the differences, and which one is better?

CFA or CPA: An Overview

The CFA and CPA titles cannot be compared apple-to-apple because they represent qualification in two different sub-sectors within the general accounting and finance field.

CPA is the black-belt in accounting. It is originally a designation for public accountants, but non-public accountants, tax accountants and finance professionals seek the CPA title to proof their number crunching expertise. CPA also has statutory rights to sign audit report which makes the title special.

CFA, on the other hand, is the gold standard in finance and investment. For those who are looking for career as equity analysts, fund managers, and professionals in asset management or hedge fund houses, this is the best title you can get.

CFA or CPA: Application & Qualification

The CPA license is granted by each of the 55 states or jurisdiction in the United States. There is no centralized administrative body and each state has slightly different CPA exam and licensing requirements.

The eligibility criteria for US CPA is the highest among all finance related qualifications. Candidates must have at least a 4-year bachelor degree and in most cases, 150 credit hours (equivalent to 5 years of higher education) to sit for the exam.

Because of the high barrier of entry and complicated application process, it is quite a challenge for non-US candidates to take the exam.

CFA is a designation granted by CFA Institute, a global non-profit organization. The institute is based in the US, but there are 3 regional offices and 200 local chapters around the world. Candidates apply through the institute and application is relatively simple.

As long as the candidate has a bachelor degree (not necessarily 4 years), this person can sit for the exam. The candidate can even take the exam before graduation.

CFA or CPA: Exam Content and Format

There are 4 exam sections: Financial Accounting & Reporting, Audit & Attestation, Regulation and Business Environment & Concepts.

The exam is 100% computerized consisting of multiple choice questions, task-based simulations (case studies) and written communications. Grading is mostly computerized.

You can choose to take the 4 parts one at a time, 2 at a time or even 4 at the same time. You can sit for the exam any time (Monday to Saturday) during the first 2 months of each quarter and at any prometric centers throughout the US. There are also testing centers in Japan, Brazil and 4 Middle Eastern countries.

The exam format is much less flexible for CFA. There are 3 levels of exam, and you need to complete one in order to move on to the next. Exam content is focused on financial analysis and portfolio management instead of accounting, audit and taxation.

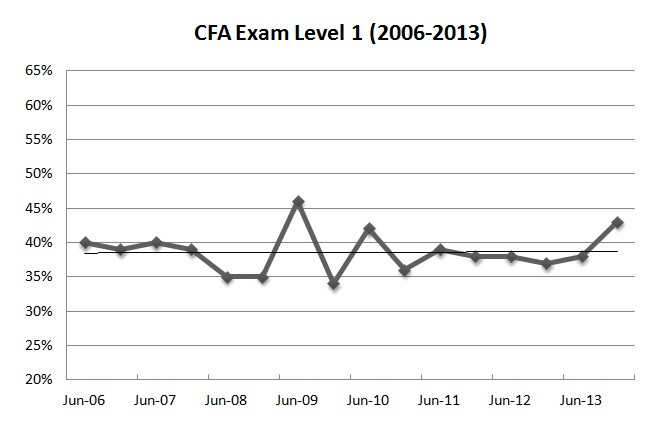

The exam is in the traditional pencil-and-paper format graded by human. The test is administrated twice a year for Level 1, and once once a year for Level 2 and 3.

There are many international testing centers for CFA exam in major cities and metropolitan areas.

CFA or CPA: Time Required to Become Qualified

Most candidates aim to pass the CPA exam within a year. Some who have the time and commitment can study all materials within 6 months, take all 4 parts of the exam in one go and pass.

Most state boards require 1 year of accounting experience before getting the license, and for most states this experience has to be supervised and verified by a US CPA.

Although technically candidates can complete the CFA exam within 18 months (Level 1 in December, Level 2 in June, Level 3 in June the year after), most candidates take 4 years to complete the exams. It takes much longer to become a CFA than a CPA.

4 years of relevant experience is required to get the CFA designation. Your supervisor, who will be verifying your experience, does not need to be a CFA. This adds a lot of flexibility in the process.

Conclusion

When deciding whether to go for CFA or CPA, the first and foremost consideration is the relevancy to your career. Other than that, CPA has more restrictive education and experience requirement, but once you get qualified, the process is much faster. CFA has a lower entry barrier but it takes much longer time to complete.

Here are Our Choices. Whats Yours?

Stephanie chooses to be a CPA only while John is a CPA and CFA. Whats your choice?