Causes of Economic Recession 11 Factors With Examples

Post on: 5 Май, 2015 No Comment

Here’s the 11 Biggest Causes of a Recession

Economic recessions are ultimately caused by a loss of business and/or consumer confidence. As confidence recedes, so does demand. This is the tipping point in the business cycle where the peak, often accompanied by irrational exuberance. moves into contraction.

This loss of confidence makes businesses and/or consumers stop buying and move into defensive mode. Once a critical mass moves toward the exit sign, panic sets in and creates a destructive downward spiral. In short order, you get mass layoffs and rising unemployment. which create a slowdown in retail sales. Manufacturers cut back in reaction to falling orders, further increasing layoffs. To restore confidence, the Federal government and central bank must usually step in.

Please note: a decline in GDP growth is a sign that a recession may be underway, but it is rarely a cause. That’s because GDP is only reported on after the quarter is over. By the time GDP has turned negative, the recession may already be underway.

What you want to do is identify the causes, and signs, before the recession occurs. Here are the seven most important causes of recession:

- High interest rates. When rates rise, they limit liquidity. or the amount of money available to invest. The biggest culprit was the Federal Reserve, which often raised interest rates to protect the value of the dollar. The Fed raised rates to battle stagflation. causing the 1980 recession. It did the same thing to protect the dollar/gold relationship, worsening the Great Depression.

- A stock market crash. The sudden loss of confidence in investing can create a subsequent bear market. draining capital out of businesses. Here’s how a stock market crash can cause a recession .

- Falling housing prices and sales. As homeowners lose equity, it forces a cutback in spending as they can no longer take out second mortgages. Over time, it will cause foreclosures. This was the initial trigger that set off the Great Recession, fut for different reasons. Banks that lost money on the complicated derivatives based on underlying home values.

- A slowdown in manufacturing orders. Orders for durable goods started falling in October 2006, before the 2008 recession actually hit.

- Massive swindles. The 1990 recession was caused by the Savings and Loans Crisis. More than 1,000 banks (total assets of $500 billion) failed as a result of land flips, questionable loans and illegal activities.

- Deregulation. The seeds of the S&L crisis were planted in 1982 when the Garn-St. Germain Depository Institutions Act was passed. This removed restrictions on loan-to-value ratios for these banks.

- Wage-price controls. Fortunately, this only happened once, when President Nixon kept prices too high, cutting demand. Employers laid off workers because they weren’t allowed to lower wages.

Cause of 2008 Recession

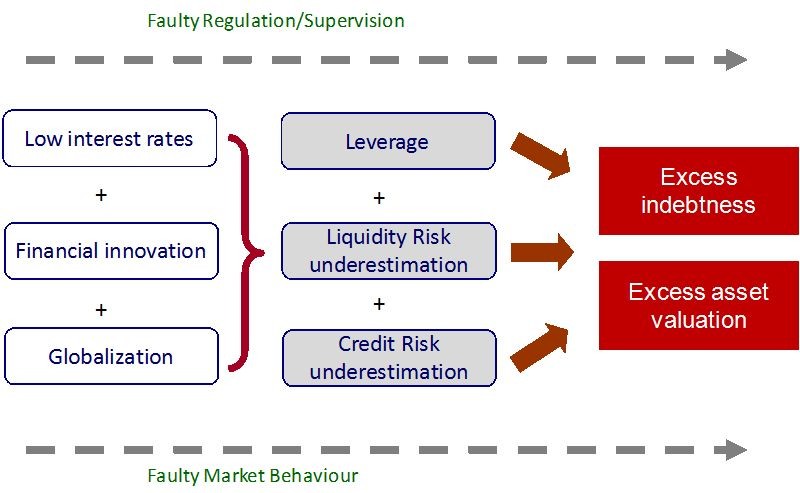

Irrational exuberance in the housing market led many people to buy houses they couldn’t afford, because everyone thought housing prices could only go up. The Fed should have raised interest rates in 2004. Low interest rates in 2004 and 2005 helped created the housing bubble. Irrational exuberance set in again as many investors took advantage of low rates to buy homes just to resell. Others bought homes they couldn’t afford thanks to interest-only loans.

In 2006, the bubble burst as housing prices started to decline. This caught many homeowners off guard, who had taken loans with little money down. As they realized they would lose money by selling the house for less than their mortgage, they foreclosed. An escalating foreclosure rate panicked many banks and hedge funds. who had bought mortgage-backed securities on the secondary market and now realized they were facing huge losses.

By August 2007, banks became afraid to lend to each other because they didn’t want these toxic loans as collateral. This led to the $700 billion bailout. and bankruptcies or government nationalization of Bear Stearns. AIG. Fannie Mae. Freddie Mac, IndyMac Bank, and Washington Mutual. By December 2008, employment was declining faster than in the 2001 recession.

In 2009, the government launched the economic stimulus plan. It was designed to spend $185 billion in 2009. And in fact, it halted a four-quarter decline in GDP by Q3 of that year, thus ending the recession. However, unemployment continued to rise to 10%, and many business leaders still expected a W-shaped recession by the end of 2010. High unemployment rates still persisted into 2011.

What Caused the Recession of 2001?

The recession of 2001 was caused by irrational exuberance in high tech. In 1999, there was a economic boom in computer and software sales caused by the Y2K scare. Many companies and individuals bought new computer systems to make sure their software was Y2K compliant. This meant that the operating code would be able to understand the difference between 2000 and 1900, since many fields within that code only had two spaces, not the four needed to fully differentiate the two dates. As a result, the stock price of many high tech companies started to increase. This led to a lot of investors’ money going to any kind of high tech company, whether they were showing profits or not. The exuberance for dot.com companies became irrational.

It became apparent in January 2000 that computer orders were going to decline, since the shelf life of most computers is about two years, and companies had just bought all the equipment they would need. This led to a stock-market sell-off in March 2000. As stock prices declined, so did the value of the dot.com companies, and many went bankrupt.

In spite of the stock market decline in March 2000, the Federal Reserve continued raising interest rates to a high of 6.25% in May 2000. The Fed didn’t start lowering rates until January 2001, and lowered them about 1/2 point each month, resting at 1.75% in December 2001. This kept interest rates high when the economy needed low rates for cheap business loans and mortgages.

What Will Cause the Next Recession?

It’s hard to say exactly where it would occur, but you can bet it will be some combination of low interest rates that creates irrational exuberance on the part of investors. If the Fed raises rates too soon or too fast,it will pop the bubble, leading to panic and causing a recession. Article updated September 5, 2014