Carry Trade

Post on: 19 Апрель, 2015 No Comment

The carry trade is an investing strategy in which an investor borrows money in one country at a low interest rate and invests it in another country at a higher rate. The carry trade takes advantage of differences in interest rates in different countries — which often come about as a result of different central bank actions. For example, the central bank in one country may lower interest rates to stimulate the economy, while a central bank in another country might keep interest rates high to fight inflation.

The perennial problems faced by a trader relate to the achievement of consistency in profits, and the minimization of losses. Some traders seek the solution in optimized, highly-developed technical trading strategies, others attempt to utilize automated trading in order to overcome the weaknesses of human nature. These approaches are valid, but they are often too complicated and difficult to implement, or even grasp for the average retail trader with moderate means in both capital and time. The forex carry trade, on the other hand, is both effective and simple, and it is a great solution to this problem for the average person who likes to trade forex.

Trading with the Carry Trade

The carry of an asset is the opportunity cost of holding it. The carry of a bar of gold is the cost of storage. The carry of $100 deposited at a bank account is the interest received, while the carry of $100 in the wallet is the inflation-loss. We concern ourselves with the carry of a forex pair, and in that case, the gain or loss is determined by the interest rate differential of the currencies in question. Since each forex transaction involves the buying of a currency, and the sale of another to finance the purchase (when we buy one lot of EURUSD. for example, we buy one lot of Euros, and sell one lot of USD ), in order to maintain the position beyond the closing of the New York market in the United States, we will be paying interest on the currency sold, and receive interest on the currency purchased. It is obvious that if the interest received on the purchased currency (the Euro. in our example) is higher than that paid for the sold currency (the USD), our account will register a profit just for holding the position.

The carry trade adds another dimension to our trading plans. When the currency pair we hold is interest-neutral, or the carry of the bought and sold currencies cancel each other, the only source of profit or loss is the movement in the price of the currency pair. Thus, we must be right about our expectations about where the price is going in order to make even a tiny profit in trading. But when the carry is positive, our position will accumulate a positive stream of income even as market fluctuations lead to a loss in the position’s value. The advantage of this is obvious: a positive-carry trade (or in short, a carry trade) will add an additional layer of protection, and increase the lifetime of a trade for as long as it exists. The longer the lifetime of the position, the greater the interest income, and the larger the buffer area against market fluctuations.

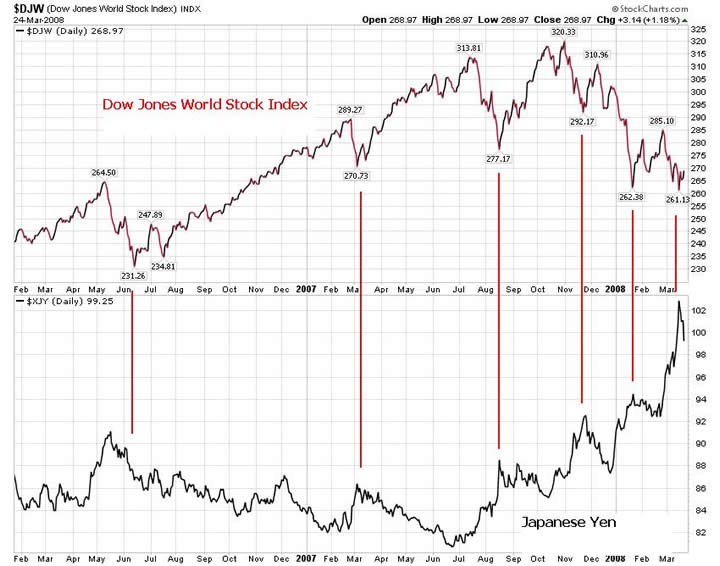

The main problem with the carry trade is its vulnerability to volatility and market shocks. An event that impacts a low or negative carry pair modestly can have catastrophic results for a high-risk, high-yield position. It seems that the first pairs that get punished in adverse market conditions are the carry pairs, especially the JPY pairs where traders often take highly risky bets against the high current account surplus and limited external financing needs of the Japanese economy by shorting the currency.

We may conclude by noting that in spite of all the arguments against it, the carry trade remains a valid and highly profitable trading strategy for many different kinds of traders. If you seek to apply this approach in your trading decisions, we recommend that you choose a suitable one among the forex brokers [1] that offer a high interest income for pairs held. There is a great degree of variability in the carry friendliness of brokers, and you’d do well to research this aspect thoroughly in order to maximize your returns.

Japanese Carry Trade Example

Carry trades are common instruments in the currency markets. One of the most popular carry trades have been to borrow money in Japan and use it to invest in other countries. This has been fueled by a low Japanese interest rate. For example: An investor could borrow money at Japan at 2% interest and invest it in US treasuries at 3% interest — allowing the investor to keep the excess 1%.

Currency carry trades bear the risk of changing exchange rates. In the example above, the investor could potentially lose money if the US dollar fell in value against the Japanese Yen.

During the past months the yen has been replaced by the cheap US dollar, so that everything priced in dollars has soared. Some economists, like for example Roubini, are warning about the coming bust of the US dollar carry trade.