Canadian Oil Sands Dividend Stocks

Post on: 25 Август, 2015 No Comment

Alberta’s Oil Fortunes

Comments ( )

By Joseph Cafariello

Friday, July 25th, 2014

When investing in stocks, investors will generally focus on capital gains earned from the appreciation of stock prices. Yet stock appreciation alone does not outperform the broader market. To even come close to beating the overall market, you need the help of dividends.

As the Royal Bank of Canada tabulated, from 1986 to 2012, dividend paying stocks generated compounded annual returns averaging 10.2% per year, while the broader market index posted 6.4% per year, with non-dividend paying stocks delivering just 0.7% compounded annual returns. As a class, non-dividend payers couldnt even keep pace with the broader market index which is made up mostly of dividend paying stocks.

Yet when choosing dividend stocks to include in our portfolios, we need to seriously consider how sustainable those disbursements are. And that requires considering the overall future prospects of the sector the company is in.

So lets pick a sector that has a future of long-term growth ahead of it, whose products and services will be in demand not just for years but for decades, and whose companies operate in our own backyard, insulated from external market and geopolitical risks.

Got it the energy sector, specifically the North American petroleum industry. It enjoys strong protection and support by both the U.S. and Canadian governments who understand the importance of a self-sufficient energy industry that is not susceptible to foreign turmoil. The sector also enjoys an abundant supply of reserves that are among the largest in the world. And of course, the industry is highly profitable, with many of its companies sharing the wealth with their investors through some of the most generous dividend payouts to be found.

For todays picks, lets focus on one of the fastest growing oil regions of them all the Canadian oil sands.

Canadas Oil Sands A Waking Giant

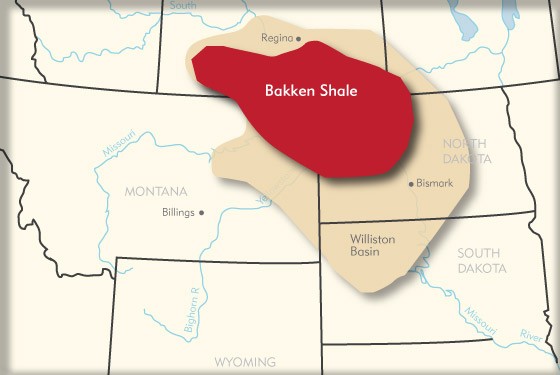

While investors familiar with the energy sector are already well aware of the massive profit potential of the Baaken shale deposits in Montana and North Dakota, few are aware that there exists an even larger reserve of unconventional oil slightly to the northwest in the Canadian province of Alberta containing three massive heavy oil deposits: the Athabasca, Cold Lake, and Peace River oil sands.

Source: Norman Einstein

Different from the shale rock of the Baaken region, oil sands are comprised of bitumen made from sedimentary sand that once lay at the bottom of the ocean. As the North American tectonic plate began pressing against the Pacific Ocean plate, the continent began buckling, lifting the Rocky Mountain chain upward, along with the vast sea basin to the east which is today the mid-west flatlands. As the Rocky Mountains compressed, oil was squeezed eastward, where it accumulated in large regions of shale rock in the U.S. and sedimentary sand in Canada.

Just how massive are these deposits? As a comparison, according to Continental Resources, The Bakken/Upper Three Forks formations hold an estimated 577 billion barrels of original oil in place A 3.5% recovery factor translates into 20 billion barrels of recoverable light oil.

What do they mean by original oil in place? Original Oil In Place (OOIP) simply means the total amount of oil in a deposit, including unrecoverable oil which cannot be extracted by current technology. As technology improves, more OOIP will be recoverable. Following a deposits OOIP number, you will usually find the amount of oil that is actually recoverable using the current technology available.

Thus, in the Bakken region, a 3.5% recovery factor means that with current technology, some 20 billion barrels of the total 577 billion barrels in the deposit are actually recoverable.

How do Canadas oil sands measure up? The Alberta government estimates that with current technology, 10% of its bitumen and heavy oil can be recovered, which would give it about 200 billion barrels of recoverable oil reserves out of a total OOIP of 2.2 trillion barrels.

That makes the Canadian oil sands ten times richer than the Bakken shale deposit using current technology, and four times larger in terms of original oil in place. In fact, 2.2 trillion barrels of OOIP puts Canada in third place in proven oil reserves behind second place Venezuela and first place Saudi Arabia.

According to the CIA World Factbook, crude oil production in Canada reached 3.856 million barrels a day in 2012, ranking 5th in the world, while the U.S. ranks 2nd at 11.11 million barrels produced per day.

Yet the U.S. is also the worlds largest importer of crude at 7.719 million barrels a day according to the U.S. Energy Information Administration (EIA). Of those imports, 2.569 million barrels a day come from Canada, making Americas little brother to the north its largest single supplier of foreign crude.

Given the U.S. governments commitment to reducing its reliance on oil from politically turbulent regions abroad, the Canadian oil sector is undoubtedly the richest and best protected source of oil in the world. Ample reserves that are easily accessible, the worlds largest market right next door, a commitment by governments to keep the oil flowing, and some of the best paying dividends of any market make the Canadian oil sector a great place for investors to put their money.

The Best Free Investment You’ll Ever Make

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Gold & Silver Mining Stocks.

Enter your email:

Great Canadian Oil Companies

While Canada is generally known as a land of ice and snow, few realize that is also a major hub of the global oil market. According to David Carey, Sr. Vice President of Capital Markets at ARC Energy Trust, greater than 50% of the worlds public oil and gas companies are listed on Canadian exchanges, with energy companies making up more than 25% of the countrys largest stock burse the Toronto Stock Exchange (TSX).

If youre going just by dividend yield alone, you might try such high yielders as:

Twin Butte Energy Ltd (TSX: TBE), yielding 11.03%

Freehold Royalties Ltd (TSX: FRU), yielding 6.29%

Crescent Point Energy Corp (TSX: CPG), yielding 6.12%

Baytex Energy Corp (TSX:BTE), yielding 5.98%

Canadian Oil Sands Ltd. (TSX: COS), yielding 5.85%

Yet while their dividend yields are very attractive, all five companies listed above have underperformed both the S&P 500 broader market index and the SPDR Select Sector Energy ETF (NYSE: XLE).

Ideally, we would want a high dividend payer which also delivers high capital appreciation, as can be found in the following five companies:

Vermilion Energy Inc. (NYSE: VET), yielding 3.53%. This $7.29 billion mid-cap founded in 1994 and headquartered in Calgary, Alberta, has been publicly traded since 2003, and is engaged in the exploration, development, acquisition, and production of oil and natural gas in Australia, Canada, France, Ireland, and the Netherlands. The company has 347 net producing natural gas wells and 307 net producing oil wells in Canada, 316 net producing oil wells in France, 43 net producing gas wells in the Netherlands, and 6 offshore wells located off the coast of Ireland.

Not only are revenues increasing, but so is the companys efficiency, posting year-over-year quarterly revenue growth of 21.60% and quarterly earnings growth of 97.10%, with returns on assets and equity of 10.83% and 23.12% respectively. Over the past year VETs stock has appreciated 28% versus the energy sectors (XLE) 21%, with five-year gains of 153% versus the XLEs 95%.

AltaGas Ltd (TSX: ALA), yielding 3.55%. This $6.12 billion mid-cap founded in 1993 and headquartered in Calgary, Alberta, has been publicly traded since 2010, and is engaged in gas, power, and regulated utilities businesses in Canada and the northwestern U.S. The companys gas segment is engaged in the extraction, processing, transmission and storage of natural gas, with delivery to end-users in Alberta, British Columbia, Nova Scotia, Michigan and Alaska. Its power segment sells and delivers electricity throughout Alberta, British Columbia, California, Colorado, Michigan, and North Carolina.

While quarterly revenue growth yoy has increased 33.60%, the companys earnings have shrunk by 12%. Yet it does manage to deliver solid returns on assets and equity of 2.35% and 8.20%, with stock price appreciation of 39% over the past year, and 165% over the past five.

Bonterra Energy Corp (TSX: BNE), Fielding 5.85%. This $1.94 billion small-cap (almost mid-cap) headquartered in Calgary, Alberta, has been publicly traded since 2001, explores, develops, produces, and sells crude oil, natural gas, and natural gas liquids in the Western Canadian Sedimentary Basin. The company informs that its production volumes averaged 12,190 BOE per day in 2013, and are expected to average 12,400 to 12,700 BOE per day in 2014, with proved reserves of 37.1 million barrels of crude oil, and 83 billion cubic feet of natural gas.

Both revenues and earnings are growing impressively, with year-over-year quarterly revenue growth of 22.70% and quarterly earnings growth of 81.50%, alongside returns on assets and equity of 6.26% and 10.94% respectively. Over the past year BNEs stock has appreciated 23%, with five-year gains of 150%.

Whitecap Resources Inc. (TSX: WCP), yielding 4.54%. This $4.05 billion mid-cap headquartered in Calgary, Alberta, and publicly traded since 2002, engages in the acquisition, development, optimization, and production of crude oil and natural gas in western Canada. The company has proved and probable reserves of 132.5 million barrels of oil equivalent, and operates 1,861 net producing wells.

While WCPs yoy quarterly earnings shrank by 18.70%, its quarterly revenues grew an outstanding 77.10%, drawing investors in en masse, lifting its stock price 48% over the past year, and an incredible 1,300% over the past five.

Enbridge Income Fund Holdings Inc. (TSX: ENF), yielding 4.66%. This $1.67 billion small-cap headquartered in Calgary, Alberta, and publicly traded since 2003, owns energy infrastructure assets, crude oil gathering pipelines, and crude oil storage terminals throughout western Canada, plus a 50% stake in pipelines leading to Chicago, Illinois. It also owns renewable and alternative energy wind, solar, and waste heat recovery facilities.

Though ENFs yoy quarterly revenues grew a modest 4.50% and quarterly earnings grew just 2.40%, its returns on assets and equity were a decent 3.91% and 6.12%, prompting investors to lift its stock 149% over the past 5 years, and 19% over the past one.

Source: Own

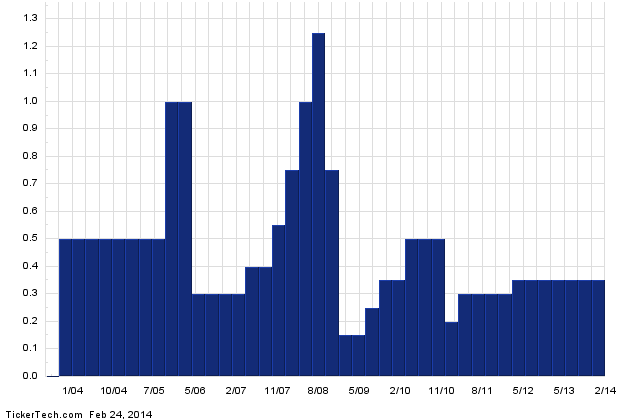

In the graph below, the five highlighted companies are compared to the S&P 500 (black) and the SPDR Energy Sector ETF (blue).

Source: BigCharts.com

Joseph Cafariello