Calendar Spread Calendar Option Trade Calendar Spread Strategy Time Spreads

Post on: 22 Июль, 2015 No Comment

The Calendar Spread, also known as the Time Spread is a favorite strategy of many option traders, especially market makers.

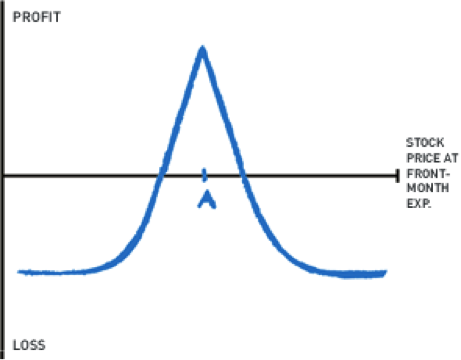

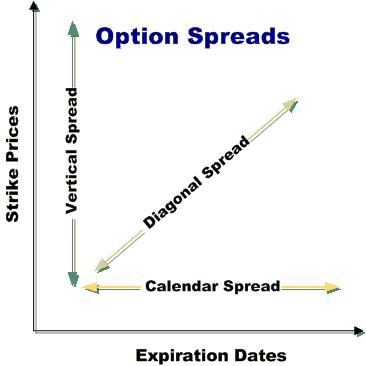

The Calendar is basically a play on time and volatility. It is comprised of two options, both at the same strike price. One is a near month option, which is sold. The other is a farther out option which is bought. So you are selling a near term option and buying a farther out term option and paying for the trade. Thus, the Calendar Spread is a debit trade.

The Calendar Option Spread Makes Money in Two Ways.

The first is with time decay. The sold option will decay faster than the long term option. As long as the underlying instrument stays near the strike price.

The second way a Calendar Trade makes money is with an increase in volatility in the far month option or a decrease in the volatility in the short term option. If there is a rise in volatility, the option will gain value and be thus increase in value. So if the underlying drops in price, chances are the volatilities of both options will increase.

I trade options every month. Become a member today to get access to my site and my current trades. You can also see my past trades and how I adjusted them when I had to. Find out more about becoming a member.

The Benefits of Calendar Spreads

There are several benefits to the Calendar Option trade.

1. It is relatively inexpensive. You can put these trades on for just a few dollars in lower priced stocks.

2. It is easy to adjust. There are many calendar spread adjustments to choose from and they are realtively easy to implement.

3. Since the calendar is a debit trade, the maximum a trader can lose is the amount of the debit and thus risk is limited.

4. The risk/reward is great.

5. If there is a sharp rise in volatility, the trade can increase in value 20-30% or more in just a couple days.

The Negatives of Calendar Spreads

1. Calendar spreads use a lot of contracts so your commissions might be higher.

2. If there is a sharp drop in volatility, the trade can lose 20-30% or more in just a couple days.

3. The trade is one that needs to be watched carefully and adjusted when needed.

4. The stock or underlying needs to stay inside the breakevens for the trade to be positive. Quick moves up or down can hurt the trade.

Calendar Spread Example — link to blog post

Here’s an example of a Calendar Spread Trade that I posted on my blog as a papertrade and traded it like a normal trade. Calendar Spread Trade Video. The video is a little grainy.

GLD (ETF for Gold) at the time was trading at 125.50.

The Calendar was entered by Selling the Oct 125 Calls and Buying the Nov 125 Calls. This set the breakevens on the trade at 122.07 on the low side and 128.14 on the high side.

What we wanted was to have GLD stay within the breakevens and as close to 125 as possible. But that was not to be. GLD continued to advance and was soon outside of the upside breakeven.

So what I did was added another calendar to the trade.

Double Calendar Spread

I turned the singular calendar into a double calendar by adding the Oct/Nov 128 Call Calendar Spread. Now I had two calendars and my breakevens became 123.61 and 129.59. The adjustment doubled my margin.

As the days passed, GLD kept moving higher, all the way to 130.70. My options were to remove the 125 Calendar, or add a third calendar and make the trade into a triple calendar. I did not think GLD was going to pull back so what I did was take off both the 125 and 128 Calendars and replaced them with a double calendar at the 130 and 133 strikes. The breakevens became 129.39 and 133.77. By this time I was down $450 in this trade on margin of $3,200.

The next few days, GLD calmed down and not only did the trade get back into positive territory it made money. Watch the video for the details.

This was not a textbook example of a calendar spread. As you can see, everything did not work well and I was forced to monitor and adjust the trade twice. But I think the example shows that this strategy can work and can be profitable even when things do not go the way you expected them to.

Overall, Calendar Spreads are a great option strategy to make decent returns with limited risk in short amounts of time. Most traders enter Calendar Spreads with 30 days or less to expiration to take advantage of the increased time decay during this time.

To learn more about option selling and more trade examples, sign up for our free options course by entering your name and email in the box above and to the right.

Common Calendar Spread Questions

1. How do you find stocks to trade Calendar spreads on?

Normally you want a stock that is not too volatile. I know some traders that make good money trading calendars on IBM every month. Any DOW stock can make a good candidate as long as there is enough premium in the options.

2. Can I trade Calendar Spreads on Weekly options?

Yes you can. But I have found that with the weeklys, you have to stay on top of the trade and adjust several times. The commissions eat a lot of the profit. Especially since you have to trade a greater number of calendars in the weeklys because the premium is lower than regular options.

3. What is the risk when trading Calendar Spread options?

The risk is the amount you pay for the trade. Since a Calendar Spread is a debit trade you have to pay for it. This amount is the max you can lose.

4. Is it true you can make 100% or more on a Calendar Spread?

Yes you can, but it is very rare. In order to make that much you have to be in the trade until expiration and have the stock be extremely close to your strike.