Calculate the Dupont Model for ROI Analysis

Post on: 16 Март, 2015 No Comment

You can opt-out at any time.

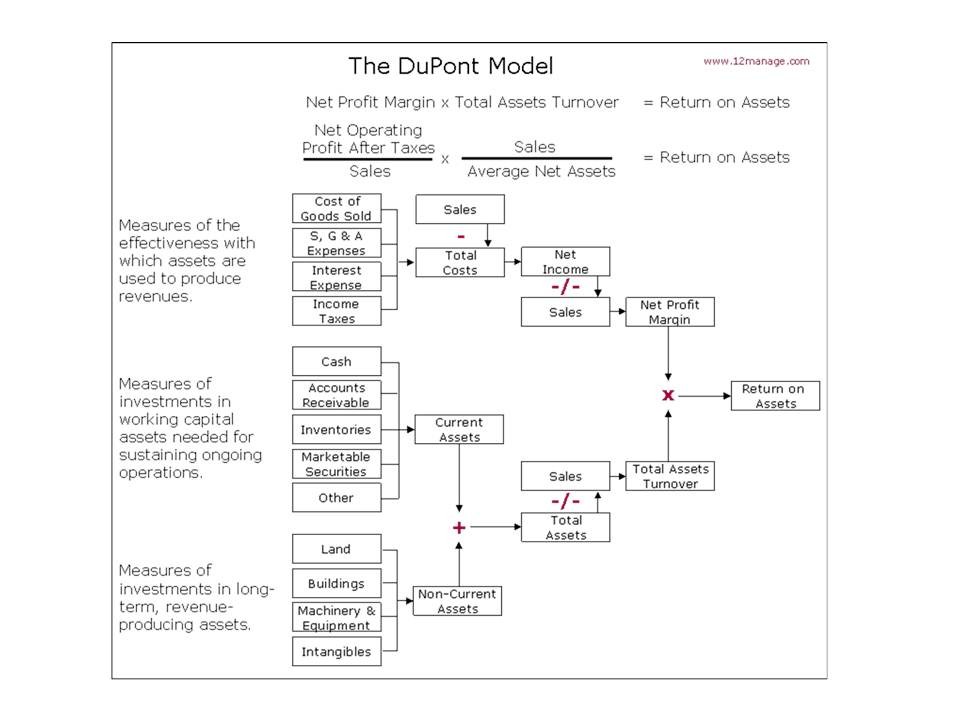

The Dupont Model is a valuable tool for business owners to use in order to analysis their return on investment (ROI) or return on assets (ROA). The extended Dupont Model also allows for analysis of return on equity. There are so many financial ratios for a business owner to analyze that it is often easy to get lost in the details. Using the Dupont Model allows the business owner to break the firm’s profitability down into component parts to see where it actually comes from.

Here are the steps in using the DuPont Model to calculate both return on investment and return on equity.

Difficulty: Average

Time Required: Indeterminate

Here’s How:

First, look at the company’s Return on Investment (ROI) or Return on Assets (ROA) ratio which is:

ROI = Net Income/Total Assets = _____% where net income is taken from the income statement and total assets is taken from the balance sheet. This ratio tells you how efficiently you have been using your asset base to generate sales.

As an example, let’s say that ABC, Inc. a small hardware firm, generated $113.5 million in sales in 2009 and had total assets of $2,000 million. Then, the calculation for ROI would be:

ROI (ROA) = $113.5/$2,000 = 5.7%

This doesn’t tell you much, but it you look at a source for industry average ratios like Bizminer.com. you can compare your ROi with that of your industry. If your industry average is, for example, 9.0% for small hardware firms, then you know that your ROI is below the industry average.

Since the ROI (ROA) for ABC, Inc. is below the industry average, you want to find out why. To do that, you can use the Dupont Model and break down the ROI into its component parts. ROI will look like this:

ROI = Net Income/Sales X Sales/Total Assets = _____% where Net Income/Sales is the net profit margin and comes from the income statement and Sales/Total Assets is the Total Asset Turnover and sales comes from the income statement and total assets comes from the balance sheet.

ROI is composed of two parts: the company’s profit margin and asset turnover or its ability to generate profit and make sales based on its asset base.

Next, you want to find out which part of ROI is causing the problem for your business — the profit margin or the asset turnover. If it is given that the net profit margin is 3.8% and the total asset turnover is 1.5X, then:

ROI (ROA) = 3.8% X 1.5 = 5.7% which is what you got in Step 1. Now we know what each part of the equation contributed to the return on investment of the firm. ABC, Inc. earned 3.8 cents for every dollar of sales and turned its assets over 1.5X per year. If the small hardware company industry had a net profit margin of 5.0% and a total asset turnover of 1.8X, ABC, Inc. was low on both counts, particularly the net profit margin.

We have determined that the company we are using as an example, ABC, Inc. is performing poorly with regard to their ROI and the industry average. The extended Dupont Model allows us to examine return on equity in the same way.

ROE = Net income available to common shareholders/Common Equity = _____% where Net Income comes from the income statement and Common Equity is the sum of all the equity accounts on the balance sheet .

The return on equity ratio can be restated:

ROE = ROI X Equity Multiplier or

ROE = ROI X Total Assets/Common Equity where Total Assets are taken from the balance sheet as is Common Equity. The equity multiplier makes ROE different from ROI by adding the effects of debt to the equation.

Using the numbers from the example of the calculation of ROI, this is the next step in calculating return on equity or ROE:

ROE = 5.7% X $2,000/$896 (common equity from balance sheet) = 12.7%

If the ROE for ABC, Inc. is 12.7% and we get the industry average for the small hardware industry and it is 15.0%, ABC, Inc. is performing poorly with regard to ROE as well as ROI. ROE is a measure of the wealth of the shareholders of the company and is the profitability ratio shareholders look at most often.

This is the extended Dupont equation:

ROE = (Net Profit Margin)(Total Asset Turnover)(Equity Multiplier)

=Net Income /Sales X Sales/Total Asset Turnover X Total Assets/Common Equity

Three elements interact to form the ROE of a company. These elements are the profit margin. the efficiency with which the firm uses its assets to generate sales (total asset turnover ratio), and the effect of debt on the firm (equity multiplier). For ABC, Inc. the net profit margin and asset turnover, in particular, are weak and are lowering the return on equity.