Buy Sell or Hold Silver Wheaton (SLW)

Post on: 20 Июль, 2015 No Comment

September 24, 2012 | Comments (0)

When considering any stock for your portfolio, don’t be swayed by just the positives. Examine its pros and cons, and decide whether it’s possible upsides outweigh its risks. Let’s take a look at Silver Wheaton ( NYSE: SLW ) today, and see why you might want to buy, sell, or hold it.

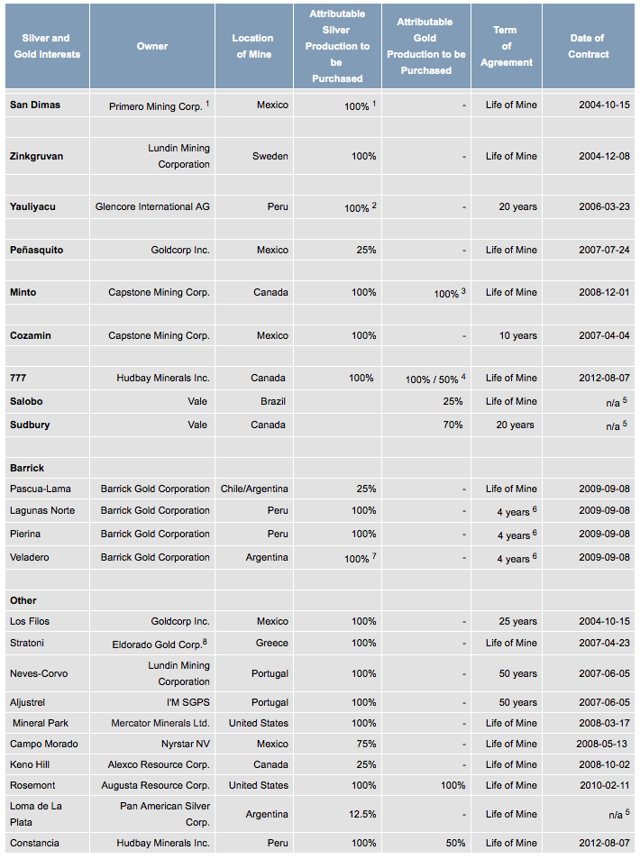

Headquartered in Vancouver, Canada, and with a market capitalization of roughly $14 billion, Silver Wheaton is a mining company specializing in silver streaming. It has more than a dozen long-term agreements to purchase silver and other precious metals from enterprises around the world.

Over the past year the stock has gained about 14%, and over the past five years, it has averaged 24% annually. My colleague Christopher Barker has called it the most profitable company in the world .

Buy

One reason to like the company is its beautiful business model. which has it not engaging in the capital-intensive enterprise of mining for metals, but instead offering financing to mining companies in exchange for a cut of their loot. This arrangement leaves the miners with most of the risks, such as variable costs, and leaves Silver Wheaton with a fixed cost and little risk. Nice.

For example, the company recently inked a deal to provide $750 million to Hudbay Minerals ( NYSE: HBM ). receiving in exchange the right to buy 100% of the silver produced at Hudbay’s two key mines at a price of $5.90 per ounce. Note that silver has recently been selling for more than $30 per ounce! It also got similar rights with a big chunk of Hudbay’s gold production, securing a price of $400 per ounce, when gold has recently been selling for more than $1,700 per ounce.

Silver Wheaton also has deals to profit from production at Goldcorp ‘s ( NYSE: GG ) Penasquito mine, as well as Barrick Gold ‘s ( NYSE: ABX ) Pascua-Lama mine, which is expected to start producing silver by the middle of next year.

Consider now the relatively low price of silver these days. That might seem like a reason to sell. Instead, it’s actually causing some trouble for some silver miners, and that only makes them more likely to seek deals from Silver Wheaton. The more a miner is struggling, the more favorable terms Silver Wheaton is likely to get. A glance at the company’s balance sheet recently revealed more than $1 billion in cash, and its cash pile growing briskly. (And, by the way, long-term debt is negligible.)

Want some more pretty numbers? Both cash from operations and free cash flow are growing at a good clip. Over the past five years, both revenue and earnings per share have grown by an annual average of more than 35% — in the past year it has been more than 70%. Net margins have been growing, and they’re fat. recently topping 70%. Return on invested capital? Also growing, and above 20%.

Then there’s the dividend. It has recently been yielding only about 1%, but the dividend is new and has gone from $0.03 per quarter to $0.10 per quarter in a little over a year. The company has a sensible policy tying dividend payouts to operating earnings. too.

Sell

An important reason to sell this company is if you expect the price of silver to fall and stay down for a long time, as that will constrict profit margins and perhaps production, as well.

Given the reasons to buy or sell Silver Wheaton, it’s not unreasonable to decide to just hold off. You might want to wait for the price of silver to rise, which would boost the company’s profit margins even more. (It has already been on an upswing lately.) Or, you might want to see production increases from miners.

You might also look at other mining-related companies, such as molybdenum-mining specialist Thompson Creek Metals ( NYSE: TC ). which roughly has been halved over the past year, largely on a big price drop for molybdenum. Some have seen it as rather undervalued now, while others worry about its rising debt.

The verdict

I’m not invested in Silver Wheaton at the time of this writing, but I hope to be adding it to my portfolio in the near future. Remember, of course, that there are plenty of other compelling stocks out there. Everyone’s investment calculations are different, so do your own digging and see what you think.

The Motley Fool thinks there are profits to be made from precious metals, and we’ve found one tiny stock that could dig up massive gains . Download this free report today and hurry, as the report is only available for a limited time .

Longtime Fool contributor Selena Maranjian. whom you can follow on Twitter. holds no position in any company mentioned. Click here to see her holdings and a short bio. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days .