Bitcoin Investing Is the Bubble About to Burst

Post on: 12 Июль, 2015 No Comment

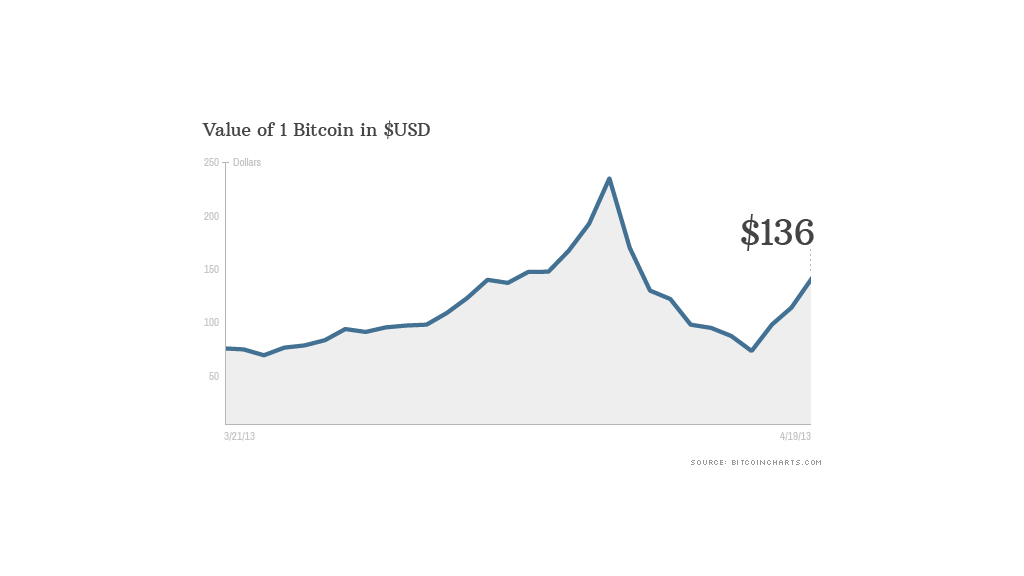

Bitcoin prices are incredibly volatile, and will remain so

Bitcoin investing has really taken the web by storm in 2013, and with good reason. Since the start of the year, Bitcoin prices have gone up from about $20 to a high over $400 .

But after snapping back from a low around $70 in July, do Bitcoins have a chance of sustaining the record high levels recently set?

Or is this a Bitcoin bubble just like the one we saw in spring, before the alternative currency saw its value cut by about two-thirds in a matter of days?

For some investors, its difficult to concede that Bitcoins are caught up in a bubble because of their hopes for viability in this alternative currency. After all, in an era of currency wars and central bank shenanigans around the world, theres some comfort in the idea of an alternative asset that will retain its value. Seeing as gold prices have been incredibly volatile, that means a lot of folks see the value in Bitcoin as the new alternative investment of choice.

But whether or not Bitcoin prices are fair right now is a very different question than whether Bitcoins are viable long-term as a kind of alternative to the U.S. dollar or gold.

And unfortunately, it appears speculators have driven up Bitcoin prices too much too fast.

Risks of a Bitcoin Bubble

So what has fueled the volatility in Bitcoin?

On the surface, Bitcoin prices are simply tied to investors looking for an alternative to the dollar or to gold. However, there are bigger issues at play most recently, the spread of Bitcoin to China and access to even more speculation as a result.

The single strongest argument for sustained growth in Bitcoin is that unlike any individual currency, Bitcoins are of a fixed quantity and thus can never be depreciated by a flood of new monetary supply.

But as a currency, Bitcoin is not exactly catching on quite like the proponents believe it. As one expert said in the Chinese news publication Caixin. every time the Bitcoin market boomed, it was driven by a stunt and not backed by real transactions.

Of course, its worth noting that you cant just walk into McDonalds and pay for a Big Mac with a gold coin.

However, gold has big cultural and historical significance to make it a store of value. Bitcoin has nothing more than sentiment behind it.

The reality is that any investment that tacks on double-digit gains every week and starts attractive investors simply because it goes up is by definition a bubble. And while there may be a small crowd of Bitcoin investors out there who are buying for the right reasons, the fact that speculators and overly bullish sentiment are both taking hold means that everyone is going to be taken for a ride.

Bitcoin might stick around as an alternative currency, especially as a focus on central banking and federal spending creates an emotional argument for some kind of safe-haven asset beyond the U.S. dollar.

But buying Bitcoins just because Bitcoin prices are soaring is the very definition of speculation and bubble behavior.

Keep this in mind if youre considering this putting some money in the digital currency.

More on Bitcoin

Jeff Reeves is the editor of InvestorPlace.com and the author of The Frugal Investor’s Guide to Finding Great Stocks. Write him at editor@investorplace.com or follow him on Twitter via @JeffReevesIP . As of this writing, he did not own a position in any of the stocks named here.