Bid ask spread

Post on: 30 Июнь, 2015 No Comment

Understanding the basic terms such as bid, ask and spread, is crucial when trading on the financial markets

Rule of thumb

In MetaTrader 5 platform it is possible to show the columns by pressing the right-mouse-button anywhere within the Market Watch window, then clicking with the left-mouse-button on „Columns” from the contest menu, and  finally choosing the respective options

Price is the key issue related  to the investment on financial markets, and as such, the MetaTrader 5 platform  is represented in real time, from the first moment the demo account is initiated.

The current prices from various markets can be seen both in  a digital form – on the left side of the screen in the window „Market Watch” – and graphical charts showing the historical and current prices on selected markets, in the middle of the MetaTrader 5 platform window.

This article covers the digital form of price representation. The analysis and making investment decisions upon the basis of charts is the subject of a separate section of our website, devoted to the Technical Analysis .

The current price on a given financial market is typically represented by at least three parameters:

- Symbol of the market – be it the EURUSD for the „Euro vs US Dollar” currency market, or F.GOLD for the price of gold commodity.

- Bid – the highest price at which the trader can sell a contract on a given market, i.e. enter the short position .

- Ask – the lowest price at which the trader can buy a contract on a given market, i.e. enter the long position .

In other words, whenever a trader is looking at the possibility to open a long position, or close a short position that has already been opened, the point of interest will be the Ask price. If the traders wants to open a new short position, or close a long position already opened, the Bid price is the one to follow.

There  is  a lot of other data that can be followed at the same time in the Market Watch window, and some of  it  can be quite useful, such as:

- „Time ” – the time of the last change of  a price, useful especially on a less liquid market.

- „Bid High ” and „Bid Low ” – respectively the maximum and minimum Bid price so far on the current day.

- „Ask High ” and „Ask Low ” – respectively the maximum and minimum Ask price so far on the current day.

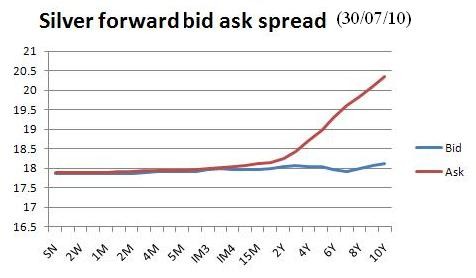

Another important concept is spread – a difference between the Bid and Ask price. The spread is measured in points. As a rule, the most popular markets also have the lowest spreads, due to the high liquidity caused by the interest of the investors.

An example is a situation where on the EURUSD market the price Bid/Ask is given as: 1,4020/1,4022. In such a case, the spread will be equal to the difference, i.e. 1,4022 – 1,4020 is equal to 0,0002. In other words, the spread is 2 points. In other cases:

- GBPUSD — 1,6059/1,6062 – the spread is 3 points.

- GOLD – 1600,20/1600,90 – the spread is 70 points.

In order to determine whether the conditions on the given market are attractive, the spread should be compared with market volatility in the chosen time scale. In general, the lower volatility and shorter time horizon, the more important is the spread value.

Typically, a spread and to some extent swap points (described in this section ) represent the only cost of transactions on CFDs instruments. The spread value is directly related to a liquidity and volatility of the market in question.