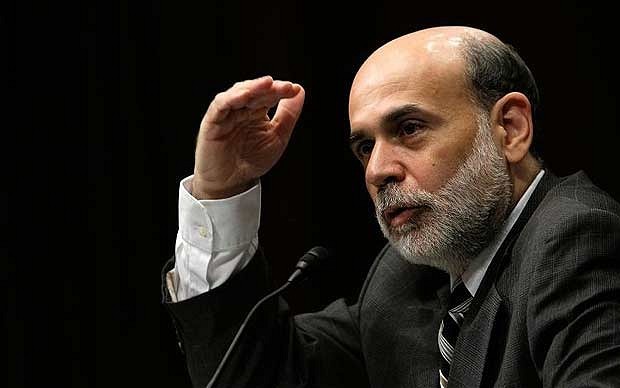

Bernanke Irresponsible to Compare US to Greece

Post on: 20 Апрель, 2015 No Comment

by Edward Harrison / on 9 February 2012 at 14:39 /

Thats the headline from my latest talk on RTs Alyona Show. Before I send you to the clip, let me explain my thinking because I dont think I was really clear in the video.

Heres what I was saying about the differences between Greece and the US: Greece is in a currency union that has the euro operating much as the gold standard did in the 20th century, restricting government spending in a way that produces deflationary policy responses to avoid default. Without the convertibility, government has more policy space. Heres how I put it in December:

While I have an Austrian bias overall, for me, MMT is the best way to think about nonconvertible floating exchange rate systems as distinct from fixed exchange rate, currency board, pegged and convertible systems. The difference is policy space and what I would call the bond vigilante relief valve.

[]

Today the release valve is always the currency because there is no gold tether. So the currency gives way, not interest rates. And to the degree that interest rates would increase, the central bank can print. The currency revulsion question then is always currency depreciation, inflation and even hyperinflation (when and under what preconditions) not interest rate spikes.

Sovereigns with significant foreign currency liabilities face the same issues as sovereigns under the gold standard – as we saw in Iceland in 2008. In the Russia and Argentina defaults last decade, those countries had foreign currency liabilities and a currency peg. This was the problem. It’s different for nonconvertible floating exchange rate currencies issued by a sovereign with no foreign currency obligations.

Where the bond vigilante story is usually flawed is in thinking that the bond vigilantes have power. Shorting government bonds when the central bank is politically aligned with the Treasury is a sure-fire way to lose lots of money. The consolidated government’s balance sheet consists of IOU liabilities that it can manufacture in infinite quantities. Why would anyone think they can win that game? It’s like my writing Yves IOUs for blog points. Maybe I write more than I can ever cover her for. But I create the points. I can always create more. if I write too many, their value depreciates.

Bottom line. The US is not Greece. It doesnt face the same constraints as Greece and cant be rendered insolvent involuntarily like Greece because its only liability, unlike Greece, is an IOU which it can manufacture in infinite quantities. Thats why Japan has 200 percent debt to GDP and the lowest interest rates in the world.

I am not making a judgment here as to whether being able to print is a good thing. I would argue it is not a good thing because the policy space will be used to promote corporatism aka crony capitalism rather than full employment. But thats a different argument. Here I am just making clear that the US faces very different constraints than Greece and that Bernanke knows so or at least should know so.

As for government deficits as far as the eye can see. this is related to why Bernanke is making the false claims he has made. I addressed this one week ago:

- Cyclical deficits are just that, cyclical. Raising taxes or reducing spending before you reach full employment is likely to increase these cyclical deficits.

- Deficit sustainability is an artificial construct. The concept is usually based on a flawed view that taxes fund government expenditures when every dollar, euro, or pound in your pocket is an IOU created by government out of thin air aka fiat currency. Debt-to-GDP constraints are better at framing sustainability. But these too are artificial and are implicit indications of fears of cronyism and government waste.

- Deficits matter only to the degree they steal real resources from productive use. This can be surmised from a rapidly rising debt-to-GDP ratio .

Budget deficits are the result of an ex-post accounting identity. In plain English that means the policy prescriptions are the economic input and the deficit is the output. Focus on the policy and policy goals, not deficits. Focusing on the deficits leads to whats happening in Greece and Spain.

P.S. Yes, I think the official US unemployment rate has been systematically massaged to produce a lower headline number, just as the official consumer price inflation numbers have been massaged to produce lower numbers. But these are systemic changes that are system-based as opposed to politically-based. The President simply does not have the micro level control necessary to manipulate employment data the way some are saying he does. Moreover, the best time to manipulate would be closer to the election. This whole meme is politically-motivated conspiracy theory nonsense. The facts are that the U-6 number of 15.1% is still near depression levels but it is down from nearly 18%. That means the employment situation is poor but somewhat improved. This is the no-spin analysis of the current US jobs data.

Edward Harrison is the founder of Credit Writedowns and a former career diplomat, investment banker and technology executive with over twenty years of business experience. He is also a regular economic and financial commentator on BBC World News, CNBC Television, Business News Network, CBC, Fox Television and RT Television. He speaks six languages and reads another five, skills he uses to provide a more global perspective. Edward holds an MBA in Finance from Columbia University and a BA in Economics from Dartmouth College. Edward also writes a premium financial newsletter. Sign up here for a free trial .