Benchmark Your 401k Plan 2015

Post on: 16 Март, 2015 No Comment

How does your 401k plan compare with other 401k’s?

Many plan sponsors want to know how their 401k plan stacks up to the typical or average plan. This is often the first question asked when attempting to determine whether an effort should be made to upgrade the features and benefits of the plan.

To help you answer this question, we have identified some of the common performance characteristics and features offered by many 401k plans and compiled the statistics below from a variety of sources* that will allow you to benchmark your plan.

Automatic Enrollment

Forty-seven point two (47.2) percent of plans have an automatic enrollment feature. The most common default deferral is 3% of pay, present in 51.8% of plans. Fifty-seven point nine (57.9) percent of plans with automatic enrollment automatically increase default deferral rates over time. The most common default investment option is a target-date fund, present in 72% of plans.

Of those that don’t have an automatic enrollment feature, 39% say they already have a high participation rate and do not feel they would benefit, and 20% think it would be too expensive due to increased cost of the match.

Catch-up Contribution

Catch-up contributions for participants aged 50 and older are permitted in 98.6% of plans. Forty-two point seven (42.7) percent of these plans offer a match on the catch-up contributions.

Company Stock

Only 18.2% of plans allow company stock as an investment option for both participant and company contributions. Three (3.0) percent of plans allow company stock as an investment option for company contributions only.

Eligibility

In 1998, only 24% of plans allowed employees to begin contributing to their 401k plans immediately upon employment. Now, 62% do so. Forty-six point two (46.2) percent of companies that provide a matching company contribution provide immediate eligibility to receive the match, while 29.4% require one year of service prior to eligibility to receive it.

Employee Participation Rate

On average, 87.6% of eligible employees have a balance in the plan. Twenty-one point eight (21.8) percent of plan participants are no longer actively employed by the plan-sponsoring company.

Employer Contributions

The average company contribution in 401k plans is 2.7% of pay. Numerous formulas are used to determine company contributions. The most common type of fixed match, reported by 40% of employer’s, is $.50 per $1.00 up to a specified percentage of pay (commonly 6%). Thirty-eight (38) percent of all plans match $1.00 per $1.00 up to a specified percentage of pay. Forty-three (43) percent of employees said the company match was the primary reason they participate in the plan.

Hardship Withdrawals

Hardship withdrawals are permitted in 83% of 401k plans. Only 4% of participants took a hardship withdrawal when permitted by the plan.

Investment Advice

Investment advice is offered by 35% of plans. Seventeen point six (17.6) percent of participants used advice when it was offered.

Investment Advisors

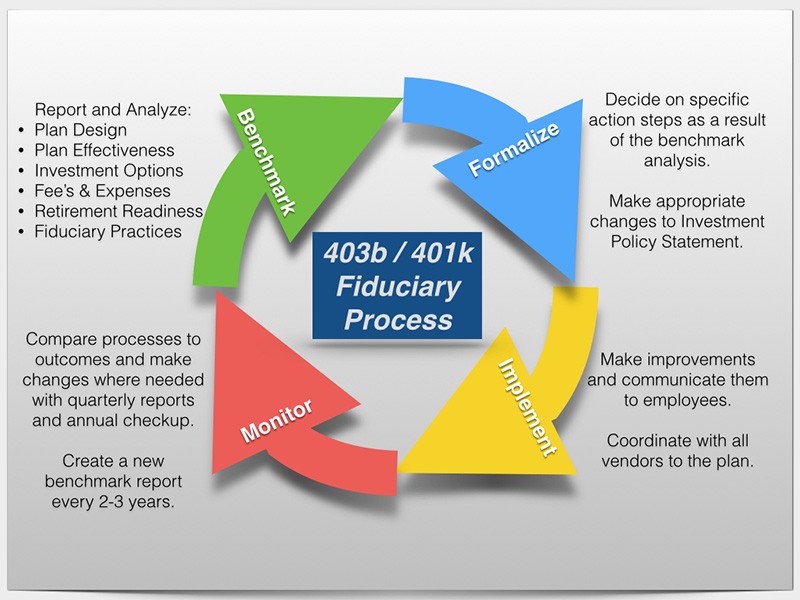

Sixty-eight point seven (68.7) percent of companies retain an independent investment advisor to assist with fiduciary responsibility.