Beginning of major bear market

Post on: 30 Июнь, 2015 No Comment

Beginning of major bear market?

Page 1 of 1

Disclaimer. To the extent that any content in this report constitutes advice, it is general advice that has been prepared by Lesley Beath without taking into account the particular investment objectives, financial situation and particular needs of any individual investors. If necessary, you should consult with a licensed investment adviser or dealer in securities such as a stockbroker before making an investment decision. Opinions expressed herein are subject to change without notice and may differ or be contrary to the opinions or recommendations of Morningstar as a result of using different assumptions and criteria.

I used to always joke with colleagues and friends that they should be wary when I took holidays as the financial markets always seemed to behave badly when I was away. And you could bet that the Australian dollar would take a hit whenever I went overseas!

So it has happened again. My last report was in mid-September and at that stage the US market was still moving higher.

But there were cracks elsewhere and I suggested at the time that price action in global equity markets suggests a cautious stance is still warranted. The S&P pushed higher for a few days after that report, peaking on 19 September. It has since declined by almost 6 per cent.

The ASX 200 is down by a similar amount over that period, taking the decline from the early September high to 8.6 per cent. The Australian dollar was trading at 90.79 cents when I left. It hit a low of 86.43 while I was away. There has been plenty of action across the board.

At the time of writing the last report I suggested that, Overall, across all markets, this is a good time to be sitting on the sidelines. I still think that is the case. At this stage, I cannot see too many positive signs, although there are a couple of things that we can monitor for an early indication that a reversal is imminent.

Firstly, the US market, as measured by the S&P 500 and the Dow Jones Industrials, is now testing its 200DMA. And both indices are in close proximity to the 2011 uptrend. That is a potential turning point.

In addition, the VIX is trading at the upper limits of the range that has been in place since late 2012. That level has marked reversal points in the S&P on four occasions.

Each of those reversals came after a relatively minor correction, similar in magnitude to what we are now experiencing. (Remember that the US market has not undergone a 10 per cent correction since it began to accelerate to the upside in late 2012. That is very uncommon.)

Another positive, as of last Friday, was that while the Dow Transports broke below the August low, the Dow Industrials did not confirm that break.

So there are some potential positives. But beyond the short-term support and resistance levels on the main US indices and the VIX, there is not a lot to calm the nerves.

Stepping back and looking at the longer-term chart of the NASDAQ, we see that the recent decline came after the index tested the upper limits of the trend channel that has been in place since early 2010.

Price retreated from that resistance in March this year, without too much damage, but given the action in the Russell 2000, this retreat looks more ominous.

I have highlighted the Russell 2000 on a number of occasions over the past few months as it failed to follow the S&P to new highs. It broke below the 2011 uptrend in mid-September (as the S&P registered new highs) and broke below important lateral support last week.

That support was the 2014 lows and the downside break, if not reversed very quickly, can be construed as the completion of a significant top formation. The initial target from that formation is in the vicinity of 950, almost 10 per cent below current levels.

Of course, with the S&P on support and the VIX at resistance, there is scope for a quick reversal, but the chart formation is quite negative.

If we move on to Europe, there is little to suggest a near-term reversal. We have been monitoring Germany and France regularly as both broke below their prevailing uptrends, and their 200DMA, back in July.

I noted in early August that the break in both those markets suggested possible trouble in Europe and it was one of the reasons that the topside break in the All Ordinaries was viewed with scepticism.

Both markets rebounded, pushing back above the 200DMA, but the rebound was considered to be a pullback to the trendline. Recent action suggests that interpretation was correct. (The concept of a pullback was discussed in August so I won’t go into detail again).

Germany and France continue to present a weak profile and the German DAX appears to have completed a significant top formation, similar to that on the US Russell 2000.

In the UK, the FTSE has also broken its 2011 uptrend. If you remember, the index had been butting against major resistance (the 2000 and 2007 peaks) for the past year, unable to post a topside break.

This resistance and the resistance on the Japanese Nikkei, in conjunction with the downside breaks in Germany and France, were some of the factors which made me cautious about the outlook for global markets. The FTSE has declined by 8.6 per cent in the past month.

As for China, well, it has bucked the global trend, closing the month of September with a 6.6 per cent gain. It also closed higher last week.

What about the Australian market? The All Ordinaries has broken the 2012 uptrend and also its 200DMA. The latter will now become resistance, as will the May and June lows. This combined resistance sits at 5400-5355.

The market is obviously oversold and if the US market can bounce from support over the next week, our market has the potential to rebound.

But at this stage, the price action here suggests the odds favour continued weakness towards support at 5070-5016. That level will be crucial to the longer-term outlook. Failure to hold above there would restrict upside potential going into 2015.

Gold is sitting on critical support ($1182). Silver has already broken its key level, which is a concern as it often leads the gold price.

The US dollar has pushed beyond the upper limits of its recent range and there are no clear signs of a reversal at this stage. This will continue to put downward pressure on gold.

Gold did bounce from support last week and momentum indicators are beginning to rise from oversold levels, giving some glimmer of hope. Let’s see what happens over the next week. If the recent low is broken decisively, gold has downside potential towards the $1,000 level.

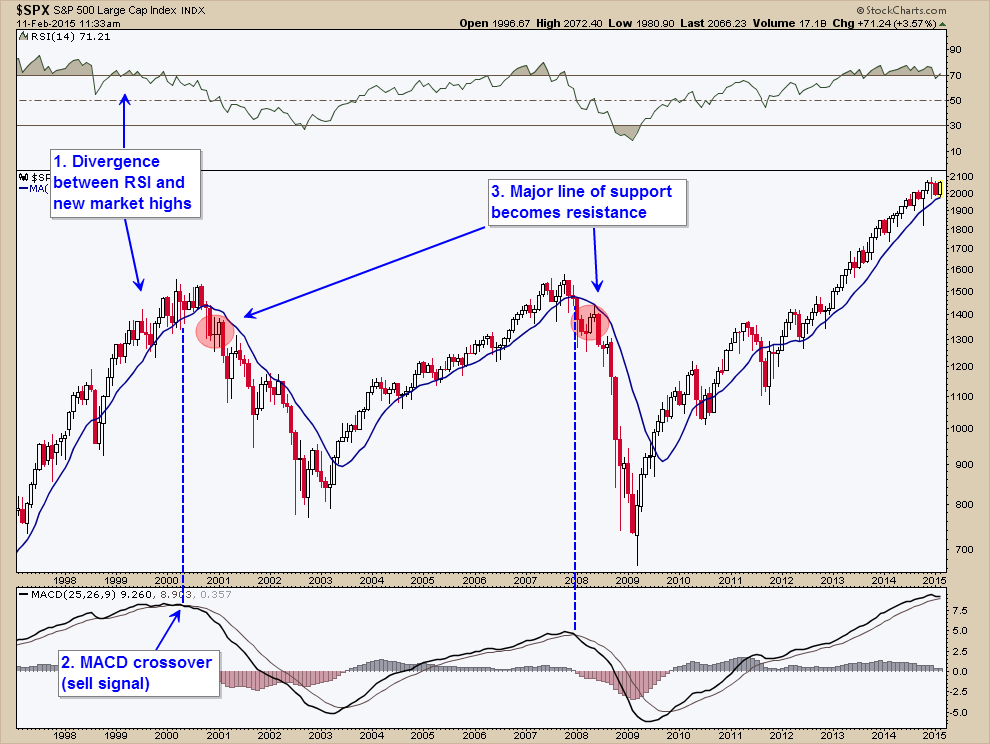

So, what’s the bottom line as far as global equity markets are concerned? Is this the beginning of a correction akin to the 2011 and 2012 episodes? Is this the beginning of a lengthy bear market?

Or will the US market bounce from its 200DMA and push higher again, keeping the pace of the past couple of years in place?

No-one knows for sure and with the S&P still above its 200DMA, and with the VIX at a potential turning point, the US market could surprise and turn quickly. But even if we did see a short-term reversal, given the action in other world equity markets, I believe that risk remains to the downside.

So I believe it is unlikely that the US will push to new highs in the near term. Is this the beginning of a major bear market?

I think the most likely scenario is that this is going to be more like the 2011 and 2012 corrections, with scope to rally again in 2015. But as always, opinion is just opinion, and we will be guided by the market action as it unfolds.

Use the links below to view the various chart packs.