Balance of Payments Deficits and Surpluses

Post on: 16 Март, 2015 No Comment

What does a current account deficit mean?

Running a deficit on the current account means that an economy is not paying its way in the global economy. There is a net outflow of demand and income from the circular flow of income and spending. Spending on imported goods and services exceeds the income from exports.

Balance of payments and the standard of living

- In principle, there is nothing wrong with a trade deficit. It simply means that a country must rely on foreign direct investment or borrow money to make up the difference

- In the short term, if a country is importing a high volume of goods and services this is a boost to living standards because it allows consumers to buy more consumer durables.

Balance of Payments and Aggregate Demand

- When there is a current account deficit this means that there is a net outflow of demand and income from a countrys circular flow. In other words, trade in goods and services and net flows from transfers and investment income are taking more money out of the economy than is flowing in. Aggregate demand will fall.

- When there is a current account surplus there is a net inflow of money into the circular flow and aggregate demand will rise.

Wider Economic Effects of a Current Account Deficit / Trade Imbalances

Countries with Trade Surpluses

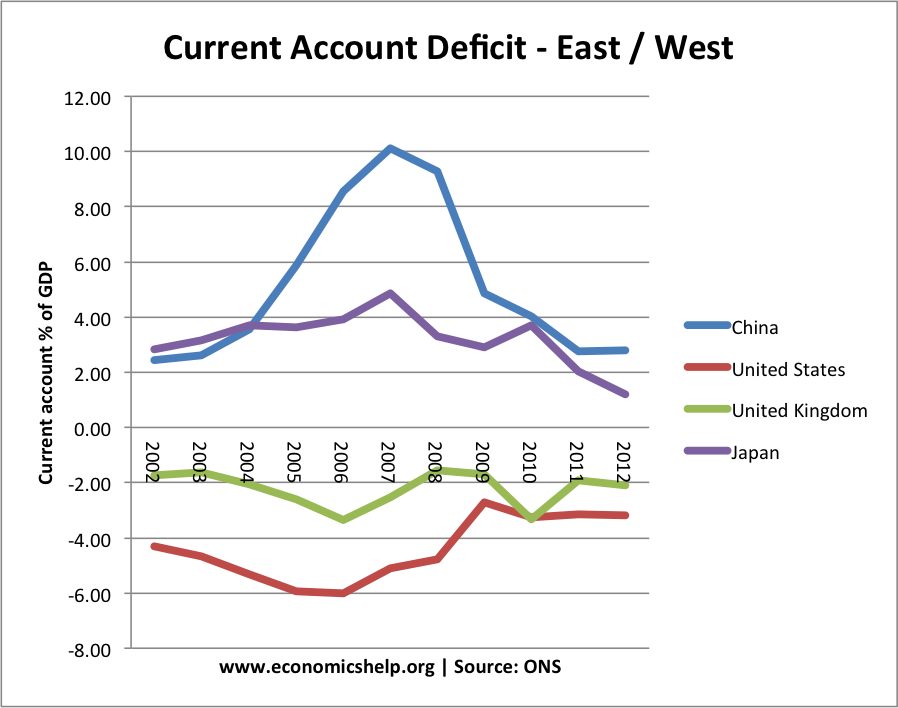

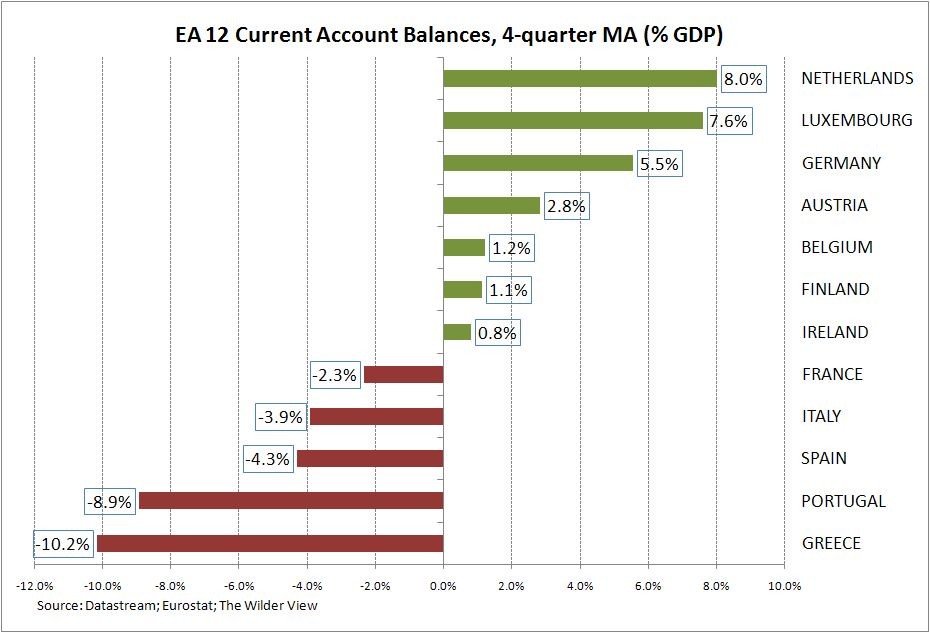

Many countries operate with a trade and current account surplus good examples are China, Germany, Japan, Norway and emerging market countries with strong export sectors.

There are several causes and each country will have a unique set of circumstances:

Export-oriented growth. Some countries have set out to increase the capacity of their export industries as a growth strategy. Investment in new capital provides the means by which economies of scale can be exploited, unit costs driven down and comparative advantage can be developed.

Foreign direct investment. Strong export growth can be the result of a high level of foreign direct investment where foreign affiliates establish production plants and or exporting.

Undervalued exchange rate. A trade surplus might result from a country attempting to depreciate its exchange rate to boost competitiveness. Keeping the exchange rate down might be achieved by currency intervention by a nations central bank, i.e. selling their own currency and accumulating reserves of foreign currency. One of the persistent disputes between the USA and China has revolved around allegations that the Chinese have manipulated the Yuan so that export industries can continue to sell huge volumes into North American markets.

High domestic savings rates. Some economists attribute current account surpluses to high levels of domestic savings and low domestic consumption of goods and services. China has a high household saving ratio and a huge trade surplus; in contrast the savings ratio in the United States has collapsed and their trade deficit has got bigger. Critics of countries with persistent trade surpluses argue they should do more to expand domestic demand to boost world trade.

Closed economy some countries have a low share of national income taken up by imports perhaps because of a range of tariff and non-tariff barriers.

Strong investment income from overseas investments. A part of the current account that is often overlooked is the return that investors get from purchasing assets overseas it might be the profits coming home from the foreign subsidiaries of multinational businesses, or the interest from money held on overseas bank accounts, or the dividends from taking equity stakes in foreign companies.

Policies / approaches to reduce a persistent current account deficit

There are a number of policies that can be introduced to achieve an improvement in a countrys trade balance some of them focus on changing the growth of demand, others look to improve the supply-side competitiveness of an economy. As with any macroeconomic problem effective policies are those that target the underlying causes .

- Demand management. Reductions in government spending, higher interest rates and higher taxes could all have the effect of dampening consumer demand reducing the demand for imports. This leads to an increase in spare productive capacity which can then be allocated towards exporting.

- Natural effects of the economic cycle. One would expect to see a trade deficit fall during a recession so some of the deficit is partially self-correcting but this does little to address the problems of a structural balance of payments problem.

- A lower exchange rate :

- The central bank of a country might decide that a lower exchange rate provides a suitable way of improving competitiveness. reducing the overseas price of exports and making imports more expensive

- For those countries operating with a managed exchange rate. the government may decide to authorise intervention in the currency markets to manipulate the value of the currency

Case Study: The BoP in Argentina: Default, Devaluation and a Managed Exchange Rate System

In 1991, Argentina abandoned a fixed exchange rate against the US dollar, ended their currency board and moved to a managed floating exchange rate. There was an immediate devaluation of the currency devaluation means that one US dollar buys more Argentinean peso. By the autumn of 2002, the peso had stabilised against the US dollar at close to 3 peso to $1.

Was the devaluation a boost to the economy? In theory a lower exchange rate represents an expansionary monetary policy — exports are cheaper overseas, imports become more expensive, there ought to be a boost to domestic demand and a recovery in growth because the Argentinean economy will have become more competitive in world markets

In the short run, the devaluation of the peso made the recession worse and led to a loss of capital from the economy. 2002 was the 4th consecutive year of recession for Argentina. In 2002, there was an 11% fall in national output that on its own is sufficient to be called a depression.

- The currency collapse caused a worsening of Argentinas terms of trade, the nation effectively became poorer measured in US dollars per capita.

- Devaluation caused a sharp spike in inflation (rising above 20%) because imports became more expensive. This caused deep cuts in peoples real incomes giving less purchasing power

- Higher inflation led to a steep rise in market interest rates in Argentina this cut consumer demand and business investment. Money market interest rates peaked close to 40%.

- Lower spending cost thousands of jobs

- The return of inflation to Argentina worsened the problem of extreme poverty especially with mass unemployment and a huge rise in imported food prices

- The collapse in the current caused capital flight from Argentina. Investors took fright and move their money elsewhere. Effectively Argentina became isolated in the global capital markets.

Economic recovery started a few years later and the economy then experienced a significant improvement in her balance of payments / trade data.

In the case of Argentina, the fundamental reason for improving trade has been high global prices for many of her major export commodities. These commodities tend to have an inelastic demand (Ped<1) so when world prices are rising, export revenues from selling cereals, soy beans and other primary products to the rest of world increase markedly. Argentina has moved from trade deficit to trade surplus in goods over the last fifteen years as favourable world prices have allowed her to benefit from her comparative advantage. Trade has been an engine of economic growth for them. Rising export demand is an injection of aggregate demand. And an extra inflow of income intro the circular flow can generate higher investment in export industries and in supply-chain businesses that prosper when exports are strong.

A competitive exchange rate has helped Argentina to achieve rapid economic growth indeed the government deliberately manages the exchange rate to aid export industries. But a significantly lower exchange rate has also brought costs in particular, a persistently high rate of domestic inflation.

High rates of inflation threaten to undermine the competitiveness of the economy. And they also create widespread social and political pressures not least demands for compensating wage increases as people seek to protect their real incomes. Growth has been strong but it is also coming at a cost a significant increase in the cost of living.

Few people believe the accuracy of Argentinean economic statistics officially inflation is around 10% but this is held down artificially by complex systems of subsidies for fuel, energy and foodstuffs. Many economists believe that the true rate of inflation in Argentina is 20% or more.

Argentinas strong growth has helped to bring down the national unemployment rate from 20% of the labour force in 2002 to 10% in 2005 and now just under 7% in 2011. Even during the growth slowdown in 2009 the unemployment rate nudged higher only by a small margin.

Although another devaluation of the peso at the end of 2001 caused a steep spike in public sector debt (much of which was borrowed in US dollars). Public sector debt has fallen below 50% of GDP since 2008 and the country has also reduced her external debts. But Argentina still owes over $7bn to western governments and shows few signs of being willing to repay outstanding debts from before the default in 2001. Argentina is in default on $8.9bn in loans to foreign governments, including Germany, Japan, the US, the Netherlands, and Italy.

Add your comments and share this study note: