Balance of Payments_1

Post on: 15 Август, 2015 No Comment

Balance of Payments

Overview

The major purpose of this chapter to show how the balance of payments arises from various international transactions and how the different balances (or sub-balances) can be interpreted. It also presents the international investment position.

A country’s balance of payments records all economic transactions between the residents of the country and residents of the rest of the world. Each transaction or exchange results in two opposite flows of value. By convention, a credit or positive item is the flow for which the country is paid — it sets up a claim on the foreign resident, so that funds (or money) flow into the country. A debit or negative item is the flow that the country must pay for-it sets up a foreign claim- on a resident of the country, so that funds (or money) flow out of the country.

Each transaction has both a credit and a debit item (double-entry bookkeeping) at least once we create a fictional goodwill item for things that are given away (unilateral or unrequited transfers). Therefore, if we add up all items for the country’s balance of payments, it must add up to zero. What we find interesting about the balance of payments is not that it must completely add up to zero, but rather how it does so. What are the values of different categories of items?

Typically, the first categories we examine are items that are international flows of goods (or merchandise), services, income, and gifts — the current account. Services include flows of transportation, financial services, education, consulting, and so forth. Income includes flows of payments such as interest, dividends, and profits. In addition to the full current account balance, we can also examine the goods and services balance.

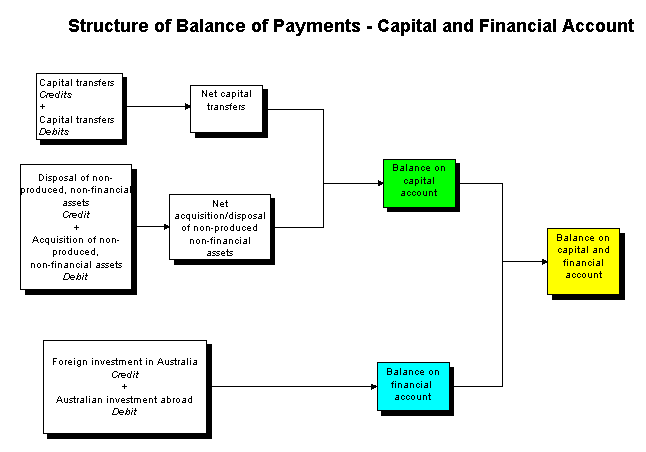

The (private) capital account includes items that are nonofficial international flows of financial assets. Capital inflows are credit items — capital or funds flow into the country as the country exports financial assets (by increasing liabilities to foreigners or decreasing assets previously obtained from foreigners). Capital outflows are debit items — capital or funds flow out of the country as the country imports financial assets (by increasing the country’s assets obtained from foreigners or decreasing its liabilities to foreigners). Direct investments are international capital flows between units of a company located in different countries. If the investor does not have management control, international investments in stocks and bonds are usually called portfolio investments. International loans and bank deposits are other capital flows included in the capital account.

The third and final major part of the country’s balance of payments records official international flows of financial assets that serve as official international reserves. The country’s monetary authority (usually, its central bank) undertakes these transactions. Official international reserves include financial assets denominated in readily accepted foreign currencies, the country’s holdings of Special Drawing Rights (SDRs), the country’s reserve position at the International Monetary Fund (IMF), and gold.

If all items are recorded correctly, the sum of all of these items equal zero. In practice, they are not and do not, so that a line called statistical discrepancy is added to make the accounts add to zero. It represents the net of many items that are mismeasured or missed (net errors and omissions).

The current account balance (CA) has several meanings.

First, it is approximately equal to the difference (X — M) between the value of the country’s exports of goods and services and the value of its imports of goods and services.

Second . it equals the value of the country’s net flow (If ) of foreign investments (both private and official).

Third . it is difference between national saving and domestic real investment (S — Id ).

Fourth, it is the difference between domestic production of goods and services and national expenditures on goods and services (Y — E). The text shows how the current account and goods and services balances have changed over time for four countriesthe United States, Canada, Japan, and Mexico.

The overall balance should indicate whether a country’s balance of payments has achieved an overall pattern that is sustainable over time. While there is no perfect indicator of overall balance, we often examine the country’s official settlements balance (B), which is the sum (CA + KA) of the current account balance and the private capital account balance (including the statistical discrepancy). The official settlements balance also equals the (negative of the) official reserves balance (OR). Most of the official reserves flows indicate official intervention by the monetary authorities in the foreign exchange market.

The international investment position is a statement of the stocks of a country’s foreign assets and foreign liabilities at a point in time. The text shows that the United States has changed from being an international debtor to creditor and back to a debtor during the past century.

Key Terms

Balance of payments: