Audusd Approaches Breakdown 2015

Post on: 22 Май, 2015 No Comment

3A%2F%2Fwww.fxstreet.com%2F?w=250 /% Check out the latest content about EURUSD updated daily: reports, news, webinars and much more in the leading forex portal.

3A%2F%2Fproacttraders.com%2F?w=250 /% The ProAct charts give very clear indicators about entrance points and targets. Try us free for two weeks and see what we see in the foreign exchanges. Forex Trading

3A%2F%2Fwww.dailyfx.com%2F?w=250 /% The Ichimoku indicator is a forward-looking technical trading system with the primary goal of being able to provide the entirety of a traders’ analysis in

3A%2F%2Fwww.fxempire.com%2F?w=250 /% FX Traders’ weekly EURUSD fundamental & technical picture, this week’s market drivers that could change it- the bullish, the bearish and likely EURUSD

3A%2F%2Fforex.tradingcharts.com%2F?w=250 /% Free online resources for Forex Trading — from novice to expert, currency traders of all levels will discover a wealth of free online resources, from quotes and

3A%2F%2Fwww.dailyfx.com%2F?w=250 /% Find out the biggest mistakes traders make, and what you can do to avoid them. DailyFX has released a special series of research articles useful

3A%2F%2Fwww.forextraders.com%2F?w=250 /% Triple Exponential Moving Average, or TEMA, is a type of exponential moving average developed by Patrick Mulloy in 1994. One of the common problems of trading with

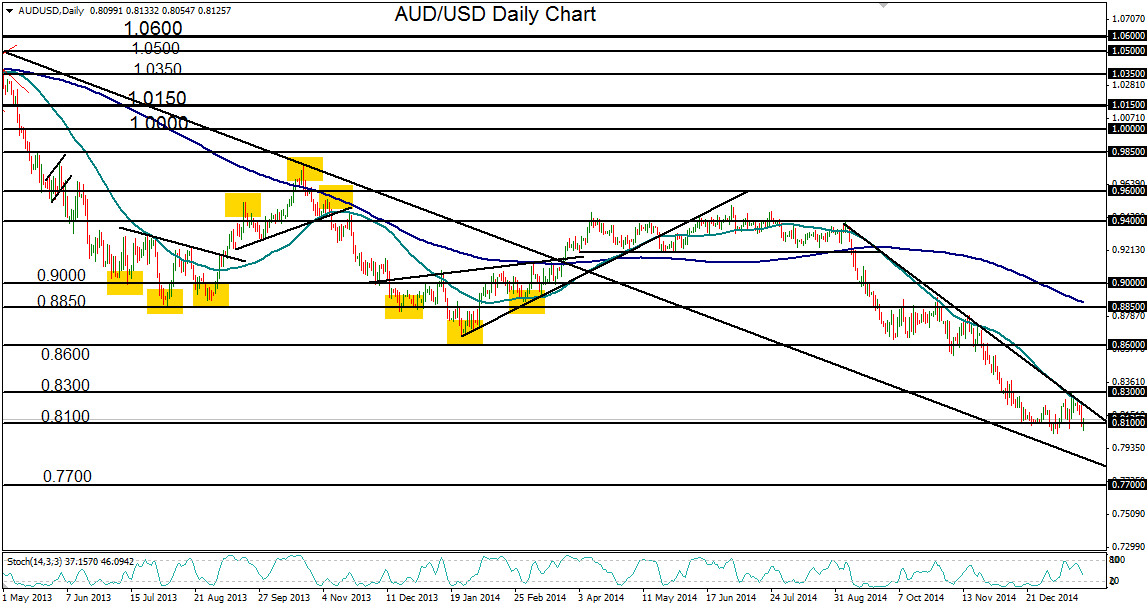

3A%2F%2Fwww.investing.com%2F?w=250 /% AUD/USD has once again dropped below the 0.7700 support level and approached the new five-year low of 0.7625, which was hit just last week. That multi-year low was the latest culmination of a strong five-month downtrend that saw price action drop from

3A%2F%2Fwww.cityindex.co.uk%2F?w=250 /% AUD/USD (daily chart shown below) has once again dropped below the 0.7700 support level and approached the new five-year low of 0.7625 that was hit just last week. That multi-year low was the latest culmination of a strong, five-month downtrend that saw

3A%2F%2Fforextv.com%2F?w=250 /% AUD/USD (daily chart shown below) has once again dropped below the 0.7700 support level and approached the new five-year low of 0.7625 that was hit just last week. That multi-year low was the latest culmination of a strong, five-month downtrend that saw …

3A%2F%2Fwww.dailyfx.com%2F?w=250 /% A substantial breakdown in Reserve Bank of Australia interest rate forecasts have forced Australian Dollar weakness, and indeed calls for rate cuts may continue to hurt the AUDUSD in the year and most basic fundamental approaches to determining the

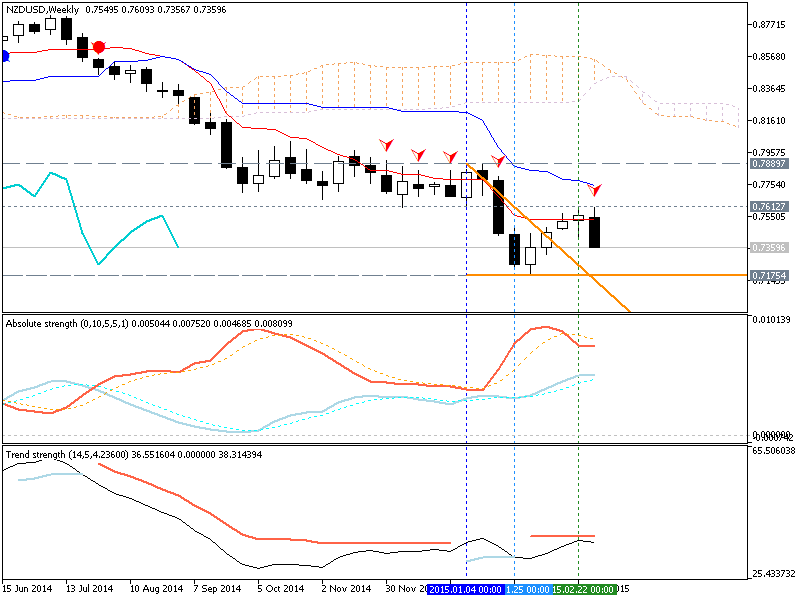

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% Keep an eye on the EURJPY as price approaches 12332 15830 is former support and a level to sell strength for a larger breakdown through long term trendline support. The AUDUSD has broken the trendline that extends off of the October and December

3A%2F%2Fwww.fxstreet.com%2F?w=250 /% Ian uses this technique and others in his own approach to trading. We will cover all 3 pairs per webinar, going through: GBPUSD, EURUSD, EURGBP, EURJPY, AUDJPY, USDJPY, USDCHF, AUDUSD, USDCAD, DAX, GOLD.

3A%2F%2Fwww.forexfactory.com%2F?w=250 /% AUD/USD (a daily chart of which is shown) as of Wednesday (3/16/2011) has dropped down to approach its key support target in the 0.9800 price region before rebounding. This occurs on a breakdown below a triangle consolidation pattern extending from the

3A%2F%2Fwww.ibtimes.com%2F?w=250 /% I’ve decided to give you the details of my sure-fire strategy (Mustpha Sure-fire Strategy For example, you could possibly sell on AUDUSD, and later buy on the same pair and win both trades (within the same week). This strategy is very simple

3A%2F%2Fwww.minyanville.com%2F?w=250 /% While I never like to jump the gun on a technical breakout or breakdown happening cross into the risk-on category for the intermediate-term. Click to enlarge AUD/USD also putting out risk-on messages for the intermediate-term.

3A%2F%2Fwww.futuresmag.com%2F?w=250 /% First we look at the AUD/USD. It experienced a 3,000 pip move from October 2008 It has been in a sideways fibonacci range for most of 2009 and in early February was probing 125.13, a breakdown of the 23.6% fibonacci support. A successful breakdown