Advantages of Fixed Exchange Rate

Post on: 16 Март, 2015 No Comment

A fixed exchange rate occurs when a country tries to keep the value of its currency at a certain level against another currency. Often countries join a semi-fixed exchange rate, where the currency can fluctuate within a small target level.

For example, the European Exchange Rate Mechanism ERM was a semi fixed exchange rate system.

Advantages of Fixed Exchange Rates

1. Avoid Currency Fluctuation s. If the value of currencies fluctuate significantly this can cause problems for firms engaged in trade.

- For example if a firm is exporting to the US, a rapid appreciation in sterling would make its exports uncompetitive and therefore may go out of business.

- If a firm relied on imported raw materials a devaluation would increase the costs of imports and would reduce profitability

2. Stability encourages investment. The uncertainty of exchange rate fluctuations can reduce the incentive for firms to invest in export capacity. Some Japanese firms have said that the UKs reluctance to join the Euro and provide a stable exchange rates maker the UK a less desirable place to invest.

3. Keep inflation Low. Governments who allow their exchange rate to devalue may cause inflationary pressures to occur. This is because AD increases, import prices increase and firms have less incentive to cut costs.

4. A rapid appreciation in the exchange rate will badly effect manufacturing firms who export, this may also cause a worsening of the current account.

5. Joining a fixed exchange rate may cause inflationary expectations to be lower

Disadvantage of Fixed Exchange Rates

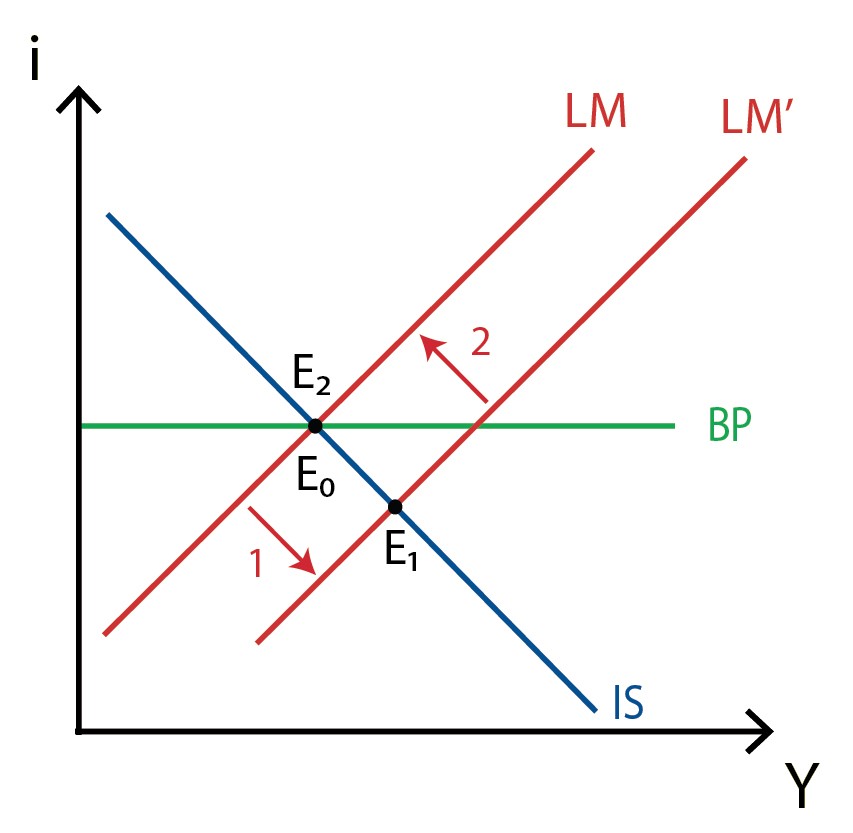

1. Conflict with other objectives. To maintain a fixed level of the exchange rate may conflict with other macroeconomic objectives.

If a currency is falling below its band the government will have to intervene. It can do this by buying sterling but this is only a short term measure.

The most effective way to increase the value of a currency is to raise interest rates. This will increase hot money flows and also reduce inflationary pressures.

However higher interest rates will cause lower AD and economic growth, if the economy is growing slowly this may cause a recession and rising unemployment

2. Less Flexibility. It is difficult to respond to temporary shocks. For example an oil importer may face a balance of payments deficit if oil price increases, but in a fixed exchange rate there is little chance to devalue.

3. Join at the Wrong Rate. It is difficult to know the right rate to join at. If the rate is too high, it will make exports uncompetitive. If it is too low, it could cause inflation.

4. Current Account Imbalances. Fixed exchange rates can lead to current account imbalances. For example, an overvalued exchange rate could cause a current account deficit. See: problems of overvalued exchange rate .