Advantages and Disadvantages of Floating Exchange Rates For Dummies

Post on: 20 Апрель, 2015 No Comment

Fiat currency doesnt imply a fixed exchange rate. In fact, fiat currencies are compatible with a floating exchange rate regime, in which the value of a currency is determined in foreign exchange markets.

Floating exchange rates have these main advantages:

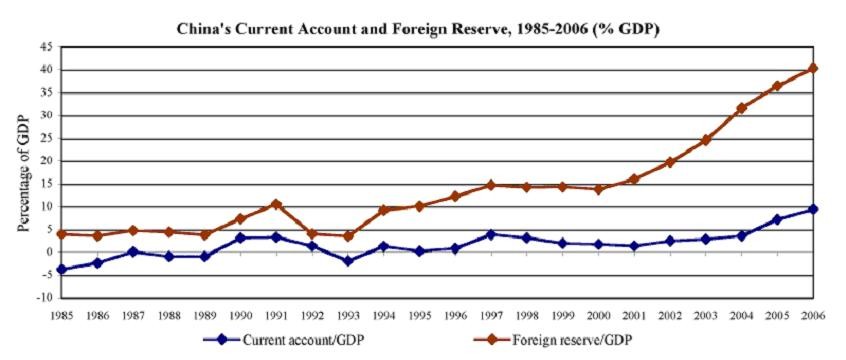

No need for international management of exchange rates: Unlike fixed exchange rates based on a metallic standard, floating exchange rates dont require an international manager such as the International Monetary Fund to look over current account imbalances. Under the floating system, if a country has large current account deficits, its currency depreciates.

No need for frequent central bank intervention: Central banks frequently must intervene in foreign exchange markets under the fixed exchange rate regime to protect the gold parity, but such is not the case under the floating regime. Here theres no parity to uphold.

No need for elaborate capital flow restrictions: It is difficult to keep the parity intact in a fixed exchange rate regime while portfolio flows are moving in and out of the country. In a floating exchange rate regime, the macroeconomic fundamentals of countries affect the exchange rate in international markets, which, in turn, affect portfolio flows between countries. Therefore, floating exchange rate regimes enhance market efficiency.

Greater insulation from other countries economic problems: Under a fixed exchange rate regime, countries export their macroeconomic problems to other countries. Suppose that the inflation rate in the U.S. is rising relative to that of the Euro-zone.

Under a fixed exchange rate regime, this scenario leads to an increased U.S. demand for European goods, which then increases the Euro-zones price level. Under a floating exchange rate system, however, countries are more insulated from other countries macroeconomic problems. A rising U.S. inflation instead depreciates the dollar, curbing the U.S. demand for European goods.

Floating exchange rates also have disadvantages:

Higher volatility: Floating exchange rates are highly volatile. Additionally, macroeconomic fundamentals cant explain especially short-run volatility in floating exchange rates.

Use of scarce resources to predict exchange rates: Higher volatility in exchange rates increases the exchange rate risk that financial market participants face. Therefore, they allocate substantial resources to predict the changes in the exchange rate, in an effort to manage their exposure to exchange rate risk.

Tendency to worsen existing problems: Floating exchange rates may aggravate existing problems in the economy. If the country is already experiencing economic problems such as higher inflation or unemployment, floating exchange rates may make the situation worse.

For example, if the country suffers from higher inflation, depreciation of its currency may drive the inflation rate higher because of increased demand for its goods; however, the countrys current account may also worsen because of more expensive imports.

- Add a Comment Print Share