Add some spice to your portfolio

Post on: 22 Июнь, 2015 No Comment

Our advisers identify five specialist funds to complement, and hopefully pep up, a wider investment portfolio.

There has long been a niche market for specialist funds, with all the potential they offer on the upside if things go well. But these are spicy little numbers and need to be used sparingly in any portfolio concoction.

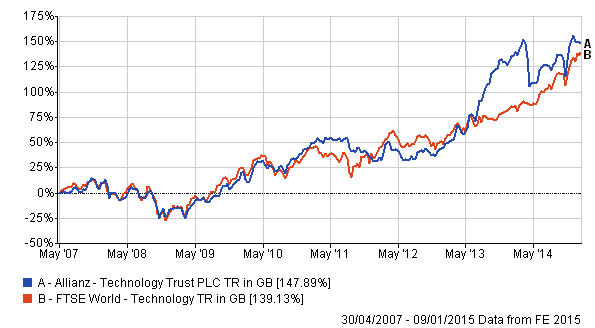

The danger is that a particular sector may become the flavour of the day, as happened with technology funds 10 years ago and, to a lesser extent, with commercial property two or three years ago, and end up in an unsustainable bubble because investors throw caution to the wind in their eagerness to be part of a booming market.

However, provided they are used sensibly and in moderation, and investors understand the potential for large falls as well as large rises, such funds can pep up an otherwise relatively staid portfolio.

Indeed, as well as being used in the conventional portfolios of actively managed funds chosen according to factors such as past performance, specialist funds may be utilised by advisers following ‘passive core and active satellite’ principles of portfolio construction.

This year, we have separated specialist and emerging market investments in recognition of the fact that both groups have effectively moved into the investment mainstream and are no longer looked upon as marginal categories used only by sophisticated investors.

Several of the funds highlighted in the specialist list below are picked out by independent financial advisers working on that basis.

Christine Morris of Informed Choice, for instance, supplements a core portfolio of M&G corporate bond funds with a shortlist of specialist investments, including Jupiter Financial Opportunities, Merrill Lynch Gold & General and Investec Global Energy, while Robin Keyte of Towers of Taunton takes an environmental slant with Impax Environmental Markets, an investment trust. and Henderson Industries of the Future.

M&G Property Portfolio

In light of the commercial property sector’s troubles of the past three years and the recent signs of recovery, it’s perhaps not surprising that some advisers are looking once more towards bricks and mortar, although most of them view property funds as a still relatively unloved punt.

Colin Rothery at Throgmorton Financial Services makes the point that most of his clients are not game for anything rare or racy in the specialist sector, but will tolerate commercial property funds.

Not only can these help diversify their portfolio away from bonds and equities. but they are currently a good bet for income seekers.

He picks out the M&G Property Portfolio: a 750 million fund investing in a mix of mainly UK commercial buildings and yielding around 3.5%.

It has weathered the worst of the property slump relatively well, losing only around 26% of its value over the last three years compared with 35% by the property sector as a whole.

Jupiter Financial Opportunities

This fund has attracted much attention over the past year, in part because of the drama that hit a previously relatively staid financial sector.

As Darius McDermott of Chelsea Financial Services explains: Financials took a hammering when a range of financial institutions looked as though they were going to the wall.

The recent rally has seen some dramatic upward share movements, but these were from very low levels. There are some serious endemic problems left to iron out, but the long-term investor should be rewarded for persevering with this sector.

Christine Morris of Informed Choice agrees. She points out that while, on the one hand, the financial sector dominates world equity indices (accounting for 25% of the FTSE 100 ), it remains cheap relative to other sectors.

Philip Gibbs, manager of Jupiter Financial Opportunities, now believes that banks, including investment banks, are the most liquid and desirable place for investors to participate in economic recovery and we agree, she says.

The general consensus is that Gibbs’s fund, which has returned almost 900% since launch in 1997 and 25% over the past year, offers the most reliable route into the sector.

Gibbs has run the fund from the outset and, as Ben Yearsley at Hargreaves Lansdown observes, he knows his sector inside out.

Yearsley explains: He demonstrated, in 2008, why he is such a good manager when he largely dumped financial shares and bought gilts. fixed interest and other lower-risk asset classes.

Peter McGahan of Worldwide Financial Planning agrees, describing his calls on UK banks as strong, forward-thinking and accurate, and the addition to the team of Guy de Blonay in January is likely to strengthen it further.

JPM Natural Resources

Commodities made a very strong showing in 2009, driven in part by China’s rally, and this fund, split between base metals, energy and gold, is up almost 120% over the 12 months to 1 December alone.

Looking ahead, Jennifer Storrow at Gee & Co comments that commodities funds should remain a good opportunity due to long-term global demand for natural resources, but this remains a volatile market and investors will require patience from time to time. This fund is very much the market leader in the commodities sector.

It is also favoured by Christine Morris.

Again, however, advisers emphasise that this is a good fund because it is run by an outstanding manager. As Ben Yearsley puts it, JPM Natural Resources is chosen because of the quality of the fund management team at JPMorgan, led by Ian Henderson.

This isn’t based on past performance, it is based on meetings with the manager and his attitude to managing the funds, he explains.

Henderson Industries of the Future

Robin Keyte at Towers of Taunton ignores past performance when selecting funds on the grounds that it tells us very little about how future performance will shape up.

Instead, he makes his selections on the basis of costs and fund ratings from Standard & Poor’s (S&P) and Old Broad Street Research (OBSR), with an additional ethical/environmental overlay where possible.

This fund, which started life as the Henderson Ethical fund until it was overhauled and repackaged in 2005, is not rated by S&P or OBSR, but Keyte regards it very much as a fund of the future, run on a very different basis from typical fund management.

Run by Tim Dieppe, who manages Henderson’s global socially responsible investment funds, it invests in a wide range of companies worldwide that are expected to grow on the back of environmental sustainability and socially responsibility.

Holdings are categorised by a range of themes such as efficiency, knowledge, health, cleaner energy and sustainable transport.

In the past year, it has underperformed within its global growth sector, as it has little in financials or commodities (where the biggest gains have been seen), but over three years it falls well within the first quartile of the sector.

Investec Global Energy

This is another interesting themed fund, this time investing in companies involved in various aspects of the energy industry.

There’s a clear tension between rapidly growing demand for oil, gas and other energy supplies (particularly from developing countries) and a relatively fixed supply, which is likely to push prices upwards in the future.

But investors need to understand that energy is a highly volatile proposition, as oil prices over the past year will testify.

Investec’s fund, chosen by Christine Morris, is one of very few funds focusing on this theme.

There has been strong potential for profits, as we look for alternatives to fossil fuels, and there is strong demand for energy from the emerging markets. especially the BRIC [Brazil, Russia, India and China] economies.

Clients understand this logic and have been willing to invest despite the potential for volatility, Morris observes.

Her clients have been well rewarded for their initiative: the past year has seen good returns for investors, with gains of 45% over the year to December. On a longer-term perspective the fund is up more than 120% over five years despite losing more than 25% in value over 2008.

This article was originally published in Money Observer - Moneywise’s sister publication — in February 2010

FTSE 100

A market-weighted index of the 100 biggest companies by market capitalisation listed on the London Stock Exchange. It is often referred to as The Footsie. The index began on 3 January 1984 with a base level of 1000; the highest value reached to date is 6950.6, on 30 December 1999. The index is weighted by how the movements of each of the 100 constituents affect the index, so larger companies make more of a difference to the index than smaller ones. To ensure it is a true and accurate representation of the most highly capitalised companies in the UK, just like footballs Premier League, every three months the FTSE 100 relegates the bottom three companies in the 100 whose market capitalisation has fallen and promotes to the index the three companies whose market capitalisation has grown sufficiently to warrant inclusion. Around 80% of the companies listed on the London Stock Exchange are included in the FTSE 100.

The familiar name given to securities issued by the British government and issued to raise money to bridge the gap between what the government spends and what it earns in tax revenue. Back in 1997, the entire stock of outstanding gilts was 275bn; by October 2010 it had surpassed 1,000bn. Gilts are issued throughout the year by the Debt Management Office and are essentially investment bonds backed by HM Treasury & Customs and considered a very safe investment because the British government has never defaulted on its debts and this security is reflected in the UKs AAA-rating for its debt. Gilts work in a similar way to bonds and are another variant on fixed-income securities.