5 Advantages of commodity v options

Post on: 14 Июнь, 2015 No Comment

Based on experience with new commodity traders, weve found about 80% of them have a history with stock options. Most of these traders, when pressed, express a vague desire to diversify as one of their chief reasons for taking the next step to commodities. However, its intriguing that few have a firm grasp of the real advantages that commodity options can offer especially if they are accustomed to the constraints that stock option selling can place on an investor.

Dont misunderstand: Selling equity options can be a lucrative strategy in the right hands. However, if you are one of the tens of thousands of investors who sell equity options to enhance your stock portfolio performance, you may be surprised to discover the horsepower you can get by harnessing this same strategy in commodities.

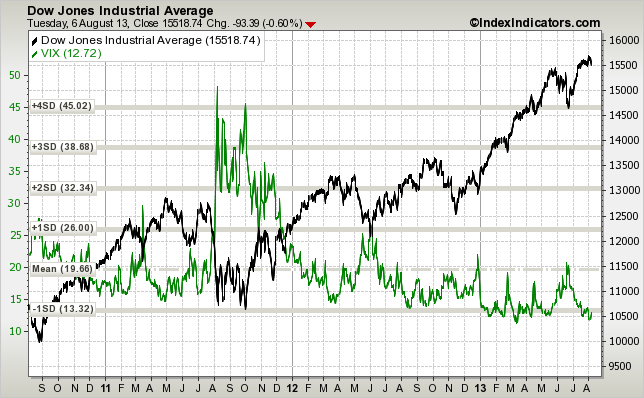

In an era when sudden and excessive volatility is common, diversification is more important than ever. But the advantages dont end there.

Selling benefits

Selling (also known as writing) options can offer benefits to investors in both equities and commodities. However, there are substantial differences between writing stock options and writing options on futures. What it generally boils down to is leverage. Futures options offer more leverage and, therefore, can deliver greater potential rewards (in addition to greater risk).

In selling equity options, you do not have to guess short-term market direction to profit. The same remains true in futures, with a few key differences:

- Lower margin requirement (that is, a higher return on investment). This is a key factor that attracts many stock option traders to futures. Margins posted to hold short stock options can be 10 to 20 times the premium collected for the option. With the futures industrys margin calculation system, however, options can be sold with out-of-pocket margin requirements for as little as one to one-and-a-half times premium collected. For instance, you might sell an option for $600 and post a margin of only $700 (total margin requirement minus premium collected). This can translate into substantially higher return on your working capital.

- Attractive premiums can be collected for deep out-of-the-money strikes. Unlike equities where to collect any worthwhile premium, options must be sold one to three strike prices out of the money futures options often can be sold at strike prices far out of the money. At such distant levels, short-term market moves typically will not have a big impact on your options value; therefore, time value erosion may be allowed to work less impeded by short-term volatility.

- Liquidity. Many equity option traders complain of poor liquidity hampering efforts to enter or exit positions. While some futures contracts have higher open interest than others, most of the major contracts, such as financials, sugar, grains, gold, natural gas and crude oil, have substantial volume and open interest, offering several thousand open contracts per strike price.

- Diversification. In the current state of financial markets, many investors are seeking precious diversification away from equities. By expanding into commodity options, you not only gain an investment that is not correlated to equities, option positions also can be uncorrelated to each other. In stocks, most individual stocks, and their options, will move at the mercy of the index as a whole. If Microsoft is falling, chances are your Exxon and Coca Cola holdings are falling as well. In commodities, the price of natural gas has little to do with the price of wheat or silver. This can be a major benefit in diluting risk.

- Fundamental bias. When selling a stock option, the price of that stock is dependent on many factors, not the least of which are corporate earnings, comments by the CEO or board members, legal actions, regulatory decisions or broader market direction. Soybeans, however, cant cook their books, and copper cant be declared too big to fail.

The supply/demand picture of commodities is analytically cleaner. Knowing the fundamentals of a commodity, such as crop sizes and demand cycles, can be of great value when selling commodity options. In commodities, it is most often old-fashioned supply and demand fundamentals that ultimately dictate price, not the actions of a badly behaving CEO. Knowing these fundamentals can give you an advantage in deciding what options to sell.