401(K) vs Roth IRA Which Offers Superior Savings

Post on: 16 Март, 2015 No Comment

The law of compounding tells us that the earlier you start saving, the more you will have when retirement arrives. So it makes financial sense to begin savings as early as possible. For those who just get their first full-time job (likely in your early 20s) and ready to save, there is often the decision between picking a company-sponsored 401(k) plan or Roth IRA.

Heisenberg Media / Flickr source

How do you decide where to put your retirement savings? Is a 401(k) or a Roth IRA better when you’re young?

Employer-matches come first

When choosing between a 401(k) and a Roth IRA, you first want to consider whether or not your employer offers matching contributions. A matching contribution is essentially free money and you should take advantage of it. Not doing so is one of the mistakes you can make when savings for retirement.

It would be wise to invest at least the maximum amount that your employer will match before you make contributions to any other retirement plans.

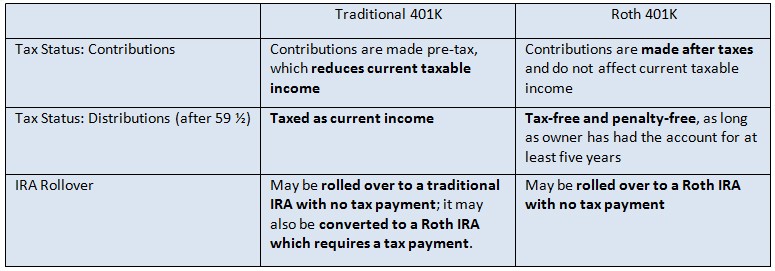

(When you take distributions from a 401(k) plan during retirement, you will owe taxes, but your contributions are tax-deductible.)

Other benefits of a 401(k) plan

A 401(k) plan also offers a way for account owners to borrow some of their own money without paying early withdrawal penalties. If your 401(k) plan administrator allows loans, you can borrow from your retirement savings.

Loans from 401(k) plans are not typically recommended, since the reduced balance of the account will result in less earnings over time. However, it remains an option in the event of a financial emergency.

When you make loan repayments, you’re paying yourself back (with interest). If you leave the company, you will have to repay the full balance of the loan or else it will be considered an early distribution from a retirement plan and you’ll have to pay income tax on the amount withdrawn and a 10 percent penalty.

Roth IRA for rising tax rates

Roth IRA contributions, unlike traditional IRA contribution s, are made through after-tax dollars you withdraw the money tax-free. If you believe you are in a low tax bracket when you were in your 20s compared to your retirement years, it makes sense to save the majority of your retirement savings in a Roth IRA.

For most young people in the early stages of their careers, this happens to be their situation.

But, always start with a 401(k) plan if the employer matches your contributions, and contribute just enough to get the matching contribution (free money!) but then the rest of your retirement savings can be saved in a Roth IRA.

You’ll pay less in taxes if you belong to a lower tax bracket and avoid taxes when your tax rates rise.

Other benefits of a Roth IRA

Starting a Roth IRA in your 20s means you could potentially have a few thousand dollars saved by the time you are thinking about buying your first house. You can withdraw up to $10,000 from a Roth IRA without a 10% early withdrawal penalty if the money is used for the purchase of your first house. You have to open your Roth IRA at least five years before you intend to use money from the account toward a home purchase to qualify for the penalty-free early withdrawal.

Because you make contributions to a Roth IRA with after-tax dollars, you can take withdrawals on your original contribution amount for any reason and at any age without paying taxes or penalties. But you cannot take any of the investment earnings the Roth IRA has earned without a 10 percent early withdrawal penalty.

Related Stories: