4 Passive Portfolios For The Lazy Investor

Post on: 31 Май, 2015 No Comment

Using ETFs and mutual funds to build a portfolio is nothing new, and for many, it is a tried and true method for generating moderate returns for the long haul without the typical investment of time. The simplicity and ease is attractive to many investors.

1. The Traditional Retirement Portfolio

I won’t spend much time on this, for obvious reasons. The traditional retirement portfolio is that your stock allocation should be 100 minus your age, and the rest should be in bonds.

For example, a 25-year-old would have 75% in a stock market ETF and 25% in a bonds ETF. Every year, this would change slightly. At 30, he would have 70% in stocks and 30% in bonds. This allows him to take greater risks as a younger man and fewer risks as he gets older.

2. The 50-50 Portfolio

Quite a bit of research has shown this incredibly simple approach is actually extremely stable over time. A Vanguard study, as reported by the New York Times. found that over the last century, such a strategy actually would have led to roughly the same basic results regardless of whether one was in a recession or not.

It’s fairly conservative, of course. The after-inflation gains are about 5% per year, and those are actually great returns. The average investor should be happy with basic returns like this, though the more savvy investor might want to use a different strategy to get better returns.

3. The Permanent Portfolio

I’ve written in the past about the permanent portfolio. Similar to the above 50-50 strategy, it’s actually 25-25-25-25. The four assets are stock market index fund, long-term bond index fund, short-term treasury bill fund, and gold. It’s greatly outperformed the stock market since the 70s, and the last time the portfolio lost money during a year was in 1994. Not bad.

It is, however, a very low-return portfolio for whenever there’s an equity bull market, and there will be a huge temptation to dump it for more stocks. But for people with self-control, this is a nice boring strategy that is more about how much you’re willing to add to it regularly over time than anything else.

4. Gone-Fishin’ Portfolio

I stumbled across this about a year ago, and haven’t attempted to replicate it, but it seems extremely diversified for investors looking to hedge risks and focus on building profits through frugality and savings rather than increased risks. The portfolio is as follows:

- US Equities 30%

- International Equities 20%

- Emerging Markets 10%

- REIT 5%

- Commodities 5%

- Fixed Income 30%

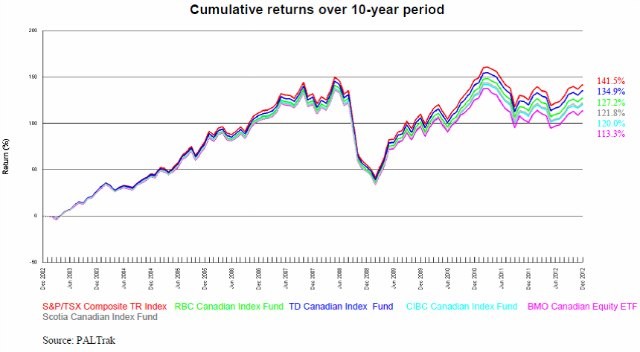

You can see some of the returns here. mostly on the basis of when you decide to rebalance.

Overall, the strategy one uses is completely dependent on the goal’s, personality, and risk tolerance of the investor. For some, the permanent portfolio is best, and for others, the 50-50 is best, and for others, the more traditional allocation is best.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.