3 Reasons to Own Gold That Will Shock You

Post on: 1 Апрель, 2015 No Comment

by David Engstrom October 10, 2014

Share this

This year, as the markets surged to record highs, the perception of gold as an investment has changed. The views shared are many and often based more on emotion than actual market data. Perceptions vary widely between those who own gold and those who do not. What is your perception of gold as an investment? Whether you currently own gold or are still considering it, you will be shocked to learn the top 3 reasons to own gold in todays markets.

Reason #1 Growing Money Supply

Its a fact of life. Money supply has to increase in order to maintain the ability to service rising debt. Consider your own household. If debt rose faster than your income (money supply) you would eventually reach a point where you could no longer pay your bills.

Another fact of life is that gold prices rise along with the money supply. Why? Because you cannot create gold out of thin air. The supply of gold is finite and strictly limited to how much physical gold can be pulled out of the ground.

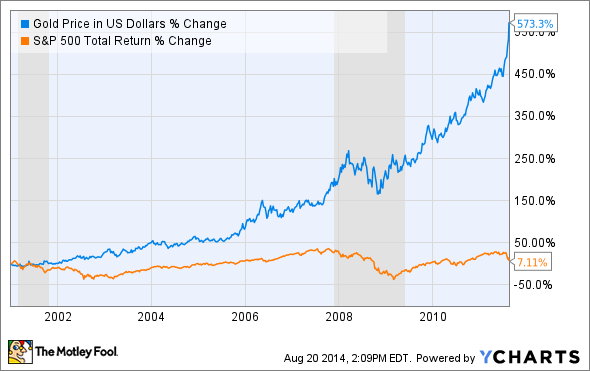

Prepare to be shocked. Since year 2000, a time when we actually had a budget surplus of $237 billion dollars, the monetary base, (supply of currency that circulates throughout the economy) has risen by 591%. Money supply has grown three times faster than debt! Even based on todays low price, gold has increased 371% during the same period 2000 to present.

By 2018, money supply is projected to grow to 1328% of year 2000 levels. If the price of gold paces the increase in money supply, that puts an ounce of gold at $2385 nearly double what it is today.

Reason #2 Shrinking Supply

In 1933, in the throes of the Great Depression, Gold ownership was made illegal. It was deemed government needed the gold more than its citizens and gold held by individuals was confiscated. Once government completed its gold harvest, Gold was revalued from $20 an ounce to $35 an ounce. This created a windfall opportunity for Gold Miners and production soared. Within 10 years or so, annual production more than doubled, rising from a mere 600 tons to 1300 tons.

By the early 70s, annual gold production, reached 1500 tons but tailed dramatically as the cost of mining began to outweigh the benefit. The gold price had not risen in more than 30 years. In 1972 that changed. President Nixon once again legalized gold ownership and by August 1974 individuals began buying gold near the $150 per ounce level. Production, previously in decline stabilized near the 1200 ton level in anticipation of rising demand.

In 1980 gold took center stage in the investing world and for a variety of reasons, rose to $850 an ounce. Miners once again saw the opportunity for big profit and began to ramp up production. As production levels skyrocketed the gold price plummeted. By 1999 mines were churning out 2600 tons of gold. In 2001 mine production reached an all-time high and the gold price fell to a low of $256 an ounce.

2002 would prove to be the beginning of a new era. It was in this year that China made it legal for its citizens to own gold. This time, however, miners could not respond to the call. The low-hanging fruit had been picked and mining costs were soaring. The gold bull market was now reborn.

By 2008, mine production fell to a 13 year low of 2409 tons and the gold price reached a record nominal high of $947 an ounce. In 2009, miners were able to boost production to 2584 tons. And while the production shortfall to demand dropped from 1397 tons in 2008 to just 909 tons in in 2009, this wasnt nearly enough. There was a new player in the game. For the first time in over 20 years, Central Banks became net buyers of gold. In the decade leading up to 2009, Central Banks had dumped more than 4000 tons of gold on the market. Now, they wanted it back.

By 2013, the production to demand shortfall more than doubled 2009 levels, reaching 1890 tons. With all the latest mining technology, miners are barely able to produce as much new gold as they did 15 years ago. Only because there was a mysterious outflow of 900 tons of gold from ETFs, did the gold price drop. By the end of 2013 the gold price fell to $1180 an ounce, still markedly higher than the 2009 highs.

The growing and massive shortfall of gold production to demand has many experts suspicious. Throughout history, the value of gold has risen and fallen in direct correlation to production and demand. Suspicion revolves around the reported gold supply. It is believed that world gold supplies are nearly gone. Central banks, motivated by the desire to buy back all the gold it sold, are believed to be making unreported gold purchases. Very large purchases. Surely, if the world knew central banks were buying more gold than reported, the gold price would skyrocket.

This brings to question, why do central banks want more gold? There are many answers but just one simple one. The world is awash in debt. Banks know that todays debt will be paid back in currency that is worth far less in the future. Throughout history gold has been the great equalizer, a hedge against inflation and financial uncertainty. It is the only tangible asset that has a 5000 year history of being an effective store of wealth.

While reports of declining gold demand is driving the gold price down, evidence to the contrary is mounting. It suggests gold demand may be far greater than what is being reported. If demand is truly as high as some suspect, that means supply is vanishing before our eyes. Prepare to be shocked as you weigh the evidence for yourself. Stories of missing gold appeared on these dates: (See links at end)

- May 27, 2011 230 Tons of Gold Missing From IMF

- January 16, 2013 Germanys Request to Repatriate 300 tons of Gold From U.S. Denied

- April 9. 2013 Comex Gold Inventories Collapse By Largest Amount Ever

- 8/10/2013 1200 tons of gold missing from Bank of England

- 1/24/14 Record One-Day Withdrawal of Gold from JP Morgan

- March 18, 2014 500 Tons Gold Missing From Global Market

There is overwhelming evidence that gold demand is far greater than that reported in the mainstream. If the evidence holds, the implications are staggering. Eric Sprott of Sprott Asset Management, questions whether Western Central Banks have any gold left. Sprott warns that Gold has moved from the West to the East with much of the Wests former holdings now in the hands of China, Russia and India. Both China and Russia have made it clear they want the U.S Dollar replaced as the worlds reserve currency.

Remember the Golden Rule. He who holds the Gold makes the rule. If word gets out the West has indeed divested itself of Gold, the dollar is defenseless. Its value would collapse. How could word get out? Any time now, China is expected to release its report on official gold reserves. If Chinas reserves have risen enough to account for most or all of the missing gold, that would prove major amounts of gold have been depleted and migrated from West to East.

Reason #3 The 98 Percent Rule Puts Todays Gold Price at $2551/oz. and Rising

Decades of data show the price of gold has risen in direct correlation to debt as well as money supply. As debt rises our dollar value decreases and Gold serves to balance the scale, preserving wealth and purchasing power.

Since the creation of the Federal Reserve in 1913:

- Our national debt has risen 595,100%;

- Our Dollar has lost 96% of its purchasing power;

- Debt per man, woman and child has risen from $30 to $55,975: and

- Our true debt, including unfunded liabilities, has risen to $115 trillion dollars.

It was 1975 when national debt began to skyrocket and gold prices began to rise in an 86% correlation to debt. By 1999 that correlation tightened to 98%. By this measure, gold should be trading today at $2551 per ounce.

Once the veil of secrecy is lifted from the gold supply picture now painted, the gold market will be free to trade in accordance with true data. The gold supply has been diminished, money supply is rapidly expanding and true debt is quickly rising to a point where we will soon be borrowing money to pay just the interest.

When China reveals its official gold holdings, the world will be shocked. Gold is sitting on a powder keg and the fuse is lit. With gold currently selling at or below its all-in cost of production, the consensus amongst experts is that todays gold is underappreciated, undervalued and the price is ready to blow sky high.

Resources

May 27, 2011 230 Tons of Gold Missing From IMF

January 16, 2013 Germanys Request to Repatriate 300 tons of Gold From U.S. Denied