25 Ways to Invest in Gold with ETFs in 2014 Yahoo Finance Canada

Post on: 28 Март, 2015 No Comment

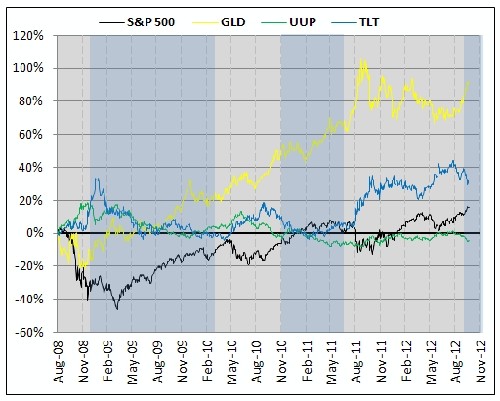

Over the last few years, gold has become one of the most polarizing assets in the investing world. After surging to new highs in mid 2011, the precious metal had investors and analysts alike clamoring for more gains. The commodity suffered a correction in 2013, finally ending a 12-year bull-run while invoking the interest of many who hope to time the bottom. For those looking to invest in gold, we outline 25 ETFs that take varying approaches to the metal and help you add gold exposure to your portfolio [for more gold ETF news and analysis subscribe to our free newsletter ].

Physically-Backed

Without a doubt, the physical gold ETF space is the most popular, making up tens of billions in total assets. There are currently four gold ETFs that represent a physical gold investment:

- SPDR Gold Trust (GLD, A- ): By far the most popular gold ETF, this fund represents approximately one-tenth the price of an ounce of gold. GLD is the most actively traded ETF and comes with a strong options market.

- COMEX Gold Trust (IAU, A ): This fund represents one-hundredth of an ounce of gold, making it more accessible to those with low capital bases. IAU attempts to beat out GLD by charging 15 basis points less for investment.

- Physical Swiss Gold Shares (SGOL, A+ ): Debuting in 2009, SGOL differentiates itself by holding its physical bullion in a vault in Zurich, Switzerland. This fund may be appropriate for those who feel that the holdings in Switzerland are safer and less likely to be impacted by any kind of U.S. policy surrounding gold, or attacks on New York and London (where GLD and IAU hold their gold).

- Physical Asian Gold Shares (AGOL, B- ): AGOL also holds physical gold but stores all of its bullion in vaults in Singapore.

Futures-Based

For those who prefer to play gold via futures markets, there are two options currently on the market.

- DB Gold Fund (DGL, B+ ): DGL made its way to the market in 2007 and tracks gold-utilizing front-month futures contracts. Note that as an ETF this futures-based product will issue a K-1.

- E-TRACS UBS Bloomberg CMCI Gold ETN (UBG, B- ): UBG uses a near-identical methodology as DGL, but because it is an ETN investors will be issued a 1099 rather than a K-1; 1099s are typically less of a headache come tax season.

Leveraged/Inverse

For traders and anyone looking to make a big speculative bet, there are a handful of products that apply leverage and inverse strategies to this commodity:

- 3x Inverse Gold ETN (DGLD, B ): For the true gold bears, this fund uses gold futures to employ a -300% leverage.

- DB Gold Double Long ETN (DGP, B ): Utilizing gold futures and 3-month T-bills, DGP offers a 200% leverage on gold.

- DB Gold Short ETN (DGZ, A ): DGZ also invests in gold futures and 3-month T-bills, but is an inverse product, or -100% leverage.

- DB Gold Double Short ETN (DZZ, A ): DGP’s bear component, DZZ uses the same strategy but offers a -200% leverage.

- UltraShort Gold (GLL, A- ): GLL is designed to reflect -200% of the performance of gold bullion.

- Ultra Gold (UGL, B+ ): UGL is the bull counterpart to GLL as it offers a 200% leverage on gold bullion.

- 3x Long Gold ETN (UGLD, C ): Using futures contracts, UGLD grants investors a 300% leverage on gold.

Alternative

There are two ETFs in particular that offer unique spins on gold investing that are found nowhere else on the market:

- Gold Shares Covered Call ETN (GLDI, n/a ): This ETN launched in early 2013 and offers a covered call strategy using options and shares of GLD.

- Gold Trendpilot ETN (TBAR, A- ): This fund oscillates between investing in gold bullion and 3-month T-bills based on a simple historical moving average basis.

*GLDI’s performance since inception on 1/29/2013.

Large Cap Gold Miners

Gold miners are another way to make a play on gold. Note that these companies typically have a high beta and are sometimes considered a leveraged play on gold itself.

- Daily Gold Miners Bear 3x Shares (DUST, B ): This ETN grants a -300% exposure to gold mining equities.

- Market Vectors TR Gold Miners (GDX, B+ ): Easily the most popular mining ETF, GDX focuses on the largest gold miners across the world.

- Daily Gold Miners Bull 3x Shares (NUGT, B- ): The bull partner to DUST, this fund offers a 300% leverage on gold mining equities.

- Global Gold and Precious Metals Portfolio (PSAU, C+ ): This fund invests in companies all around the world that are involved in gold mining but also those involved in mining the remaining three precious metals: palladium, platinum and silver.

- iShares MSCI Global Gold Miners ETF (RING, B ): This fund invests in gold miners all around the world but excludes those that hedge gold prices.

Junior Gold Miners

The small-cap gold mining space, known as “junior” miners, has taken off in recent years, now with four ETFs to choose from:

- Market Vectors Junior Gold Miners ETF (GDXJ, B+ ): With over $1 billion in assets, GDXJ has proven that its small-cap holdings have resonated well with investors.

- Pure Gold Miners ETF (GGGG, C ): A number of the world’s largest gold miners still derive a decent portion of their revenues from the mining of other metals. GGGG focuses only on those who see a majority of their operations focused on gold, giving it a more small-cap slant.

- Daily Junior Gold Miners Index Bear 3x Shares (JDST, n/a ): For those who can stomach a fair amount of volatility, this fund applies a -300% exposure to junior gold miners.

- Daily Junior Gold Miners Index Bull 3x Shares (JNUG, n/a ): The bull counterpart to JDST, this fund applies a 300% leverage to junior gold miners.

*JDST and JNUG’s performances since inception on 10/3/2013.

Gold Explorers

There is currently one ETF dedicated to the exploration and finding of gold, as opposed to mining it and extracting it from the ground:

- Gold Explorers ETF (GLDX, B- ): This fund debuted in late 2010 and is focused on gold explorers from all over the world.

Follow me on Twitter @JaredCummans .

[For more ETF analysis, make sure to sign up for our free ETF newsletter ]

Disclosure: No positions at time of writing.