2012’S worst performing sector will be 2013’s best

Post on: 2 Июль, 2015 No Comment

Money Morning

IN THIS ISSUE:

- Go long and hang on before this sector rallies in 2013

- The one never to be repeated buying opportunity

- Profit as the sector with the fastest earnings growth on the JSE rewards investors

Dear MoneyMorning Reader,

2012s worst performing sector was driven by fearful investors.

Investors fled this sector in fear of an economic slowdown, a hard landing from China and the looming US Fiscal Cliff.

And the round of strikes that plagued the sector for around two months, earlier this year, sent stocks even lower.

This sell off was not based on the fundamentals of the sector, which is why I believe now is the best time to buy into this sector on the cheap.

In fact, certain stocks in this sector are trading at less than they were five years ago. And this presents a great time to buy into this sector before it rallies higher.

So what is this sector?

Have you noticed how some people always seem to have more money than others?

They dont necessarily have better jobs. Nor do they always earn more money.

They just have more money.

But where. How. Did they get it? Whats their secret?

Thats why Im writing to you today. Discover the secrets the rich use to make wealth-building a regular and central part of their lives. What they do to generate wealth automatically, habitually. Without even thinking about it.

The resource sectors five-year low gives you a buying opportunity never to be repeated

The resource sector is the least loved of all sectors on the JSE right now. Its been sold down to prices last seen at the end of 2007.

And the best part is many blue chip resource stocks are trading at prices lower than they did five years ago:

Anglo Platinum is 15% lower,

Anglo American is 11% lower,

Impala Platinum is 7% lower and

Stocks like Harmony Gold, Gold Fields and Anglogold Ashanti are all

trading around the same level they were five years ago.

But why am I so confident these stocks will rally higher in 2013 and not continue to fall?

Its because the fundamentals for the sector paint an entirely different picture.

Steal Your Retirement: A Fed-up Unconventional Millionaires Revolutionary Blueprint for Getting the Retirement We Were Promised (without lifting a finger)

Whether youre 30, 40, 50 or even 60, no-one likes to THINK ABOUT RETIREMENT. But the fact is, the closer you get to it, the more you worry about it

The bad news is, if youre counting on giant institutions (like your financial adviser, your broker and insurance companies) to take care of your money. Good luck.

I think youre in for a rude awakening.

The good news, however, is that if youre willing to take off the blinders of institutional thinking, you can (legally) steal back your retirement, no matter what your current situation.

In short: Im talking about how to get the retirement we were promised, and deserve, without doing any extra work or taking big risks.

Profit as the sector with the fastest earnings growth on the JSE rewards investors

If you look at the fundamentals of the resource sector, youll see its been the best performing sector when looking at earnings growth over the past five years.

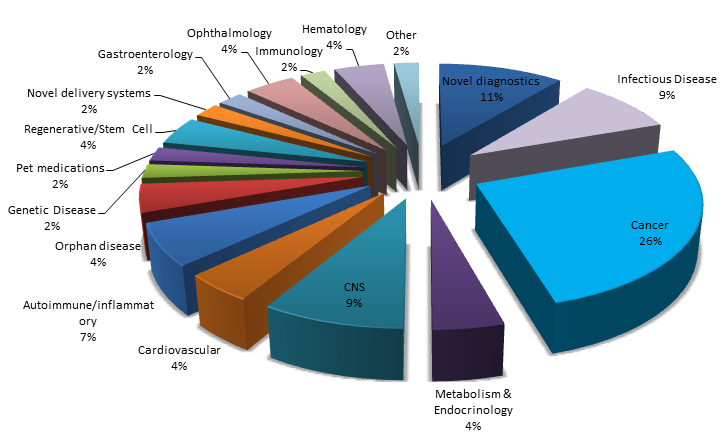

The chart below shows this perfectly.

Source: Cannon Asset Managers

The resource sector has had earnings growth, since 2007, of 100% followed by the second best sector Large Cap Industrials (Globally Owned) with around 80%, then Financials with around 55% and Domestically Owned Industrials with around 40%.

As you know, a stocks price follows its earnings over the long-term, so theres been a major underperformance from the resource sector.

And when you add the strong and increasing demand for resources and commodities thatll come from faster global economic growth, massive infrastructure projects, rising inflation and growing populations, theres only one way for resource stocks to go in 2013

And thats up!

The resource stocks you should invest in are the ones that supply what the world needs most especially ones with contracts to supply foreign markets.

But, not all stocks in the resource sector present great profit opportunities.

Thats why I recommend you take a look at my colleague Francois Jouberts Resource and Scarcity Report. Hes FSP Invests resident resources expert.

In his Resource and Scarcity Report Francois will help you find the best stocks to profit from in the resource space. To find out what resource stock Francois believes will deliver your portfolio great profits in 2013 make sure you get your hands on the December issue of the Resource and Scarcity Report now.

Until next time,

20Templates/Finance/Finance/New%20Templates/MMO/2012/December%202012/Gav%20Sig%20small.jpg /%

Gavin Fourie