10 For 13 Emerging Markets ETFs For 2013 Credicorp Ltd (NYSE BAP) iShares MSCI Emerging Index

Post on: 26 Апрель, 2015 No Comment

With 2013 finally here, reflecting back on the year that was for exchange-traded products can provide investors with some clues regarding what themes and trends will be hot this year. This is not a bold prediction, but it is reasonable to expect one of 2012’s hottest asset classes to stand tall again in 2013.

The asset class being referred to is emerging markets ETFs, both bonds and equity-based funds. While the final tally for 2012 ETF inflows has not yet been published, it is worth noting that emerging markets bond ETFs had hauled in $5.4 billion through the end of November.

In November alone, diversified equity-based emerging markets ETFs such as the iShares MSCI Emerging Markets Index Fund (NYSE: EEM ) raked in $1.8 billion in new capital, according to Morningstar data.

With the outlook, a bullish one at that, for emerging markets debt ETFs in 2013 having been previously highlighted. it is time to focus on which equity-based ETFs could present the best opportunities for investors looking to gain exposure to the developing world in 2013.

There are few things about this list to keep in mind. First, no fixed income funds are featured here. Second, only 10 country-specific ETFs will be featured here, in no particular order, but the universe of emerging markets funds is obviously many times larger. Third, given the sheer size of the emerging markets ETF universe, these are not the only funds that will be worth trading or investing in this year.

iShares MSCI Brazil Index Fund (NYSE: EWZ ) A quick recap of EWZ’s 2012 performance would go like this: The largest ETF tracking Latin America’s largest economy was, quite simply, one of the year’s biggest emerging markets disappointments .

Coming off a year in which the fund tumbled 6.3 percent and was sharply outpaced by its small-cap equivalents. EWZ showed some signs of life in the last month of 2012, gaining 8.5 percent.

Just as EWZ’s 2012 misfortunes are easy to explain, so is the 2013 outlook for this fund. Brazil’s GDP has been shocking paltry in recent quarters. For the third quarter it was just 0.6 percent. That is not what investors are accustomed to emerging markets A smart investor is apt to wonder why it is worth taking the risk on an ETF with a beta of almost 1.8 against the S&P 500 when the U.S. is offering far superior GDP growth.

Bottom line: EWZ can offer investors a positive reversal of fortune in 2013, but the stars need to align properly for that to happen. Economic growth must improve, the Rousseff Administration must show foreign investors that Brazil is not as politically risky as it appeared in 2012 and Petrobras (NYSE: PBR ), EWZ’s largest holding, must cease being the laggard among global integrated oil stocks.

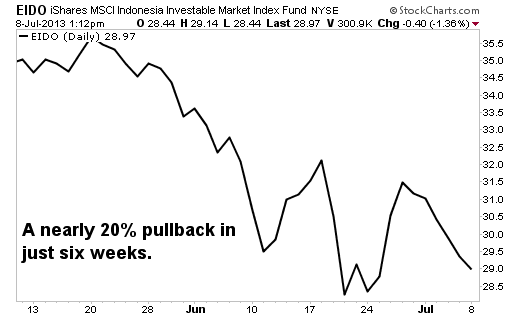

Market Vectors Indonesia ETF (NYSE: IDX ) From one 2012 disappointment in EWZ to another in IDX. The oldest Indonesia ETF lost just 1.6 percent last year, but that performance is woeful compared to the returns offered by other ETFs tracking Southeast Asian nations such as the country-specific funds for the Philippines and Thailand.

With 2012 in the books, investors will be looking to see if IDX offers potential for a significant rebound in 2013. In fact, it does. Indonesia is Southeast Asia’s largest economy and the fourth-largest country in the world by population. Those factoids do not mean IDX should rise (or fall), but it is worth noting profits are increasing at large-cap Indonesian firms J.P. Morgan is sounding a bullish tone on the country .

What is crucial to the Indonesian investment thesis is that foreign investors take a proper view of the country. Meaning they must recognize that the country is not as export-dependent as many outsiders think it is. Indeed, exports account for 20 percent of GDP, but Indonesia is arguably the envy of much of the developing world because its consumers driver 60 percent of GDP.

The government expects 2012 GDP growth of 6.5 percent while the World Bank is forecasting 6.3 percent growth in 2013. A look at IDX’s sector lineup. which includes a 12.8 percent weight to staples names, shows the ETF is intimately levered to the Indonesian consumer story.

iShares MSCI Philippines Investable Market Index Fund (NYSE: EPHE ) From a Southeast Asian disappointment in IDX to one of 2012’s shining starts in the iShares MSCI Philippines Investable Market Index Fund. EPHE was not only one of the region’s best-performing ETFs last year, it was one of the best among all emerging markets funds with a gain of almost 44 percent. A 44 percent surge in one year obviously begs the question can it happen again the following year?

Obviously, asking for a repeat of a 44 percent gain is asking a lot, so investors might do well to temper their expectations with EPHE in 2013. However, that does not mean the ETF will not impress again. Actually, the catalysts are in place for another strong year for EPHE .

Those catalysts include soaring GDP growth (7.1 percent in the third quarter, topping estimates of 5.4 percent) and a push for an investment-grade credit rating the Philippine government is far from shy about. Should the country’s economy continue on its current pace, it is unlikely that even slow-moving ratings agencies will let the country’s sovereign rating languish in junk territory much beyond the second quarter.

Another important factor to remember about EPHE and the Philippines is that, as Benzinga reported in January 2012. the country is not intimately dependent on exports to China to drive its economic growth. As the top business process outsourcing destination and the call center capital of the world, the Philippine economy is far less export-dependent than many think it is.

There are risks, though. The Philippines is home to rampant poverty and over-population. Those are cautionary tales on their own, but a reputation for corruption and graft presents an issue when it comes to attracting foreign direct investment.

WisdomTree India Earnings ETF (NYSE: EPI ) As has been noted. 2012 was a wild year for Indian equities and the ETFs that track them. EPI finished the year with a 18.5 percent gain, which is arguably somewhat deceiving given a nasty decline that saw the fund slide from around $21.60 in late February to $15.60 in early June.

There are reasons to be cautiously optimistic regarding what 2013 has in store for EPI and other India ETFs. The government has taken steps to bolster the economy. including reducing diesel subsidies and opening India’s retail sector to more foreign investment. Inflation, perhaps the biggest stumbling block for the Indian economy over the past several years, is moderating a bit and that could give the Reserve Bank of India room to cut interest rates later this month .

An interest rate cut should be supportive of India large-cap ETFs because these funds are typically heavy on bank stocks and cyclical sectors. EPI, for example, allocates a combined 39 percent of its weight to financial services and materials names.

Still, Indian policymakers are carrying heavy burdens going into 2013. Inflation must be reduced, the country must keep hold of its investment-grade credit rating and domestic infrastructure must finally be improved.

iShares MSCI All Peru Capped Index Fund (NYSE: EPU ) There are multiple ways of interpreting some of Peru’s latest economic data points. The Andean nation showed economic growth of 6.71 percent in October 2012 compared with October 2011, but that is down 1.2 percent from September 2012. Still, there is no debating the fact this South America’s fastest-growing economy with expected 2013 GDP growth of seven percent .

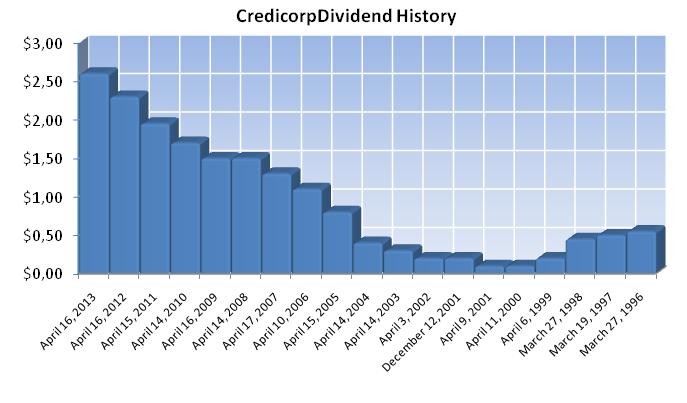

Given that Peru is one of the world’s largest producers of copper, gold and silver, EPU is often viewed as a materials play. It is that with a weight of 51.5 percent to that sector, but there is more to the story. Financials account for almost 27 percent of EPU’s and that is a good thing because Peruvian banks are flourishing. Bank lending in Peru could rise by as much as 18 percent this year .

Impressively, Peruvian banks increased lending in 2012 with nary a bump regarding non-peforming loans. As one example, Credicorp (NYSE: BAP ), EPU’s largest holding with a weight of almost 21 percent, had a non-performing loan ratio of just 2.34 percent at the end of the second quarter of 2012. Generally, an acceptable NPL ratio is in the area of five percent. At the end of November, the NPL ratio among private Peruvian banks was a stellar 1.79 percent .

On a related note, Peru’s central bank lifted reserve requirements four times last year in an effort to keep inflation tame. The outlook for 2013 is generally positive, but EPU returned almost 24 percent last year, leaving investors to wonder if a sequel is possible. More upside is possible though Peru will need at least two of the following three factors to work in its favor: Continued improvement in the Chinese economy, the same thing in the U.S. and any type of positive economic momentum out of the eurozone.

iShares MSCI Thailand Investable Market Index Fund (NYSE: THD ) Like so many of the other ETFs on this list, the iShares MSCI Thailand Investable Market Index Fund is coming off a 2012 run that leaves investors to wonder if similar feats can be repeated in 2013. A 2012 gain of 33.5 percent and closing the year at an all-time high will do that.

The simple answer regarding THD’s 2013 fortunes is that a negative performance would represent a break from what is becoming a long-term uptrend. Since the March 2009 market bottom, THD has been one of the best-performing ETFs of any stripe and the fund has nearly quadrupled. Of course, past performance is no guarantee of future returns, but the Thai economy is well-positioned to start the new year.

The country is expected to see GDP growth of 5.2 percent this year and is sitting on a streak of 56 consecutive quarters of growth, according to Investor’s Business Daily. Like the Philippines, Thailand has a debt-to-GDP ratio that would make a developed market blush, in this case under 42 percent.

Inflation is a concern, particularly after the December report showed an increase to 3.63 from 2.74 percent in November. That leaves the Bank of Thailand without much wiggle room to lower interest rates.

That leads into the primary issue regarding THD’s continued bullishness this year. The Thai economy is export-driven and any slowdown in the global economy can weigh on Thailand. If inflation jumps while exports fall, the Bank of Thailand may not be able to cut rates. On the other hand, Thai stocks are resting at 16-year highs and international investors more than tripled their purchases of Thai equities in December from November.

Regarding THD, from 2009 through today, it can be said that every significant pullback endured by the ETF has represented a buying opportunity. With most signs pointing to another strong year for the Thai economy, THD’s pullbacks may be few and far between this year.

Market Vectors Egypt Index ETF (NYSE: EGPT ) This is how strong the Market Vectors Egypt Index ETF was in 2012: The ETF posted a gain of 32 percent despite falling 14.5 percent in the last three months of the year. For much of 2012 EGPT fought of an array of negative headlines out of Egypt ranging from bloody protests in Cairo to tensions in other Middle East nations to a new political regime that appears hardly more pleasant than the one it replaced.

What EGPT’s performance over the last few months of 2012 says is that the ETF was likely bid higher on optimism that Egyptian President Mohammed Morsi would be usher in a new era for Egyptian politics and economics. To this point, that has not been the case.

Morsi has not been a friend of business and nterference by the Morsi administration could impact foreign direct investment and plague Egypt’s domestically-focused economy, one that is already suffering from rampant poverty and high unemployment. Speaking of, Egypt has an unemployment rate of about 12 percent. but that number doubles for the nation’s young people. Investors’ patience with Egypt may be wearing thin making EGPT a sell if it falls below support at $12.

iShares MSCI Malaysia Index Fund (NYSE: EWM ) With a 2012 gain of 12.5 percent, the iShares MSCI Malaysia Index Fund appears to be somewhat of an emerging markets laggard, particularly as far as ETFs tracking Southeast Asian nations go. That does not mean EWM is not worth a look in 2013. Actually, the opposite is true.

This year is an election year in Malaysia and Prime Minister Najib Razak, the incumbent, and his Barisan Nasional coalition are facing what is expected to be one of Malaysia’s most hotly contested elections.

So what is a politician to do when he wants to retain office? Open up the government coffers to stimulate the economy. That is what Razak is trying to do with the $444 billion Economic Transformation Program, which is aimed at bolstering domestic consumption and reducing poverty. However, there may be limits to the government largess. The government does not want to exceed a debt-to-GDP level of 55 percent, but with the number currently in the 53 percent to 54 percent area, the spending to win elections scenario may be put to the test this year in Malaysia.

Note two interesting factors about EWM. It has a trailing 12-month yield of 3.66 percent and a beta of just 0.57 against the S&P 500, according to iShares data .

iShares MSCI Mexico Investable Market Index Fund (NYSE: EWW ) The iShares MSCI Mexico Investable Market Index Fund was one of the juggernauts among Latin American ETFs in 2012 with a gain of 27.5 percent. There are reasons why EWW’s uptrend can continue, though the most prominent one is how much the U.S. economy improves.

EWW and the Mexican economy have already been benefiting from an influx of manufacturing jobs from China. Rising wages in China have sent some manufacturing jobs to Mexico and due to higher fuel prices, some U.S. firms have favored production of goods in Mexico over China due to the former’s proximity to the U.S.

Key to EWW’s outlook is how much recently passed labor reforms will immediately impact the Mexican economy. Mexico has had issues with poor job creation and high unemployment in the past, but efforts to improve the domestic economy could mean a boost to domestic consumption. That could be a potential catalyst for EWW, which allocates more than 38 percent of its combined weight to staples and discretionary names.

SPDR S&P China ETF (NYSE: GXC ) This list probably would not be complete without at least one China ETF and the inclusion of such a fund is made all the more necessary by the impressive performances notched by many China funds over the last few months of 2012.

For much of 2012, China ETFs provided investors with frustration as market participants debated the ability of policymakers in Beijing to engineer a soft landing for the world’s second-largest economy. Slowing growth, dividend cuts by Chinese banks (financial services are often excessively weighted in China ETFs), geopolitical controversies and negative headlines regarding some Chinese small-caps were among the issues to confound investors looking for China exposure.

China’s new leader, Xi Jinping, is working to improve confidence in the Chinese economy and his efforts are being helped by a spate of positive economic data to close 2012 that shows China is in turnaround mode.

The subsequent ebullience helped lift the iShares FTSE China 25 Index Fund (NYSE: FXI ), the largest China ETF by assets, to a 15.8 percent gain over the last three months of 2012. That might leave some wondering why GXC should be picked over FXI. Fair question, but over the past year, two years and five years, GXC has consistently (and easily) outperformed FXI. GXC has also been consistently less volatile than FXI over longer time frames.

Not only that, by GXC is home to 220 stocks, nearly 8.5 times as many as FXI. Like FXI, GXC’s top sector weight is financials at 34.7 percent, but that is far lower than the 57.5 percent FXI allocates to the same sector.

The good news is that on a valuation basis, Chinese ETFs still look inexpensive relative to the broader emerging markets universe. FXI has a P/E ratio of 12.89 and a price-to-book ratio 1.61, according to iShares data. GXC is slightly cheaper with a P/E ratio of 10.9 and a price-to-book ratio of 1.55.

For more on ETFs, click here .

2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.