Zerodha SPAN CalculatorZConnect by Zerodha

Post on: 2 Июль, 2015 No Comment

Traders,

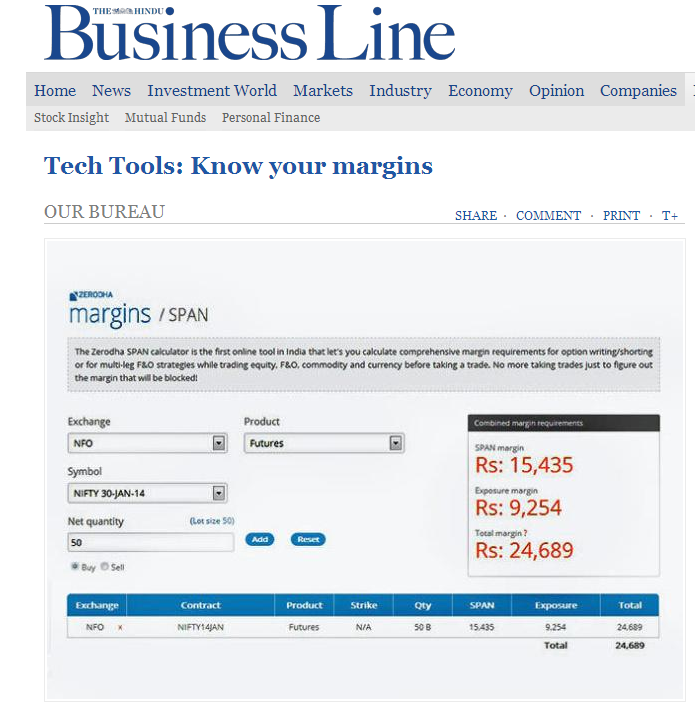

Zerodha SPAN Calculator part of our initiative Zerodha Margins is the first online tool in India that lets you calculate comprehensive margin requirements for option writing/shorting, futures and multi-leg F&O strategies when trading equity, F&O, Currency and Commodity on NSE and MCX respectively.

Zerodha SPAN will ensure that you never have the following queries again

- Margin benefit you get for taking calendar spreads (taking opposite positions on different expiry of the same contract)

- Option writing margins

- Margin benefit for various multi-leg option strategies like iron condors, straddles, strangles and more

The following post explains various ways in which SPAN can be used,

For Future Margin Requirements

See the example below for Nifty November futures margin requirement.

Total Margin = SPAN + Exposure

Total Margin is the margin required to hold the position overnight or also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

Zerodha SPAN for Futures Margin

For Calendar Spreads

Calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring a particular date and sale of the same instrument expiring another date or vice versa. Since the position is completely hedged there is a margin benefit for the combined position, as shown in the example below for a calendar spread between Nifty Nov and Nifty Dec futures.

Total Margin is the margin required to hold the position overnight also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

Zerodha SPAN for Calendar Spreads

For Option Writing/Shorting Margin Requirement

When you write options the margin required varies based on the underlying, volatility, expiry and more. Until now there was no other online tool that could tell you the margins required before taking a trade, very important for an active option trader.

The example below shows the margin required for shorting 1 lot of Nifty 6000 Dec Calls. Do note that you need to click on Sell after entering the net quantity if you want to see the option writing margin requirement.

Total Margin = SPAN + Exposure

Total Margin is the margin required to hold the position overnight also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

Premium Receivable?

When you write/short options the premium that you receive gets credited to your trading account immediately after taking a trade. Zerodha SPAN calculates this premium received based on closing price of premium from the previous day.

So in the example below, the margin required to write/short 1 lot of Nifty 6000 calls is Rs 31,625, but as soon as you take this position Rs 13,370 is credited to your trading account effectively blocking only around Rs 18,300 for this position. It works the same way for both equity and currency options.

Zerodha SPAN for option Writing/Shorting margins

For Multi-Leg F&O Strategies Margin Requirement

There are many popular multi-leg f&o strategies like Straddles, Strangles, Iron Condors, Butterfly, Bull Call Spreads, Covered Calls, and more which would involve taking more than 2 positions at a time. The margin required for such a combined position could be less than sum of individual margin requirements if the positions hedge each other, like in the calendar spread example above.

Knowing the margin requirement upfront for such a position is very important to better plan the trade. NSE sells a very complex software called PCSPAN which can be used to calculate this, but we have simplified this for you on Zerodha SPAN and for completely free. See the example below for calculating the margin requirement for an Iron Condor Strategy on Nifty

Iron Condor involves 4 legs and is a limited risk non-directional option strategy designed for high probability of earning a small profit when you perceive low volatility.

Nifty is presently at 6100

- Sell 1 OTM Put Short 1 lot of 6000 PE in the example

- Buy 1 OTM Put (Lower Strike) Buy 1 lot of 5900 PE

- Sell 1 OTM Call Short 1 lot 6200 CE

- Buy 1 OTM Call (Higher Strike) Buy 1 lot 6300 CE

As you can see below the Zerodha SPAN will show the margin required and the benefit for entering this strategy in a jiffy.

Total Margin = SPAN + Exposure Spread Benefit (If any)

Total Margin is the margin required to hold the position overnight also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

Zerodha SPAN for Multi-Leg F&O Strategy Margins

Disclaimer: Zerodha Margin Policy can change any point of time based on risk and market volatility.