Zach Schreiber Oil Short Best Bet In Hedge Fund History

Post on: 1 Апрель, 2015 No Comment

You can tell Zach Schreiber is a hedge fund manager in his soul. His recent oil trade is proof not based on its success although it was widely successful but the tell he is a long short fund manager comes but considering this thought process.

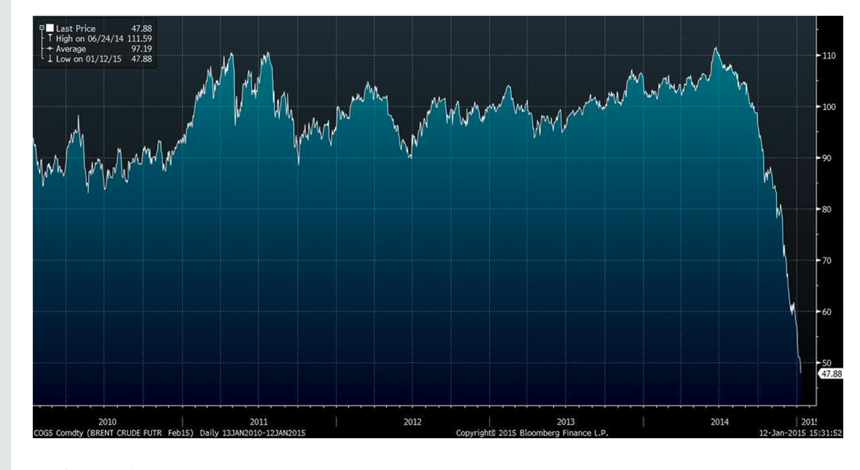

Considering a correlation in supply dynamics between natural gas, which had previously dropped precipitously due to oversupply issues, and oil, which was about to experience significant supply glut, Zach Schreiber likely did the math on what would become likely the most significant hedge fund profit on an oil short in hedge fund history.

Zach Schreibers returns to investors

While in 2014 certain managed futures firms were known to have done very well in oil trading on a percentage returns basis, Zach Schreiber in total delivered $1 billion in returns to investors over the year, a Bloomberg article by Katherine Burton, Kelly Bit and Simone Foxman noted. That puts him in a different league.

Those are unheard of gross profit numbers on a commodity trade, placing him in rarefied air with historic hedge fund trades such as Ackman’s Allergan bet. Icahn’s kid help with Apple Inc. (NASDAQ:AAPL ) or even the yet to be named hedge fund who was long the Swissee to the tune of 15 percent coming into the “flash blast off” of the Swiss currency.

Great trades for sure. But what makes Schreiber a trader at heart is not just making the directional call, predicting dropping oil prices. but at the same time looking around for the relative value plays. Most momentum traders typically execute their stock pick and let the market environment do the work.

Zach Schreiber: Energy stocks that might benefit from oil price drop

After determining that oil was likely to head lower based on supply and demand factors, he proved that the markets aren’t that rational, as they traded higher to $107 before losing nearly 50 percent of their value from early summer. Next for Schreiber was to sort through the likely winners and losers, connecting the dots and noting that while oil is falling the stock price of refiners such as Valero Energy and Marathon Petroleum might benefit. Its hard to tell if such skills are enate to long / short traders or if they were taught. Regardless, the protégée Stanley Druckenmiller made the hedge fund legend look good as Zach Schreiber’s PointState Capital delivered 27 percent net return to investors, with nearly half those profits coming off the single oil trade.

It was Druckenmiller who first discovered Zach Schreiber and ultimately gave him $1 billion of the $5 billion in total assets the logical math strategist started with. When Druckenmiller was running Duquesne Capital Management he had the pleasure of profiting from Schreibers talents. Druckenmillers hedge fund now closed, Druckenmiller was on stage at the annual Ira Sohn Investment Conference on a warm July day introducing Zach Schreiber to the generally professionally dominated audience. It was here Schreiber introduced the oil trade idea that was noted by many, but most importantly it is his investors who paid attention.

Not to sound like a puff piece, but if that is not enough David Einhorn credited Zach Schreiber for some of his gains in oil related shorts, according to a letter to investors obtained by ValueWalk. Einhorn stated:

At last year’s Sohn Investment Conference, Stan Druckenmiller introduced Zachary Schreiber as a rising star. Zach lived up to the praise with a compelling presentation predicting a sharp fall in WTI oil prices, leading us to review our exposure. In mid-June we sold enough WTI oil futures to offset the subsequent declines in our positions in Anadarko, BP, McDermott International (NYSE:MDR ), and National Oilwell Varco, all of which we effectively exited at their higher June prices.

Like this article? Sign up for our free newsletter to get articles delivered to your inbox