Younger generations driving demand for socially responsible investment opportunities

Post on: 16 Март, 2015 No Comment

Most financial professionals have probably heard anecdotal evidence tying the growing demand for socially responsible investment opportunities to the changing composition of the investing community. Specifically, with members of younger generations emerging as major participants in capital markets, the importance of environmental, social and governance (ESG) factors has increased substantially.

In a recent article, Donald Liebenson, a contributor for Spectrem's Millionaire Corner, discussed some of the publication's recent research into the relationship between age and attitudes about the importance of ESG benchmarking and other responsible investing strategies.

Among Millennials with more than $1 million net worth, nearly half49 percentsaid that they consider social responsibility as a factor when evaluating investment opportunities. Corporate social responsibility was ranked as being even more important by respondents from the Millennial generation with a net worth of less than $1 million. Within, this group, 53 percent said they apply socially responsible principles when investing.

This signals a noteworthy shift in priorities. Members of previous generations were found to be much less likely to ascribe to responsible investment strategies. Among those with more than $1 million net worth, 43 percent of Generation X, 34 percent of Baby Boomers and 27 percent of those born during World War II said that social responsibility issues factor into their investment decisions.

Expansion of responsible investing already underway

Liebenson cited a study conducted by researchers at Boston College's Social Welfare Institute, which looked at the ongoing transfer of wealth from Baby Boomers to descendants of younger generations. The organization estimates that approximately $41 trillion will change hands between 1998 and 2052. If the inheritors of this fortune are aptly represented by those who participated in the Millionaire Corner survey, discussions about ESG benchmarking and other methods for evaluating corporate social responsibility will become increasingly common in conversations between investors and their advisers.

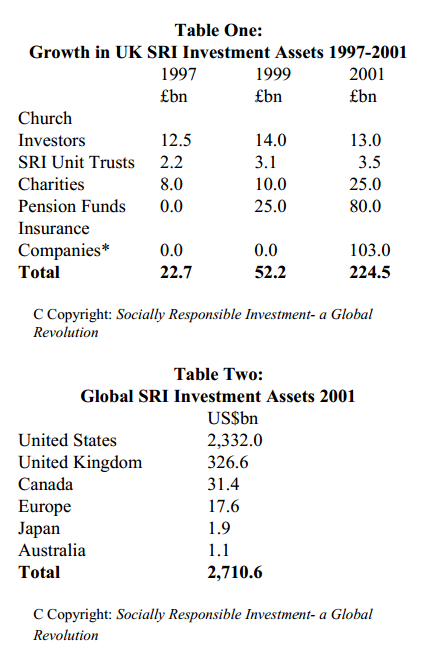

There is evidence that adherence to socially responsible investment principles is already growing rapidly among investors. An estimated $3.07 trillion out of $25.2 trillionmore than 12 percentof all professionally managed assets in the U.S. investment marketplace are managed responsibly, according to a 2012 report from US SIF The Forum for Sustainable and Responsible Investment.

This marks a stunning increase of more than 380 percent over the $639 billion that was being invested responsibly in 1995, the first year that the US SIF Foundation published its Trends Report. The organization describes its mission as the establishment of a world in which investment capital helps build a sustainable and equitable economy.

In pursuit of this goal, US SIF supports the development of consistent standards for the reporting of ESG data by corporations. An eponymous non-profit foundation undertakes educational and research activities in support of the organization's mission.

New institutions emerging to support investor interest in social responsibility

In April, The US SIF Foundation celebrated the launch of its Center for Sustainable Investment Education. The Center's inaugural online courseFundamentals of Sustainable and Responsible Investmentfocuses on how financial professionals can stay up-to-date on current trends in SRI. discuss the subject with clients and incorporate pertinent research into the management of their portfolios.

It was touted as the first online course on sustainable investment for financial advisers and other investment professionals to be launched in the United States.

In a press release announcing the Center's launch, Paul Hilton, Vice-Chair of the Board of US SIF and the US SIF Foundation, said he believes it was exactly the right time to begin offering new educational opportunities through accredited professional channels.

There has never been a more important time to help train financial intermediaries to handle the increased demand for SRI from both retail and institutional investors, Hilton explained.

Both the CFP Board and the CFA Institute have announced that they will award credits to those who take the US SIF Foundation's course on sustainable investment fundamentals. According to Lisa Woll, CEO of US SIF and the US SIF Foundation, the course launched in April will become the first in a series of online courses covering basic and specialized topics on investing for financial performance as well as social and environmental impact.

Evaluating corporations' ESG performance requires specialized research

While education and training can help prepare financial professionals for the challenges associated with benchmarking corporations' ESG performance, wealth management professionals will need access to up-to-date research on the subject to reliably deliver sustainable returns for their clients.

Firms that specialize in ESG benchmarking can provide stakeholders with the necessary data to help craft portfolios that are both profitable and representative of investors' values.

Related posts: