WisdomTree Plans Bull

Post on: 5 Апрель, 2015 No Comment

Make way for actively managed responses to the PowerShares DB dollar-focused duo, UUP and UDN.

WisdomTree filed regulatory paperwork for three separate active currency funds; two that play both sides of the U.S. dollar, and the third a bearish commodity currency fund, adding competition to a market traveled by WisdomTree itself, as well as Guggenheim’s CurrencyShares and Deutsche Bank.

The three proposed funds include the:

The two U.S. dollar funds, one bearish and one bullish, will be actively managed funds that take bets against a basket of currencies from developed and emerging markets countries. The basket will contain the most liquid currencies from countries that are a big part of U.S. trade flows, the filings said.

The bullish and bearish dollar funds will compete with two ETFs from Deutsche Bank: the $875 million PowerShares DB US Dollar Index Bullish Fund (UUP|B-90) and its short-selling counterpart, the $63 million PowerShares DB US Dollar Index Bearish Fund (UDN|B-95). The bullish fund, UUP, has an annual expense ratio of 0.80 percent, or $80 for each $10,000 invested, while UDN costs 0.75 percent.

While WisdomTree didn’t detail any prices or ticker symbols for the proposed funds, the focus on trade flows may well give the WisdomTree dollar-focused funds an edge to the extent that the PowerShares DB ETFs are organized around the U.S. Dollar Index. The Dollar Index is something of a historical artifact based on liquid currencies rather than on each currency’s trade-weighted role in the world economy.

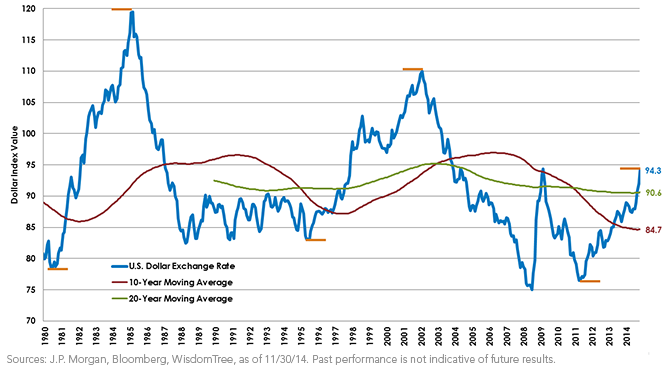

In broad perspective, the proposed WisdomTree funds come at a time when the dollar is enjoying a resurgence in international currency markets. That’s because the U.S. economy is not only exhibiting relative attractiveness, but that a bona fide recovery in the United States seems to be taking shape, putting variables such as higher official borrowing rates that will affect currency crosses into sharper focus.

The funds’ investment objectives will be reached by balancing investments in U.S.- and non-U.S. money market securities and short-term debt with positions in currency forwards or futures. They are open-end funds, while the DB products are futures-owning currency limited partnerships and the CurrencyShares’ products are grantor trusts that provide exposure to spot exchange rates of given currencies.

Those structural differences have, among other things, tax implications that are covered at length in IndexUniverse’s white paper “The Complete Guide To ETF Taxation,” which was authored by our ETF analyst Dennis Hudachek.

Currency Fund

It wasn’t immediately clear if WisdomTree had plans to follow the WisdomTree Commodity Currency Bearish Fund with a bullish counterpart.

In any case, the WisdomTree Commodity Currency Bearish Fund will focus on countries whose currency valuation is closely correlated to commodities that countries export, including Australia, Brazil, Canada, Chile, Indonesia, Mexico, New Zealand, Norway, Russia and South Africa.

That said, the prospectus mentioned that that list may change based on market developments.

On top of exposure to such countries, the fund will also seek exposure to specific commodities that tend to be influential in floating currency valuation, including industrial metals, precious metals, energy, agriculture and livestock. The fund will only pursue “floating” currencies, or those that fluctuate relative to other currency valuations, rather than a set value from a government or other body.

The three prospectuses did say that these funds will initially be listed on the New York Stock Exchange’s electronic platform, Arca.