Why You Shouldn t Bet on Higher Oil Prices Using the USO ETF

Post on: 28 Август, 2015 No Comment

Does this sound familiar? Perhaps youve heard it around the water cooler, or considered it yourself?

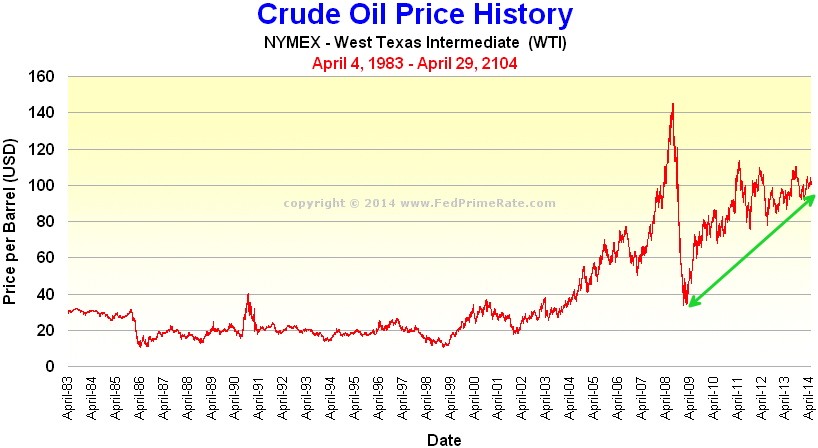

- Crude oil has dropped to $50 a barrel.

- You just know oil prices will go up eventually.

- The futures market is kinda complicated I know! Ill buy an ETF like USO .

- Profit.

Here are a few things you should know first about the United States Oil Fund (USO) and similar oil ETPs.

You arent the only one whos thought of this. Over $7 billion dollars have already gone into oil ETFs in the last two months alone. Read this series of Businessweek articles on the subject, all by different authors:

The usual market timing questions apply. Sure, the price will go up, but how long is eventually? It might be 1,3,5, or 10 years. If you have a specific time-frame in mind, then you can go out on the futures market and then buy a specific contract. But if oil hasnt risen enough at that time maybe it peaked earlier and dropped, or it peaks further in the future youll have lost money.

If you buy the ETF, when is a good time to sell? $80 a barrel? $100? $120? What if you sell and then it rises another 50%?

What if it takes a while? The longer you have to hold these ETFs, the less likely they will track the price of oil (see below). Meanwhile, the ETF provider is happily collecting their annual expense ratios of 0.50% to 1%. At the current asset level of $1.28 billion times the 0.45% management fee, thats $5.8 million a year in fees.

Your commodities futures ETF may not track the price of oil very well at all. To properly track the price of oil, youd need to buy some oil and store it somewhere (and pay storage and security costs). These ETFs dont do that, instead they buy oil futures contracts and keep rolling them over into new ones when they expire. Thats not the same thing. USO is designed to track daily price movements in the price of oil, not long-term movements!

Visually, here are a chart from Attain Capital that compares the change in USO share price (purple) as compared to the spot price of crude oil (red) when oil prices doubled between the start of 2009 and the end of 2010 (blue line adjusts USO underperformance for roll costs):

Further, consider these stats from Businessweek (emphasis mine):

Since USO launched in April 2006, it has returned -71 percent, while the spot price of oil returned -26 percent. The last time oil roared back from a bottom was in 2009, when it returned 78 percent on the year. USO returned just 14 percent.

If you dont understand the terms backwardation, contango, and roll costs then you dont understand commodities futures. If you dont understand something, you probably shouldnt buy it. Take it straight from a USO executive:

John Hyland, chief investment officer of USO, says the fund is a “tactical trading vehicle predominately used by professional traders,” and not meant to be a buy-and-hold investment.

In the end, such a play is a speculative bet and it may just pay off, who knows. But it certainly isnt a wise investment, especially if the tool youre using doesnt even do what you want it to do.