Why these ETFs are hazardous to your portfolio

Post on: 11 Август, 2015 No Comment

ScottMurray

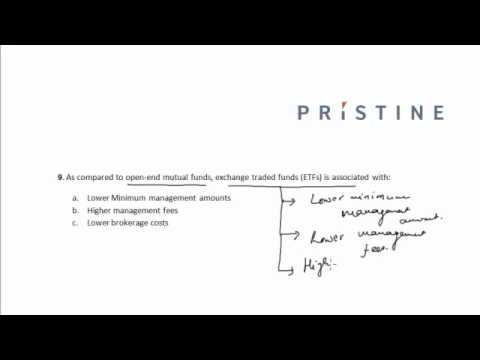

When markets sour and become more volatile, VIX-based exchange-traded funds can appear to be attractive hedges to your portfolio. Yet it should be no secret by now that these ETFs that are supposed to hedge against market downdrafts frequently do little hedging and often lose a lot of invested capital.

Notwithstanding, investors gravitate to these for a few reasons, and many of them are inappropriate for most investors. While these ETFs can provide quick returns if your timing is right, they are inevitably built to fail. Let’s break down what comprises the majority of them, how they are structured, and what few of them may actually present opportunities to invest smartly.

Volatility exchanged traded products primarily hold VIX VIX, +3.76% futures contracts. The VIX, or volatility index, is a current measure of the implied volatility of the S&P 500 SPX, -0.61% over a forward-looking 30-day period. Essentially, implied volatility is an estimate of how much the index is expected to move both up and down most of the time. The VIX index is created using a complex formula related to the prices of index options on the S&P 500, and it rolls every day to represent the 30 days immediately ahead.

VIX futures, on the other hand, measure the anticipated price of the VIX at a certain date forward. The futures are traded going out several months to create a term structure of future anticipated VIX prices, not unlike oil futures. The term structure of these future dates looks like this:

Courtesy: Vixcentral.com

Here we see that at August 20th expiration, the VIX is expected to be 16; in November it is expected to be 16.67. Currently, the curve is quite flat as the market expects that volatility in the near future, say through the end of the year, will not be much higher than now. It should be noted that these expectations are frequently wrong, not unlike a when there is a spike in natural gas or crude oil. The term structure of VIX futures prices only reflects market expectations using known information.

Many institutional investors use the VIX futures and futures options to hedge large portfolios, but this is obviously complicated and can be expensive for the smaller manager and investor. The financial crisis and the perceived need for hedging tools as well as speculative products on market volatility seeded this list of ETFs, none of which were in existence before the financial crisis:

Courtesy: etfdb.com

As you can see, these ETFs have performed abysmally so far this year, and without a recent rise in volatility it would be even worse. The cause of their futility is in the way that these are constructed using the VIX futures. The VXX VXX, +2.26% , the largest volatility product in asset value, rolls its holdings of futures contracts every day from the contract nearest expiration to the next month’s contract. The vast majority of the time this roll results in paying a higher price for the next contract. The reason for higher prices going out in time is simple; the future is more uncertain the farther out you look.

This is the major inherent flaw with these ETFs, in that most of the time they are rolling up the curve at higher prices. Generally, this roll results in a loss of 2%-7% per month, and at times this negative roll can be even more expensive. For example, Congress is approaching a deadline to vote on a debt-ceiling extension next month. The near month VIX future might be 13, while the following month could be 16 due to the upcoming event’s uncertainty. That term structure creates a negative roll of more than 20%, and if the event passes without any major surprises then these ETFs subsequently deflate with amazing speed.

The result looks like this over time:

This two-year weekly chart of the VXX demonstrates the inevitability of wealth destruction for the long-term holder of these long-volatility ETFs. Minor short term spikes last only as long as heightened fear remains in the S&P 500 options. If there were to be a major financial shock to global equity markets, the possibility exists that these could gain value by rolling down a backwardated VIX futures curve (where the nearer term VIX futures are more expensive than ones in later months). Yet hedging with S&P 500 put options is expensive, and without prolonged instability the VIX is essentially guaranteed to revert to a lower level, and this pattern reemerges as the dominant trend.

Are there inverse exchange-traded products that take advantage of this negative roll? There are a few: XIV XIV, -2.27% , SVXY SVXY, -2.29% and ZIV ZIV, -1.32% are the tickers for three examples of funds that sell VIX futures short. This tactic often works for investors because the funds are selling the more expensive future contract farther out in time and covering a short position in the nearest month. This daily roll is the exact opposite of how the VXX operates. Here is a chart of the XIV over the same two-year time frame:

Because the negative-roll profit gained over time is cumulative, these inverse funds are capable of losing a large chunk of their value during short periodic volatility spikes. This structure prevents them from being excellent investments, because unforeseen events can dent them significantly. Agile investors can buy these on dips due to temporary heightened volatility and do well most of the time.

The bottom line is quite simply that long-volatility ETFs are for day traders, while inverse ETFs can be held for somewhat longer periods. If your crystal ball can anticipate periods of heightened volatility and avoid the almost constant negative roll yield, then take a closer look at these funds. Meanwhile, new volatility ETFs are in the works due to the popularity of these flawed versions — perhaps these will be better suited to investors than short-term traders..

Scott Murray is an associate contributing writer to ETF Digest. a newsletter covering U.S. and global ETFs.