Why Leveraged ETFs Don’t Match Market Performance

Post on: 16 Март, 2015 No Comment

No product on Wall Street draws more criticism than leveraged ETFs. Leverage funds are designed to multiply the performance of indexes, but often do so poorly in the long run.

The ProShares Ultra S&P500 ETF (SSO) tracks twice the daily return of the S&P500 index every day. If the S&P 500 is up 1%, then SSO should be up 2%. If the S&P 500 is down 2%, then the SSO ETF should be down 4%.

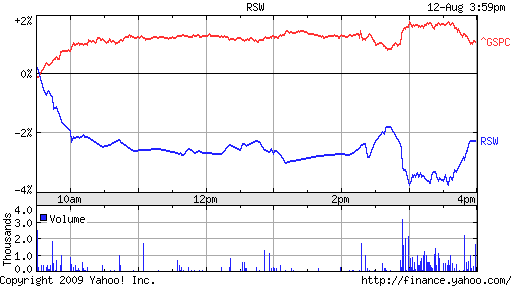

The S&P 500 was up nearly 16%. SSO was down nearly 14%. Why the disparity?

Leveraged ETFs Lose from Compounding

Compounding. the very thing that is supposed to make investors rich in the long run, is what keeps leveraged ETFs from mimicking their indexes in the long haul. Simple mathematics can explain why leveraged ETFs fail to keep pace.

Suppose that the S&P 500 index were to lose 10% on one day, and then gain 10% the next day. (Rarely do big moves like these happen, but it helps illustrate the point – round numbers are easier!)

So, if the S&P 500 starts at the round value of 1400, it would lose 140 points on day one to close at 1260. The next day, it would rise 10%, or 126 points, to close at 1386. The total loss from this two day move is 14 points, or 1%.

Supposing that SSO started out at a value of $60 per share, SSO should lose 20% of its value on the first day. The ETF would close at a value of $48. The next day, it should rise 20% from $48 to $57.60 per share.

At the end of this two day period, the S&P 500 would have lost 1% of its value. By contrast, the SSO ETF would have lost 4% of its value.

Danger of Multiplication

The order in which we do this operation does not matter. Try this out: using the round number of 100, subtract 10%. You arrive at 90. Then add 10%. You get 99. If you reverse the order and add 10% to 100 before subtracting 10%, you get the same result – 99.

The decay happens even faster when you use larger numbers. Subtract 50% from 100 before adding 50%. You’ll get 75.

But let’s get into the real fun. What if you have several days in a row of movement in the same direction? If the S&P 500 index were to move up 2% a day for 10 days straight, its ending value would be 21.8% greater than its starting value.

A 2x leveraged ETF like SSO would move up 4% a day for 10 days straight and thus its ending value would be 48% higher than its starting value. SSO’s return of 48% is greater than two times the 21.8% return of the S&P 500 index.

Volatility Destroys Leveraged ETFs

The problem is that the market does not move up or down in a straight line. Instead many daily positive and negative moves produce – hopefully! – a positive return in the long run. Exchange-traded funds that track and compound the daily moves, however, always lag their index (and eventually produce negative returns) in the long run.

Triple-leveraged ETFs decay much faster than double leveraged ETFs. For example, Direxion’s TNA fund tracks 3x the daily change in the Russell 2000 index. Since the fund was launched in late 2008 it delivered a lackluster 32% return compared to the Russell 2000 index, which delivered a 66% return. Despite leverage of 3x, the leveraged fund gained 32% to the indexs 66% return.

How to Juice Returns Safely and Reliably

The only “safe” way to leverage a portfolio is to open a margin account. If you had $50,000 to invest and wanted twice the return of the S&P 500 index, you could buy $100,000 of the S&P 500 index ETF (SPY) on margin.

Since you actually own 2x the amount of the ETF you want to double, you can guarantee that you will get twice the return (minus the cost of interest on your margin account.) You cannot guarantee that a leveraged fund will provide double the return over time.

Buying and holding leveraged ETFs is playing with fire. They are designed for day traders In the long haul, youre certain to get burned.