While Commodity Hedge Funds Falter Algo Funds Trading Commodities Shine

Post on: 10 Май, 2015 No Comment

Fundamental commodity player Armajaro Commodities has been hard hit by oil and trades in less liquid markets, including Cocoa and Coffee, are interesting and appear to be contributing to negative performance. The positions that Armajaro has taken appear to be, in some cases, a mirror opposite of the algorithmic hedge funds trading commodities.

Commodity hedge funds: Armajaros oil loss

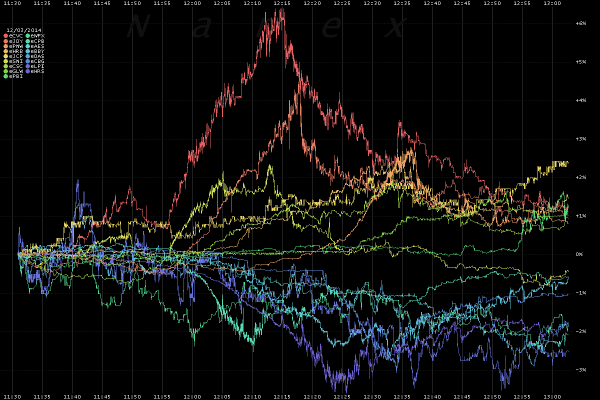

Armajaro’s oil loss come at a time when those trading a momentum strategy in the commodity markets have been feasting on the oil trade. Covenant Capital Management. for instance, will be releasing its November numbers in days and based on a preview of the results given to ValueWalk, Oil was a major factor in the fund’s success. The fund is going to report a November gain in its Aggressive program of 6.94 percent, which is up 26.62 percent year to date. Covenant’s Optimal Program, which is a highly leveraged version of the based strategy, was up 25.12 in November and stands at 200.40 percent year to date.

Algorithmic hedge funds: Covenant having best year since 2008

While many algorithmic hedge funds such as Covenant, who typically fall under the managed futures or “CTA” hedge fund categories, are having the best years since 2008, when the strategy category was a rare safe harbor during the financial crisis, fundamental commodity players have been struggling in 2014. As previously reported in ValueWalk. after September’s loss, Armajaro Commodities is now down nearly 9% for the year. Last month was not a particularly profitable period for commodity funds in general as oil fell to lowest price in two years, and only a few hedge funds in this category were able to weather the storm. According to eVestment. commodity strategies declined by 1.73% in September on average. One commodity fund succumbed to the bad tides, Hall Commodities, a London based hedge fund, will be closing shop after barely two years in business. The $100 million fund was down 11% at the end of third quarter.

Commodity hedge funds favor the long side of the commodity markets

While many commodity funds and passive ETFs favor the long side of the commodity markets. algorithmic traders such as Covenant go long and short. The decisions to buy or sell are made based on a computer program. In the case of a momentum player such as Covenant, when the computer program identifies market conditions that indicate a trend is in place and has potential to continue, they buy or sell. Looking at the Cocoa market is one example. Such programs typically have a win percentage just above 50 percent and often make their profits in how they manage risk and reduce loss size while maximizing win size.

While Armajaro’s fundamental analysis pointed to weakening supply and potentially higher prices, many of the algorithmic funds, who pay only attention to pricing dynamics, shorted the commodity in the fall as both volatility and price movement drove decisions.

On the month, currencies and energy markets were the biggest contributors to Covenant’s returns while the stock indices and grains detracted from performance.