What s a Better Hedge VIX or SPX

Post on: 27 Май, 2015 No Comment

Equity investors who want a broad-based hedge have essentially three vehicles from which to choose: equity index options (SPY, SPX, ES, etc.), CBOE Volatility Index (VIX) futures (or their ETF permutations) and VIX options. Which is best?

One argument in favor of using VIX-linked products is that they are independent of any price level in the underlying equity index. If you enter a one-year at-the-money SPX hedge today using the at the money strike price, the puts you bought won’t do you much good if the market rallies sharply for six months and then slips dramatically thereafter. Using a strike-dependent price-based hedge, it is entirely possible to lose money on both the hedge and the core portfolio if the hedged asset(s) don’t follow a favorable path over the life of the hedge.

The big advantage of volatility-based products is that they are linked not to some absolute price level, but to an absolute volatility level. In my experience, many equity investors are more concerned anyway about hedging against volatility than about protecting against declines below some specific price level. Gradual, orderly bear markets can be managed as easily as steady bull markets; it’s the sudden shocks that concern people.

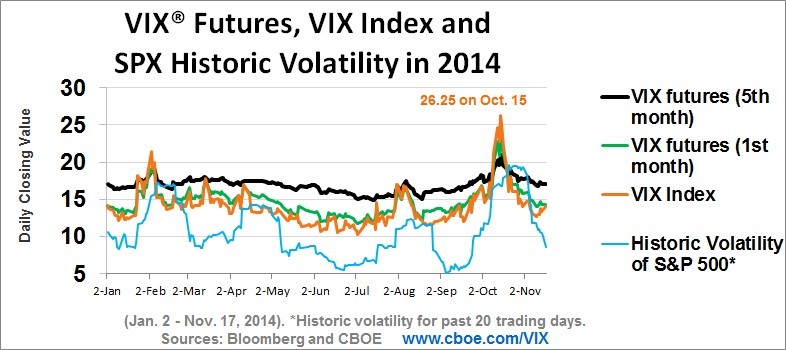

I’m not as favorably inclined toward VIX options, though. For one thing, outright VIX option buyers seem to be paying for their optionality two times over: VIX futures already have option-like properties in that they tend to carry a premium to current IV levels, especially in further months. That premium decays as a given contract nears expiration, such that a buy and hold VIX futures trader isn’t gaining long exposure to volatility explosions for free: most of the time, she is paying each month for the privilege of watching volatility not explode. That volatility risk premium is not so large that hedging becomes prohibitive — not at all — but in my opinion the added costs of VIX options are only worthwhile if those option hedges are actively and carefully managed.

That last point suggests the rejoinder available to any proponent of conventional equity index hedges: strike dependence is only a major problem for investors who insist on passive, long-dated hedges. An investor who is willing to roll their option hedges more frequently can avoid the problem of strike dependence and therefore can trade the more easily understood S&P 500 products. So my own order of preference for hedging an equity portfolio runs: VIX futures, SPX options, and then VIX options.

OptionsProfits can be followed on Twitter at twitter.com/OptionsProfits

Jared can be followed on Twitter at twitter.com/CondorOptions

EXCLUSIVE OFFER: Jim Cramer’s Protg, Dave Peltier, only buys Stocks Under $10 that he thinks could potentially double. See what he’s trading today with a 14-day FREE pass.